Study after study have revealed that consumers are abandoning new account opening processes because of frustration with poorly designed online and mobile applications. The challenges range from asking for too much information, to not being able to complete the entire process using a single digital channel.

In one study, it was found that 40% of all online applications that consumers start never get finished. What’s worse, those who applied for a product in the last 12 months digitally were found to have abandoned the process significantly more than those who last applied more than a year ago (45% vs. 26%) … indicating an increasing lack of patience.

You would think this would prompt progressive financial institutions to quickly respond to this opportunity by improving online and mobile account opening processes, capturing new business from these frustrated consumers. Unfortunately, research indicates that this call to action is being ignored, impacting customer satisfaction and, more importantly, account opening metrics.

In an extensive research report, ‘State of the Digital Customer Journey,’ sponsored by Kofax, it becomes clear that the industry is falling significantly behind consumer expectations for offering a seamless digital account opening process. Not only does the research find that the majority of banks and credit unions do not provide an online or mobile new account opening option, but even those that do provide these options require branch-based engagement to complete the process.

Branch Account Opening Still Prevails

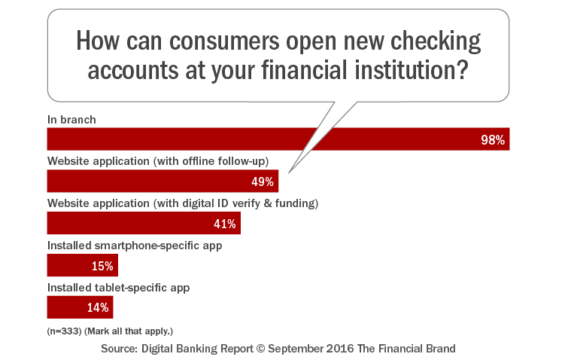

When financial institutions were asked how consumers could open new checking accounts, less than half could open accounts online, while only 15% of organizations could open accounts with a mobile device. The largest organizations were more likely to be able to support online and mobile account opening, with the credit union segment also performing better with online account opening. The community bank segment is significantly lagging in the ability to support mobile account opening.

Read More:

- Digital Account Opening Required in Battle for Customers

- Measuring and Reducing Friction in Account Opening

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Branches Still Required for Digital Account Openings

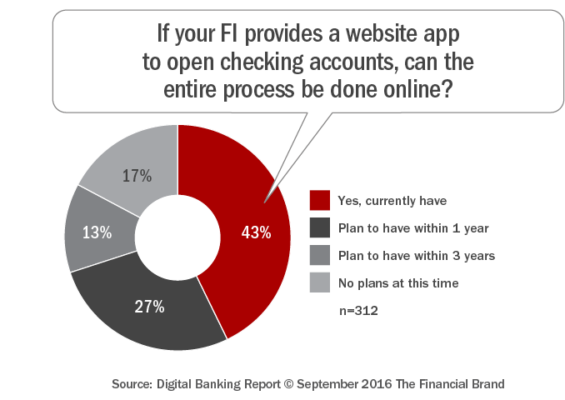

Of the close to 50% of institutions that indicated they offered online account opening, less than half of these institutions (43%) stated that the entire online account opening process could be done without coming into the branch. That means that roughly 80% of all financial institutions do not provide customers the ability to open an account entirely at their desktop.

This lack of one-stop online account opening support results in an ‘experience disconnect’ compared to organizations such as USAA, Moven, Simple and other digital-first banking organizations globally that have offered similar capabilities for years.

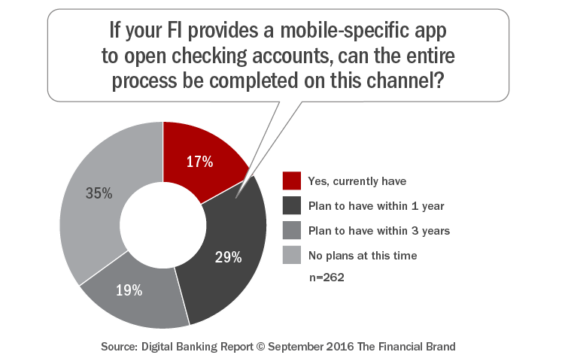

The support for single channel account opening was far worse for the 15% of organizations that responded that they allow checking account opening with a mobile device. For mobile account opening, only 17% could support a mobile account opening without visiting a branch office. Not only is the support for a seamless mobile account opening exceedingly low, the number of organizations indicating that there are NO PLANS to offer mobile account opening is frighteningly high (35%).

