Millennials are the largest generation in world history, numbering 80 million and commanding $1.3 trillion in direct annual spending in the U.S. alone. These consumers (where many define the oldest as 35 years old) represent a surprisingly diverse financial services segment, with varied needs and behaviors. This segment is more digitally focused than any previous generation, with connections to financial organizations reflecting their comfort with the App economy.

To connect with this segment that has increasing financial clout, it is important for both traditional banking organizations and fintech start-ups to build digital experiences that are seamless, well-designed and integrated with this segment’s lifestyle. For a deeper look into how financial organizations can better serve the Millennial segment, Oracle surveyed more than 4,500 consumers across 9 markets – Brazil, Canada, China, France, Germany, India, Japan, UK and the U.S. in their report, “The Millennial Migration: How Banks Can Remain Relevant In Their Decision-Making Eco-System.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Millennial Segment Diversity

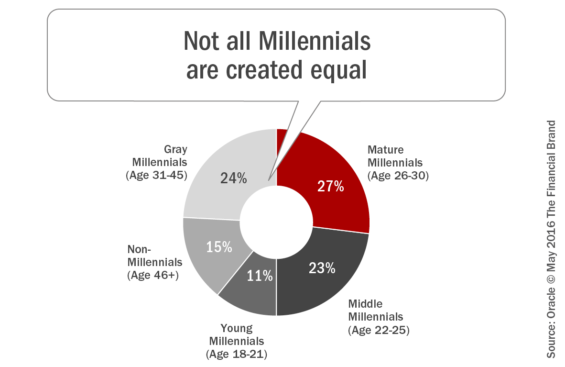

Oracle divided Millennials into four sub-segments: Young Millennials (aged 18-21), Middle Millennials (aged 22-25), Mature Millennials (aged 26-30), and Grey Millennials (aged 31-45 years old). These age-based segments provided better insights into the differences in use of and reliance on different financial services providers.

Reflecting the reality that the majority of this segment is just beginning to approach prime income earning years, the majority of Millennials (60%) view their financial institution as primarily a safe place to store money and the facilitator of financial transactions. This was especially true of the youngest sub-segment of Millennials.

The good news is that Millennials overall trust their banks on matters regarding personal finances. In fact, 88% of Millennials indicated they trust banks for advice, above family, friends, personal financial advisors or online resources. If leveraged effectively, this trust could be leveraged as the foundation for expanded relationships with this segment. Unfortunately, trust has been going down over time, especially with Millennials.

According to Rob Findlay, founder of Next Bank and contributor to the report, “Consumers are already running out of patience at banks’ lack of adaptation to a new digital future; voting with both their wallets and their notion of trust. The statistic that 60% trust banks (and is probably declining) rocks the very assumption and currency banks have around their role in the global economy.”

Movement to Non-Bank Providers

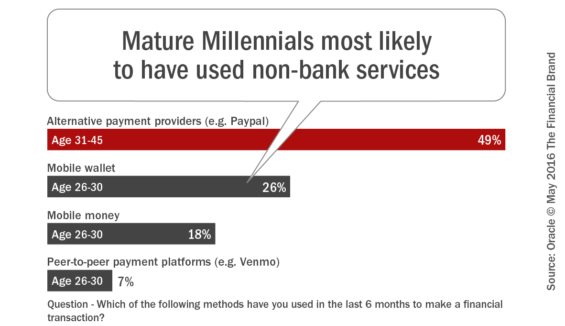

According to the Oracle study, the most frequently used payment modes are cash (79%) , bank cards (76%) and online banking (71%), which are used more frequently than non-bank alternatives such as alternative payment providers (like PayPal) or mobile wallets. That said, non-bank options are becoming more popular, especially with older Millennials.

In the study, it was found that Young Millennials (age 18-21) and Mature Millennials (age 26-30) are the most open to non-traditional modes of payment. Specifically, Mature Millennials are more likely to use mobile wallet and mobile money, while Young Millennials prefer peer-to-peer payment platforms such as Venmo and alternative payment providers such as Paypal.

The Digital Generation

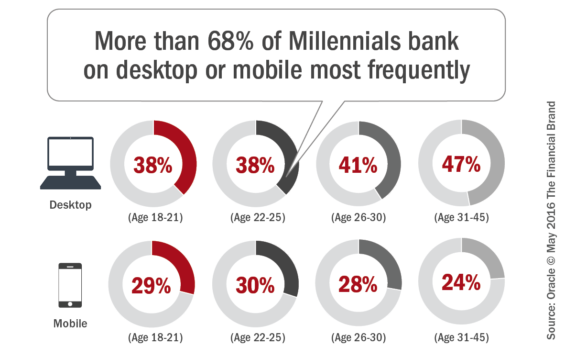

Globally, more than 68% of Millennials chose mobile or desktop as their most frequent channel of interaction with their financial institutions. In the US, 75% of Millennials were found to be at least somewhat reliant on mobile banking to manage their accounts, and more than 25% completely rely on mobile banking.

