Retail financial institutions face challenges if they are to retain their place as the cornerstone of banking services. Today, consumers view their bank as a trusted place to store, move and protect their money — the bedrock of banking. But consumers say they are not receiving the value-added services they want, so the industry is threatened with erosion, especially as scrappy non-bank alternatives gain steam.

According to a 2015 study from CGI, financial consumers say they want personalized services to protect their identity and finances, and they want to be rewarded for their business. The study, which encompassed 1,400 respondents from seven countries, also found that consumers are willing to switch to non-bank alternatives to find these new services, as well as pay fees for them.

The study suggests there are immediate opportunities for banks and credit unions able to respond to these changing consumer demands. Leading banking providers will be focused on strengthening their digital offerings to ensure they match or exceed both traditional players and new competitors. They are also rushing to develop and deliver the value-added services consumers want to further protect their business and drive additional revenue streams.

In the digital era, consumers are becoming more and more accustomed to intelligent, personalized online shopping, where service providers know them, understand their wants and needs, and fulfill those wants and needs. Financial consumers expect banks to do the same using their personal and transaction data. Consumers expect their banks to understand when they need additional liquidity or funding and offer such options at point of sale.

In response, some banks (and a handful of credit unions) have started to embrace the concept of “my digital best friend” from more digitally-advanced industries such as retail and communications, then expanding the model with a combination of smartphone and face-to-face support to deliver what financial consumers now expect.

CGI says tomorrow’s digital bank will be a provider that consumers depend on to securely manage their finances, understand their goals and preferences, and proactively deliver the right offers and services to help them achieve financial well-being. It will deliver a highly convenient, secure and trusted digital experience that will differentiate itself not only from other banks but from new market entrants as well.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Reward Consumers for Their Business

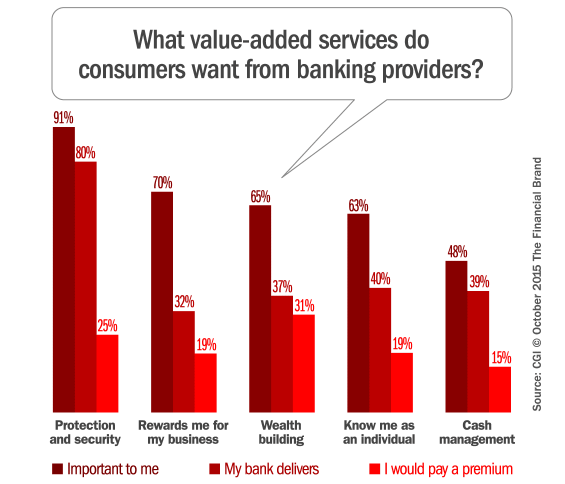

Reward schemes are in high demand among banking consumers, with 70% of respondents in CGI’s survey saying rewards are important are important to them vs. a mere 7% saying they are unimportant. This high level of demand was unanimous across all countries, age ranges, income levels and types of institutions.

Three out of five consumers (60%) who are banking with traditional community institutions or credit unions say they do not receive any type of reward in exchange for their business — nearly double those using online banks (32%).

Somewhat ironically, one in five consumers are willing to pay a premium for a reward service, with younger consumers saying they are more willing to pay for this service than older ones.

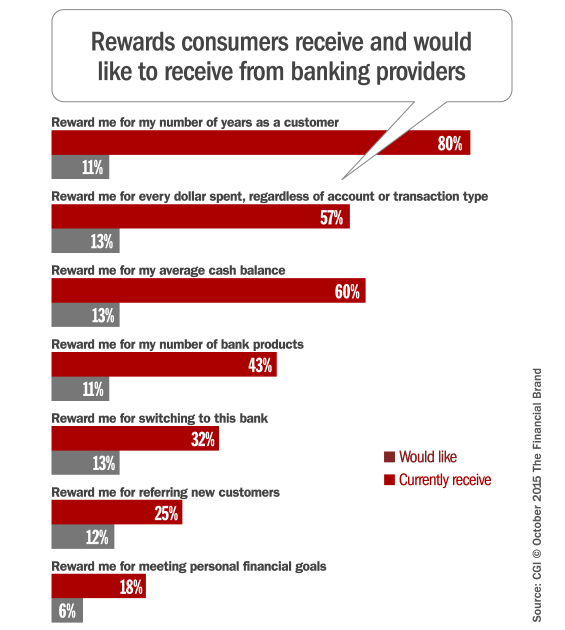

CGI asked consumers what they wanted to be rewarded for, and how this could be translated into a reward scheme they would utilize. In order of importance, the way consumers would like rewards calculated include the length of their relationship, the number of transactions they conduct, their average balance, and the number of products they hold.

How do consumers want to be rewarded for their banking relationship? With preferred rates (78%), cash (74%), point schemes (63%), and reward wallets (46%).

