The proliferation of digital banking over the past several years has impacted traditional branch banking like never before. Survey after survey indicates a greater preference of banking online and through mobile devices as opposed to using a branch.

In fact, many of the comments made by the dozens of participants in the discussion revolved around simplicity of design, the removal of friction and the ability to improve the customer experience.

The core functions of the bank in future will be about anticipating the needs of the customer proactively and presenting simple and targeted offers using traditional and digital solutions. The branch of the future will be but one example of how the delivery of these solutions will be executed.

As seen in the examples to follow, technology, innovation and channel integration are playing a key role in the re-engineering and re-energizing of ‘tomorrow’s branch.’

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

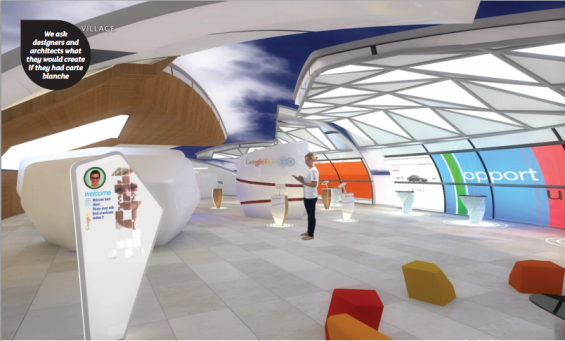

1. If Google Was A Bank…

allen international shared with FX magazine their vision of what it might be like if Google ever ventured into financial services and opened a retail bank network.

The GoogleBank branch would be open and accessible to all – a gallery and learning center, combining virtual sales and promotion space into one. It would be staffed with experts who would guide the guest to smart decisions around financial well-being. The branch would be exciting and compelling to visit, with integrated channels for a seamless customer experience … showing how Google can be an ubiquitous part of a person’s daily life.

GoogleBank would be compelling because they would illustrate the power of understanding the customer … using what they know, building specific products and services to suit, willing to be open and willing to share. GoogleBank would become a conduit to facilitate interactions at the heart of all relationships. They would be always there, when and where their customers needed them. They would get the customer’s preferred distribution model right and would communicate effectively, making banking entertaining and compelling.

2. ING Pop-Up Store Gamifies Financial Education

ING Belgium and Flair Magazine opened a pop-up store, The Orange Store, around the theme ‘saving money.’ In the shop, a visitor could find a collection of summer accessories that were selected by Flair magazine. All items were orange (the color of ING). In the pop-up store, the visitor couldn’t buy any of the merchandise. But as long as the sales period lasted, they could win a favorite orange item by participating in a game about savings.

The items were from H&M, Urban Outfitters, Mango, Habitat, Marc Jacobs, Micheal Kors, Biotherm, Alessi, Ice Watch, Chanel, Dior, etc.

With this initiative, ING Belgium wanted to show anyone who visited the Orange Store the power of saving money. The gamification is around a fictional person Laura, who saves 200 euro every month. The key was to estimate how much each item costs and calculate how long Laura would have to save for that particular item.

A great integration of retail, gamification and financial education.

3. C1 Bank Gets Funky in South Florida

The St. Petersburg-based C1 Bank designed its first South Florida branch to make an immediate impact and reflect the art and design galleries and new developments around it. Forget teller lines – the wide-open space has a circular desk with a very unique black chandelier hanging above it. There’s a huge display of artwork on the wall behind it and a conference room full of Andy Warhol paintings … of Mick Jaggar! The main desk can even fold away, creating a large area for community and charitable events after hours.

Instead of meeting with bankers in offices or at desks, the C1 Bank branch has ‘pods.’ Similar to restaurant booths with round tables and soundproof glass, each pod creates a distinctive and casual setting for bankers to discuss business and open new accounts with a specially designed iPad app.

Adding to the uniqueness of this branch, safe deposit boxes are accessible behind a wall of bookcases – think a mysterious mansion. There’s even a shower in the branch! After hours, the interior of the branch glows in neon green.

C1 Bank has three more branches under development in South Florida where unique styling is expected to continue (while maybe not at as high of a level as the Wynwood branch). The Wynwood branch was designed by interior designer Rob Bowen, of Rob Bowen Design Group, and Lisa Wannemacher, of Wannemacher Jensen Architects, both from St. Petersburg.

4. Capitec Welcomes With A Big “Hello”

South African bank, Capitec, welcomes customers and prospects entering their branches with a big ‘Hello’ translated in several dialects. This helps set the tone for a bank that wants to emphasize the ‘humanness’ of building relationships and the importance of being friendly.

Designed by allen international, the approach is intended to be fresh, bright and youthful with an emphasis on being cost-effective to roll out. Using an open-plan interior, the brand’s core colors of red and blue are used to clearly define quick transactions and consulting.

