Most financial institutions have a content marketing strategy whether they know it or now. Banks and credit unions pump out volumes of information — tips, tools, resources, educational materials, etc. But they aren’t entirely clear on how this content impacts the bottom line — how does it fit in the sales cycle? Is it working?

According to a report published by Marketo and Kapost, three out of every four financial institutions say they have a separate marketing strategy for each unique marketing channel. But you can’t help but wonder how far down these strategies actually drill down. How refined and precise do they go?

In the report titled “Building Trust with an Engagement Marketing Content Strategy: Spotlight on Financial Services,” bank and credit union marketers confess that their three biggest challenges are:

1. Struggle to produce sufficiently engaging content

2. Lack of strategy

3. The ability to report an ROI

In other words, financial marketers aren’t really sure what to say, or even why.

Financial institutions need to rethink their content strategy, the report says. Instead of viewing content as a charitable public service, it should be viewed as a strategic tool marketers can leverage at various stages in the consumer’s decision-making process. The type of engagement marketing they recommend focuses on communicating with people as they take steps through the buying journey. At its crux, the idea is to identify the most effective ways to engage consumers at each phase of the purchase funnel — in terms of audience, message, timing and medium. According to the report, a typical financial institution who deploys this type of engagement marketing strategy will see a conversion rate as high as 10% among visitors to their website.

Meet Meghan… She’s 25, Lives With Two Roommates, and Needs an Auto Loan

The report says financial marketers should start by getting to know their customers and prospects. Look into the demographics of your current customers and target accounts to find patterns. Cluster groups into “buyer personas.” When building out your personas, give them actual names, pictures, interests, fears, and goals — people you can envision and relate to. Make this information readily available to everyone in marketing, so your target audience remains top of mind.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Guiding Buyers Through the Funnel

Once you have identified your personas, consider the questions and concerns they have as they move from awareness to consideration to purchase. Keep in mind that customers at each stage have different educational, entertainment,

and informational needs. For example, at the top of the funnel, they may be more influenced by social media or a blog article. In the middle of the funnel, email or third- party reports may play a key role in moving them toward purchase. By understanding customer needs at each stage, and how customers consume information differently in these stages, marketers can map content that is truly relevant and engaging and moves customers closer to purchase or increases brand loyalty.

Build Content Pillars

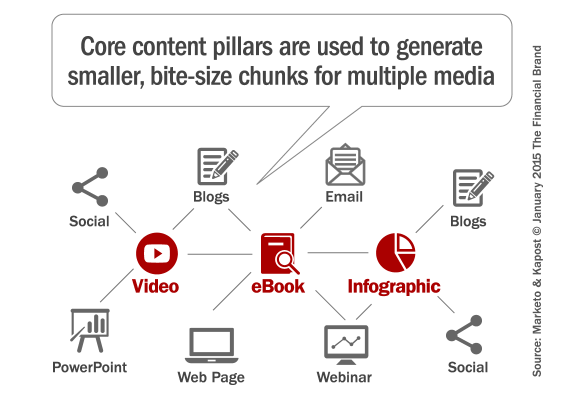

A “content pillar” is a substantive piece of content (think: eBook, on a specific topic or theme that can be broken out into many derivative assets. These smaller pieces then drive traffic back to the bigger asset, which can be downloaded in exchange for contact information. When done well, it’s a win-win: marketing generates contacts to nurture and data about customer interests and demographics; the customer gets valuable and useful information.

The most effective content pillars are created with repurposing in mind. When planning your pillar, think about how you can break apart the asset into a series of smaller content pieces to share across channels and outlets. For example, are you including a lot of data points? Separate those from the pillar asset and turn them into an infographic, which can then be used on its own. Are you conducting interviews with experts? Videotape those interviews and create short videos to share on social and video channels.

By thinking about the best way to reuse content, you’ll be able to share the full and derivative assets more widely, meeting the content demands of your organization while ensuring messaging remains consistent.

First-Touch and Multi-Touch Attribution

Using your marketing automation platform, you should be able to track First-Touch and Multi-Touch attribution. First-Touch and Multi-Touch attribution tracks the impact of your content on a customer if they view or download content at any time during the buying cycle.

If a customer’s first interaction with your marketing is to download a piece of content, and that customer purchases your product, the content gets First-Touch credit. But content can influence a customer at any point in the buying cycle, which is why you should also measure Multi-Touch influence. This tracks the impact of your content on a customer if they view or download content at any time during the buying cycle.

The report urges financial institutions to really dig into the data. Track the online behavior of your target audience, and learn which actions (clicks, email opens, ebooks, downloads, subscriptions, meeting requests) lead to new business.