Financial institutions have access to billions of existing data points on consumers that can help them better understand current and prospective customers’ needs. As a result, these same organizations are well positioned to use this data to improve targeting programs, the consumer experience, and ultimately, loyalty and revenues.

Analyzing transactional data is at the core of the data at a financial institution’s disposal. Transaction data can uncover powerful insights into customer needs, preferences and behaviors. However, transaction data represents only one type of insight that financial institutions possess. Other types of insight that reside within an organization include both structured data (demographic profiles, product ownership, balances, etc.) and unstructured internal data (call center logs, channel interactions, correspondence, etc.).

In addition to internal data sources, banks and credit unions can also take advantage of external data. Social media represents a largely untapped source of insight that financial organizations can use to develop a more holistic view of their customers. Social media insight is most effective in identifying opportunities based on recent life events, such as a birthday, marriage or even a recent major purchase.

At the end of the day, capturing and using consumer insight can be an important differentiator for organizations hoping to build new relationships and solidify those relationships already in place. In fact, CapGemini found that over 60% of financial services institutions in North America considered data analytics to be a source of a significant competitive advantage. In addition, over 90% believed that “successful data initiatives will determine the winners of the future.”

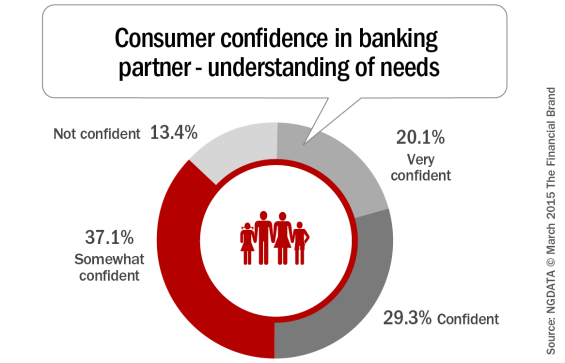

Despite this potential to leverage data to understand and serve consumers, only 20.1% of respondents to a survey from NGDATA felt very confident that their financial institution understood them. More than 50% of those surveyed were only somewhat confident or not confident at all that their bank or credit union understood their needs.

The in-depth survey of more than 500 U.S. consumers examined the most important characteristics when choosing a financial institution, the channels households prefer to use, as well as how loyalty can be earned. It was found that each of these components of a financial relationship are directly impacted by how well data is used to increase the level of consumer understanding.

“The key for financial institutions to deliver superior customer experiences is to contextualize data, and to get personal – understand the customer at the individual level, and understand their lifestyle to deliver products, services and content that are pertinent to them, via the right channel, at the right time,” stated Luc Burgelman, CEO of NGDATA. . “The research shows that consumers want to be valued, and by effectively using existing consumer data, organizations have an exciting opportunity to drive actionable results that deliver greater revenue to the business.”

Read More: Big Data… Big Opportunity In Banking… Or Big B.S.?

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

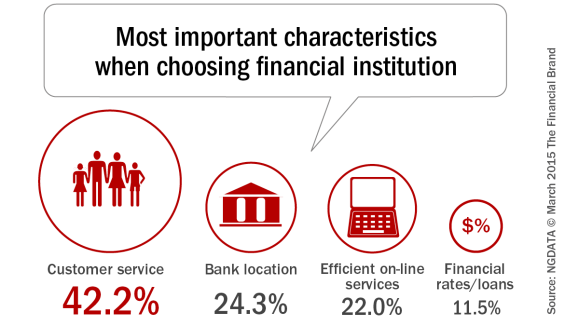

Customer Service is King

42.2% of respondents said customer service is the most important factor when selecting a financial institution, compared to bank location (24.3%), efficient online services (22%), and financial rates/loans (11.5%) offered by the bank or credit union. Furthermore, 37.7% of respondents hold multiple bank accounts, with 42.5% of 45-54 year olds holding 1-3 accounts – indicating that organizations need to identify their high value, likely-to-churn customers.

The research indicates that the overwhelming demand for quality customer service provides motivation for financial organizations and their executives to improve their customer experience levels to differentiate themselves and to stay ahead of competitors. This, in turn, will improve acquisition results, engagement and cross-sell effectiveness as well as customer loyalty and growth. Banks and credit unions can achieve this by leveraging existing and historical consumer data to target consumers at the individual level and foster a more custom and personalized experience.