Along with the movement to digital channels, Millennials are found to be increasingly demanding of the experience provided across these channels. According to David Brear, Co-Founder and CEO of 11:FS who was consulted for the research, “Banks need to stop treating mobile banking as a dumbed-down version of Internet banking. It should be the center of all customer touch points.”

Lifestage Engagement

According to the Oracle study, identifying the most relevant moments in a customer’s life will provide banks valuable insight for both product development efforts and times to engage with Millennials. These were referred to as ‘Life Moments’ in the study and ranged from shopping & budgeting ‘events’, to more significant moments, such as education, finding a new job or planning a vacation.

While each Millennial sub-segment had slightly different priorities, the top 3 Life Moments for Millennials as a whole were planning a vacation (25%), finding a new job (17%)d and Daily shopping and budgeting (16%). The top Life Moment for each segment was:

- Young Millennials (18-21): Deciding on a college/furthering education (31%)

- Middle Millennials (22-25): Finding a new job (22%)

- Mature Millennials (26-30): Planning a vacation (26%)

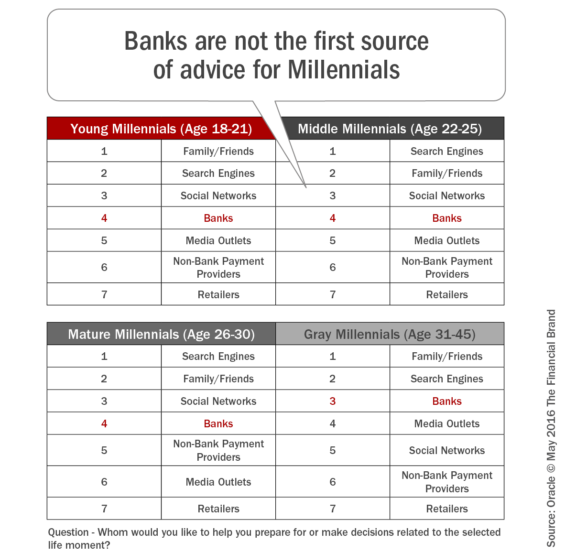

Despite the trust Millennials have with banking organizations, Millennials are not very confident that banking can be of assistance in helping them with their personal Life Moments. The research found that banks are the third most trusted source for information and advice when making decisions related to Life Moments, compared to family/friends, search engines and social networks.

According to Scarlett Sieber, SVP of Global Business Development, New Digital Businesses at BBVA “There is a huge opportunity for banks to move up the ranks through the twin principles of transparency and simplicity.”

The research found that Millennials are willing to explore new lifestyle products and services offered by their banks, with 51% likely or very likely to try new services. Of concern may be that the willingness to do so drops for each subsequent sub-segment, with just over 40% of the Young Millennials segment being open to Life Moment services. According to David Brear, “Millennials may be willing to try new services, but they have equally high expectations and are less forgiving of poor execution and user experience. Banks need to provide a customer experience of a higher level than what they are delivering now.”

Given the availability of account level and behavioral insights in banking organizations, there is both a threat and opportunity in meeting Millennial needs. While Millennials are more demanding of personalized solutions, banking organizations have more insights available than virtually any other commerce partner.

When asked about the top 5 services Millennials were the most positive about that banks could potentially offer the Oracle study found these to be:

- Discounts at relevant stores (57%)

- Checklists for tasks related to life events (55%)

- Recommendations based on customers like them (54%)

- Professional / expert reviews (53%)

- Budgeting tools or content (52%)

Millennial Satisfaction

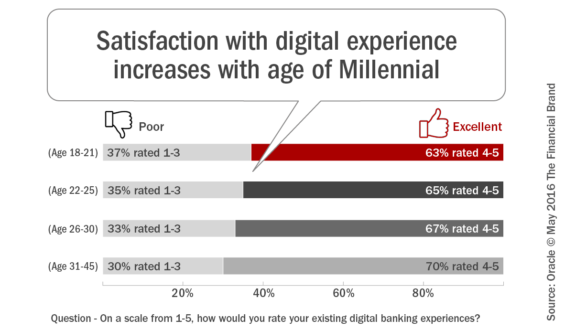

The Millennial segment is digitally savvy – and the younger sub-segments are the most digital of all, relying on mobile devices for communication, engagement and commerce. The younger Millennial sub-segments are also the most demanding and most unforgiving of all consumer groups. According to Oracle, “Banks have to look before they leap into the digital game because they only get one shot with Millennials. They are familiar with other digital players who have set benchmarks.”

Meeting the Needs of Millennials

The way to build a relationship with a Millennial is directly correlated to how well a financial institution uses the data available to build connections around this segment’s Life Moments. Contextual engagement that is both smart and timely is the key.

The three required components of meeting these needs include:

- Adopt a mobile-first approach

- Provide personal, relevant and contextual solutions

- Consider partnering with fintech start-ups

According to Oracle, “Banks need to take a human-centric approach in their product development strategies. They should leverage their customer data strategically to design and deliver an experience that is mobile, personalized and value-added. They should act now, before other digital players take their place.”