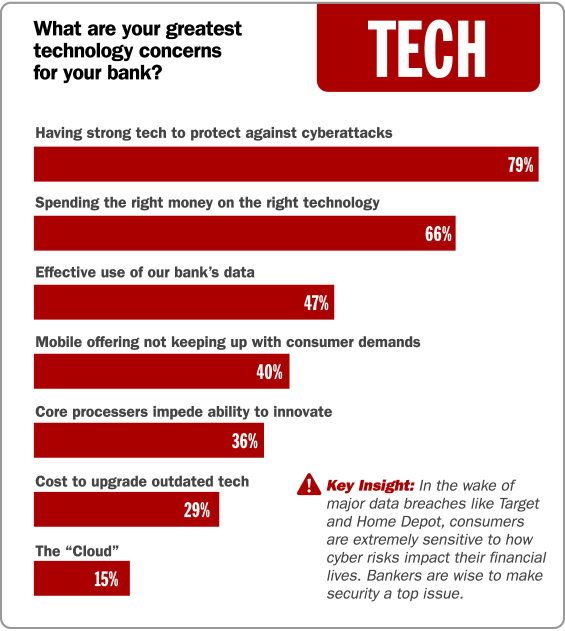

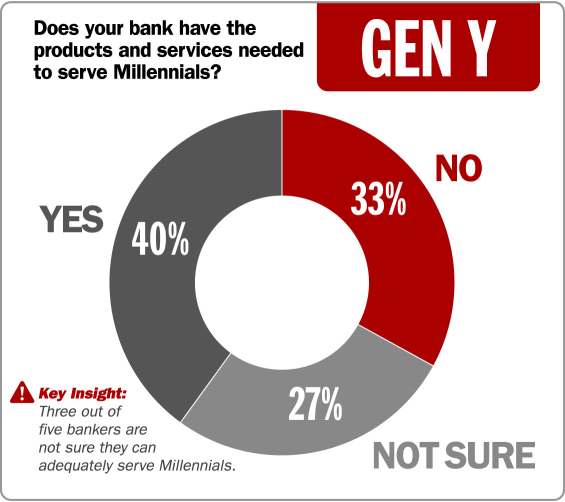

The banking industry may find itself in a tough spot, lacking the technology necessary to attract a decidedly untraditional digital generation. 60% of C-level leader and board members say their bank might not have the right products, services and delivery methods to serve Millennials. The generation gap among bank executives is compounded by a large chasm in technology: 70% of bank directors don’t even use their own bank’s mobile channel. And even fewer use newer services, such as Apple Pay.

The 2015 Growth Strategy Survey from Bank Director (sponsored by technology firm CDW) reveals how bankers perceive the opportunities and challenges in today’s marketplace, and technology’s role in strategic growth. The survey was completed by chief executive officers, independent directors and senior executives of U.S. banks with more than $250 million in assets in May, June and July of this year.

You can download the complete 27-page report directly from Bank Director’s website (instant download, no registration required). The report attacks 29 different questions, and breaks down responses by asset size and role.

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations. Read More about Navigating the Role of AI in Financial Institutions Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.