By Rob Rubin, Managing Director, Novantas

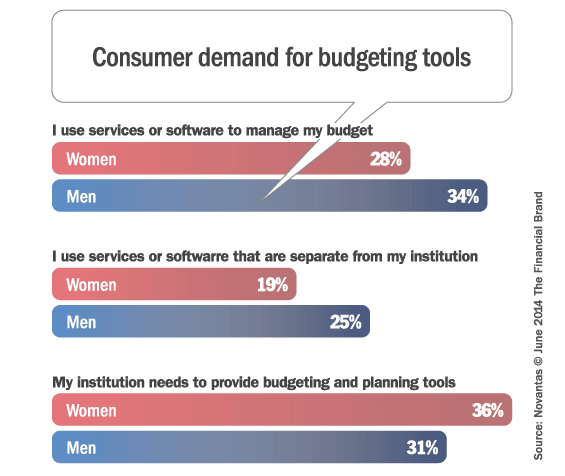

Overall, men say they use personal finance management (PFM) tools for budgeting and financial planning more than women. Women, however, are more likely to want their bank or credit union to provide these services within the online banking system.

Back in the day, banks used to give away free toasters with new accounts to lure in women that managed their families’ budgets. These days, many checking accounts come with features that seem to target one gender or the other — like an affinity debit card with your favorite team for guys, and cute custom check designs for women. But does a feature like PFM have more appeal to either men or women?

In a May 2014 BankChoice Monitor survey, 32% of respondents said they use PFM services or software to manage their budgets or for financial planning. Most of these respondents (23%) rely on third-party budgeting tools like Mint.com, and 9% use PFM tools provided within their bank’s or credit union’s online banking platform.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

In general, men use budgeting services more than women. Men are about 20% more likely to indicate that they use budgeting planning tools compared to females.

Men use third parties more than women. Men are 32% more likely to use third-party budgeting tools that are separate from their institution compared to women.

Women are more likely to expect their institution to provide PFM services. Interestingly, even though men are more likely to use services to help them budget, female bank shoppers are more likely to want these services from their bank or credit union.