It’s a classic win-win scenario. Well-constructed rewards programs offer consumers tangible, money-in-their-pocket benefits while boosting loyalty and profitability. In a similar way, rewarding two repetitive behaviors together – direct deposit and use of bill pay – can help banks and credit unions own the primary account relationship.

Every financial institution wants to own a consumer’s primary banking account relationship – the household checking account from which most transactions are made. Historically, that wasn’t too difficult to accomplish … simply help a consumer set up direct payroll deposit at account opening and you had a good chance of achieving a degree of lasting primacy.

If you could get consumers to pay most of their bills online from that account, your financial institution’s position was nearly guaranteed. However, the increasing array of consumer options for accounts and bill payment has created a pitched battle to establish and hold this primary account position.

Financial institutions can drive and solidify this critical relationship by linking a rewards program to those same key repetitive behaviors that have been proven to drive loyalty and increase tenure: direct deposit and bill pay. Forward thinking banks and credit unions are expanding their rewards portfolio to include these behaviors with good success.

A key element of this strategy is keeping rewards simple – offering cash directly back into the account for direct deposits that total more than $1,500 a month and bill pay transactions of more than five per month, for example. While the specific deposit amount and number of bills will vary by financial institution, the figures above provide a reasonable baseline.

Financial institutions already offering rewards-based cards can also extend those programs to incent direct deposit and bill pay use. Sweetening the card program by increasing the percentage reward and/or the monthly cash-back cap if direct deposit and bill pay requirements are met is a great way to add value to a brand and drive revenue by linking together three key services.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Calculus of Positive ROI

When financial institutions consider return on investment, many are focused on return-on-rewards spend. Every bank or credit union needs to analyze its own data about the value derived from a primary relationship, including the revenue and tenure enhancement that may accrue from linking rewards to direct deposit and bill pay.

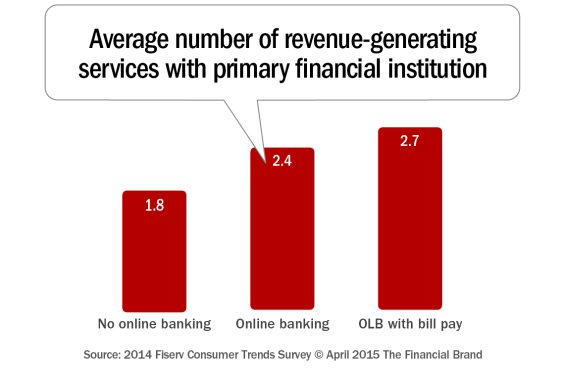

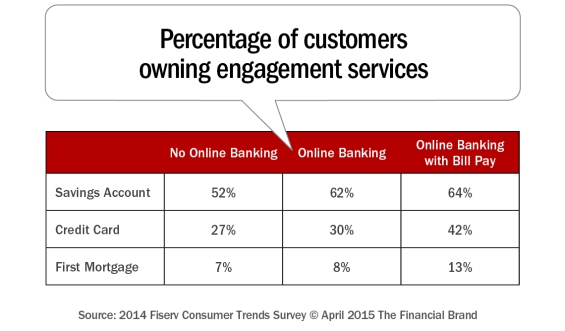

Use of bill pay is associated with more valuable customer relationships. As seen in the chart below, the average number of revenue-generating services per customer increases in tandem with use of online banking and bill pay. These revenue-generating services include savings accounts, credit cards and first mortgages.

Linking rewards to direct deposit and bill pay is proving to be a bill pay booster. One bank that took this approach saw a 240 percent increase in the number of people making bill payments over a 12 month period.

Another important consideration is customer acquisition cost. Primary accounts are often the most profitable and the least likely to attrite. With acquisition costs trending up to $300 per account, reducing attrition greatly impacts a rewards program’s positive ROI.

As with any rewards program, there are many variables that can be adjusted to optimize the amount of rewards spend versus the results. For example, a financial institution could vary the total direct deposit amount required to qualify for rewards, how frequently deposits have to be made, or the number of bills that have to be paid.

The bank or credit union might also experiment with the amount of cash-back paid for those activities. Financial institutions may also consider piloting a program in either a specific geographic region or with a specific customer segment before taking it broadly to market. Whether the goal is to attract or retain customers, this new approach to rewards is worth exploring.