Branch Engagement Caused by Legacy Processes

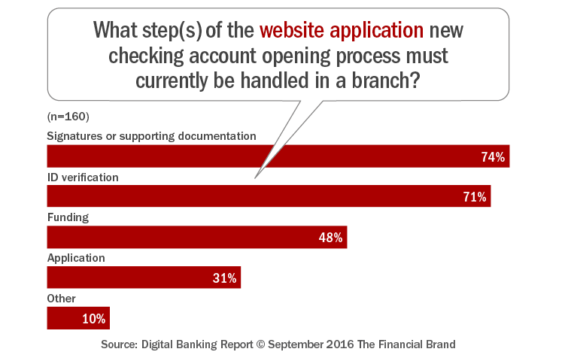

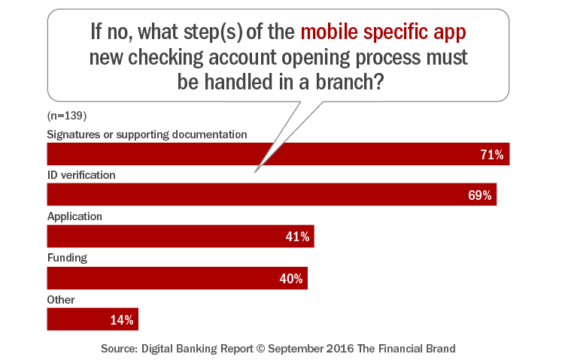

While an increasing number of banks and credit unions surveyed indicate that they allow new customers to open their accounts online or even with mobile devices, almost three-quarters of financial institutions require key Know Your Customer (KYC) components to be done in the branch. These branch-based requirements are not only not part of current regulations, but can be satisfied by increasingly sophisticated solutions provided by suppliers (improved processes and solution providers are covered in the Digital Account Opening issue of the Digital Banking Report).

The question to be answered is that if a bank or credit unions allows consumers to initiate the process online, but still require signatures, documentation, ID verification or even funding in a branch office, has the process been built for the benefit of the financial institution or the customer?

A word of warning. At many institutions, when a new customer is required to visit the branch to complete the account opening process that was initiated either online or on a mobile device, the branch staff is often incented to start the process completely over to receive credit and/or commission for the sale. This hijacking of the online account opening process usually invalidates measurement of channel attribution since there is normally only measurement of last channel used. This can significantly reduce the ability to understand the number of consumers who wanted to open an account digitally but were required to visit a branch.

Multichannel Support of Account Opening Lacking

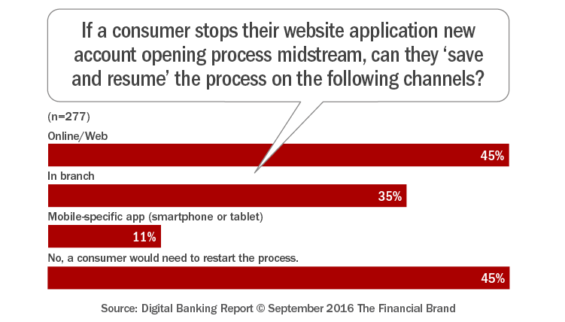

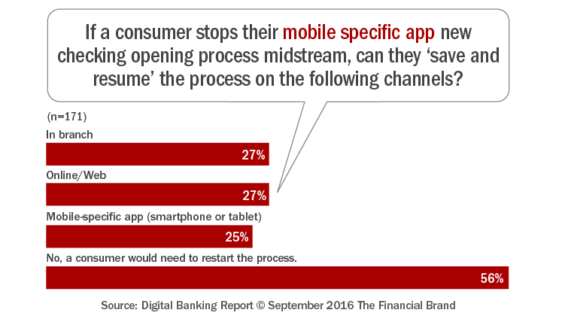

One of the key elements of a multichannel strategy is to be able to allow the new customer to ‘save and resume’ their account opening process on an alternative channel. The reason for allowing this capability is that most institutions have lengthy new account opening processes, without providing guidance as to what may be required to open a new account online. If a consumer needs information not at their fingertips, they may want to use another channel later to complete account opening.

The ‘State of the Digital Customer Journey,’ research found that, not only do half of institutions not allow a customer to stop and resume the process using a different channel, but less than half allow a stop and resume on the same channel they started the process on. This is especially apparent with mobile account openings, where only 24% could restart on a mobile device compared to 45% who could restart on the same channel if they initiated the process online.

Poor Digital Processes Lead to Abandonment

Given the challenges associated with opening a new account using either the online or mobile channel, it should not be surprising that there is a high abandonment rate associated with digital account opening processes. What should be surprising is that less than half of the organizations surveyed measure abandonment rates for digital account opening.

One of the benefits of online and mobile account opening is that a financial institution not only can monitor abandonment rates, but they can determine exactly what step caused the customer to stop opening their account. With this insight, the process can be adjusted to improve completion rates.

In addition to being able to determine what causes abandonment, monitoring the process allows financial institutions to retarget the customer who started opening an account instantaneously with a phone call, SMS text, email or some other form of re-engagement. By collecting basic contact information (name, email, cell phone number, etc.) at the beginning of the account opening process, you can recapture potentially lost customers who had difficulty with your account opening process.

Purchase The Report

The State of the Digital Customer Journey report, sponsored by Kofax, provides comprehensive insight into the minds of consumers and the activities of financial institutions around digital account opening, onboarding and cross-selling. The report includes the results of a survey more than 300 financial services organizations. The report includes 75 pages of analysis and 60 charts.

The State of the Digital Customer Journey report, sponsored by Kofax, provides comprehensive insight into the minds of consumers and the activities of financial institutions around digital account opening, onboarding and cross-selling. The report includes the results of a survey more than 300 financial services organizations. The report includes 75 pages of analysis and 60 charts.

June 10, 2021 Editorial Update: As of mid-2021, Simple has shut down and will not resume operations, according to company statements.