Consumers in the study indicated they are looking for a retail-like experience where loyalty rewards are commonplace. However, unlike the retail or airline industries, banking consumers are often longstanding customers. As a result, they are looking to banks to reward them for all of their purchasing, as well as their balances and bank products, over their lifetime. Banks need to design reward schemes that take lifetime value into account, rather than a snapshot in time. Savvy consumers know how banks make money and they want a share for their loyalty.

Some banks and credit unions have started to respond by offering reward schemes, although they are far from commonplace. In fact the opposite is more likely; some banks penalize customers who may have been previously “valuable” but are no longer so.

A More Personalized Experience (Hint: Know Your Customer)

An overwhelming 91% of respondents in CGI’s study said they believe it is important to be known by their bank. Surprisingly, nearly one in five said they are actually willing to pay their banking provider to know them better. That’s not unlike paying your boss to remember your name.

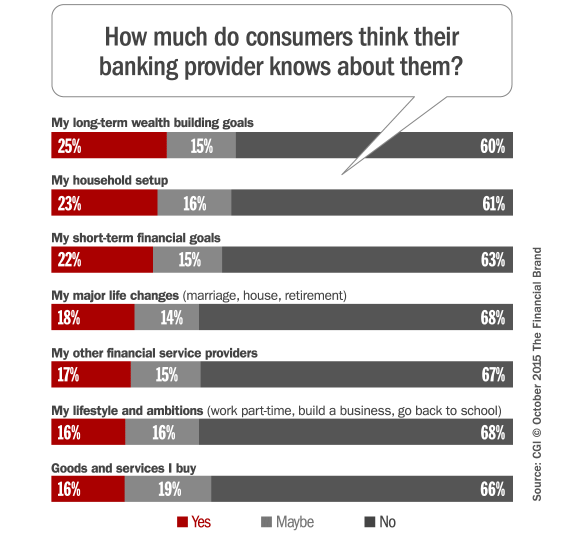

Most respondents believe that their bank does not know them or they simply are not aware of what banks do know. While younger respondents believe that banks currently know more details about them than older respondents, this view is fairly consistent across the demographics, with an average of 62% of respondents saying that banks do not know them.

Respondents believe that banks should know their short- and long-term financial goals, so that they can provide support in meeting those goals. However, an average of only 24% of respondents believes that their bank understands any of their current goals.

Service Issues and Switching Triggers

The good news for banks and credit unions is that more than half of consumers around the world believe that they are not currently experiencing service problems with their banking provider. American institutions ranked even higher, with 73% of respondents in CGI’s survey indicating that they were problem-free. A larger portion of older respondents (62%) indicated they were not currently experiencing issues, compared to their younger counterparts (47%).

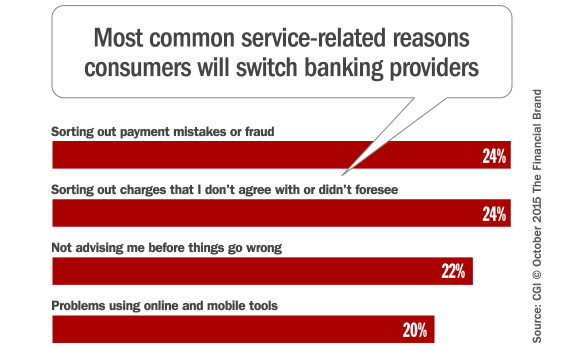

Nearly one in four respondents would switch banks due to issues with charges they do not agree with or problems sorting out payment mistakes or fraud. Just over 1 in 5 would switch if not advised on issues before they go wrong.

Although consumers say they are experiencing few service problems, resolving day-to-day issues and providing advice is a key opportunity for banking providers to move ahead. It is often reported that consumers have difficulty in getting issues resolved when using online services outside of banking. However, as more and more consumers access their banks digitally, traditional institutions are beginning to experience the same problem.

Banks and credit unions have an opportunity to move ahead by delivering excellent problem-resolution services online with user-friendly options, feedback loops, and easy to understand resolutions and appeals. The same level of service and communications should also be used to keep customers informed on the status of error corrections.

Give Consumers Security and Peace of Mind

Consumers are aware that — in the digital world — fraud is increasing, so they are demanding that banking providers protect them and their money. Consumers overwhelmingly agree that their banking provider affords them security and protection, but this is a critical service that banks do not often promote.

Protection was critical for all respondents in the CGI survey, with only 1.5% saying it is not important and around 25% saying they are willing to pay for it. Younger respondents say they are more likely to pay for this premium (29%), compared to older respondents (21%).

Consumers are looking for all aspects of cybersecurity: protection from fraud, identity theft, card theft and cyber attacks, as well as protection in the event their bank fails. The desire for banks to provide protection drops when it comes to protecting respondents from bad investments or market conditions.

Forward thinking banks are extending and promoting their current protection services to turn protection- related overhead into a revenue stream. Extending protection services also could become a valuable loyalty vehicle that gives banks a competitive edge over non-banks.