Read More: How Big Data Can Build Trust in Banking

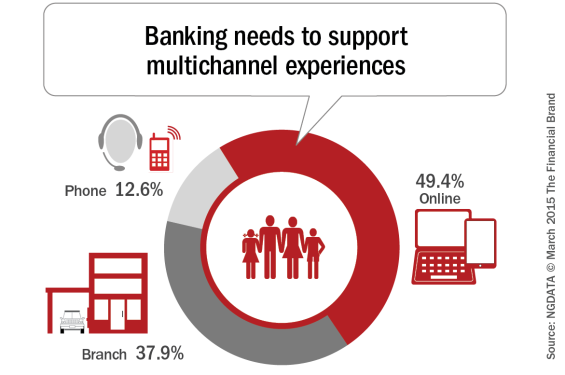

Support of Multichannel Experience

Consumers receive information from and interact with their financial institution through a number of channels, including online (web, social media, email), in-person and using the phone. While online (website, email) is the dominant channel consumers use to interact with their financial institution (49.4%), a significant amount of banking business is still conducted in-person at the branch (37.9%), while 12.6% of the interactions are done via the phone.

This research underscores the need for financial institutions to have a multichannel strategy that ensures they’re reaching the household via all the channels with which they interact. For instance, if a consumer is conducting business at a physical branch, it is critical that the bank or credit union has quick access to that individual’s profile – i.e. their level of engagement, transactional history, CRM experience, website history, social channel interaction, financial standing, etc. – so they have the information needed to deliver timely, appropriate content and offers to the consumer on the spot.

According to the NGDATA research, this consumer-centric strategy requires the anticipation of future needs – looking at behavioral patterns, market trends, and user experiences for proactive measures to secure a personalized, unique and memorable experience across multiple channels. This, in turn, enables the consumer to feel understood and valued, and likely to develop a loyalty that will be a good basis for improved retention, up-selling and cross-selling.

Consumer Loyalty is Fleeting

Nearly half of respondents (47.4%) are not very loyal to their financial institution, with 26.8% being somewhat loyal and 20.6% being neutral or not loyal at all. And as mentioned earlier, only 20.1% of survey respondents felt very confident that their bank even understands them.

“The fact that almost half of the survey respondents are not very loyal shouldn’t be very reassuring for any financial organization, and is alarming for an industry sector that most people once considered to be a trusted advisor”, stated Burgelman. “The best way for financial institutions to increase and maintain loyalty is to gain a deeper knowledge of the consumer – their interests, behavior, preferences and propensities – and in turn, they can create better, personalized user experiences that enhance brand loyalty, and increase the customer value.”

![Consumer_loyalty_difficult_to_achieve[1]](https://thefinancialbrand.com/wp-content/uploads/2015/03/Consumer_loyalty_difficult_to_achieve1-565x370.png)

Read More: Financial Marketers Unprepared For Era Of Big Data

Moving Small and Big Data Initiatives Forward

As has been said by many in the past, NGDATA emphasized that data is only good if it’s actionable, and used quickly and effectively. An example provided was that data should be leveraged to create internal alerts for customer contact personnel each morning with a specific, actionable notification such as: “Here are the 50 customers that might churn in the next 30 days.”

There is technology available today that provides the flexibility and scalability required to support a much more effective approach to data storage, data analytics and data utilization. New approaches to data storage allow for easier collection and a greatly expanded capacity for storage and analysis at a lower cost. Visualization and reporting platforms also offer a view into data only dreamed of just a few short years ago. In other words, what was once the domain of only the ‘big boys’ is now accessible to banks and credit unions of all sizes.

Having access to data and the ability to process this insight is not enough. Consumers expect their financial institution partners to be able to provide real-time recommendations based on changes in their financial profile.

As mentioned by CapGemini in their study, “While pilots deliver quick and measurable results, financial institutions need to concurrently lay the foundations to effectively scale-up consumer data initiatives. The first step towards such an approach lies in altering traditional mindsets. Data initiatives must be perceived differently from traditional IT programs. They must extend beyond the boundaries of the IT department and be embraced across functions as the core foundation for decision-making. Only then will banks be able to make the best use of their vast and growing repositories of customer data.”