After the initial branch launch, Capitec is in the process of implementing the new concept across their 500 branch network.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

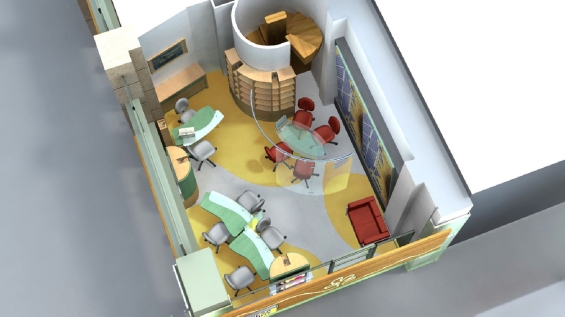

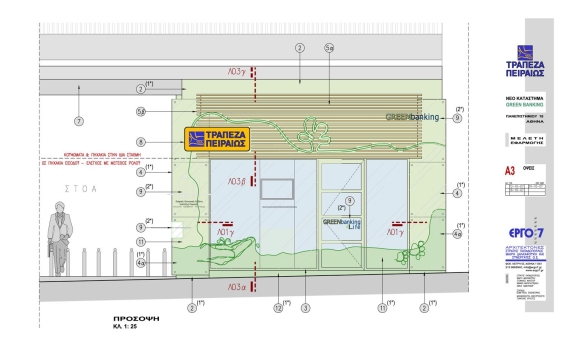

5. Piraeus Bank Branch Goes Green

An experimental, small-size special branch was designed to communicate the “green” aspects of Piraeus Bank‘s policy and to promote related products. The architectural challenge was to create an inspiring, informative micro-environment that conveys ecological values and concerns.

The essential elements of nature, earth-water-air-green, were embodied in a colorful organic design through the use of natural wood furniture, curved glass partitions, pigmented cement floor and colors. Ergo 7 Architects used organic forms, curved shapes, transparency, light and visual communication material for an effective information and sales niche.

6. High Tech Meets High Touch AT BECU

At BECU‘s new Eastside Financial Center, the signature crimson lighting makes an immediate impact … but it doesn’t stop there. The 24-hour smart ATM vestibule really isn’t a vestibule at all. This area of the branch is open 24-hours a day, with glass “nano walls” that can roll out on hidden tracks, safely locking this area from other parts of the facility, creating a totally flexible space.

The ATM wall is highlighted by ever-changing LED light topped by 5 digital monitors that showcase dynamic motion graphic content ranging from brand-building messaging, to gorgeous local NW scenery, to campaign promotions. The ATMs serve the cash-handling, deposit, and withdrawal needs of BECU members, because, like most BECU branches, there are no tellers here.

Two senior-level concierges engage guests, guiding them to the advice and solutions they’re looking for — whether loan, investment, or business related. Guests meet their advisors at desks, messaged to cross-sell services and demo savvy new mobile and tablet technologies. Some needs are handled almost instantly. For more detailed conversations, private offices are near by. Digital displays deliver dynamic content throughout the facility.

Informal meeting space combines with a formal conference room. Slide open the glass walls. Roll away the custom bar-height tables, and you have a community meeting and educational space ready to seat 55 guests.

Illustrating the flexibility of the entire branch, strategically placed glass nano-walls allow parts of the branch to operate on hours of its choosing. The loan center has the ability to run on its unique schedule — including being open on Sunday’s to serve those who want to get their home loan finalized after visiting that perfect open house. Special staging spaces provide quick informational meetings.

The design of this unique facility was done by EHS Design, with merchandising and messaging done by Weber Marketing Group.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

7. Bank of Melbourne Opts For Open Design

Bank of Melbourne worked with greater group to design a concept for multiple offices that would combine an open layout with a strong branding and a sense of community. Several offices were opened within a short period of time with variations on this central theme.

The goal was to design a branches that would be welcoming, break down the physical and emotional barriers between customers and staff, and assure customers that the services and solutions were shaped to suit the needs of local businesses, households and the community.

In each office, a custom display wall was used to present custom visuals that would resonate with the community.

8. Suncorp Responds To Changing Customer Needs

Suncorp Bank set out to develop a new store design to support their differentiated service model and growth strategy, combining technology and genuine face to face service to meet consumer’s changing banking needs. The branch is equipped with a range of new technology, including an Intelligent Deposit ATM, a Coin Counting Machine, iPads and a Teller Cash Recycler.

According to the bank, the aim of the new branch was to simplify the customer experience and free-up time for staff and customers to really connect. The new technological features were designed to enable staff to spend more time finding solutions to meet customers’ goals.

The design and colour palette was inspired by the Suncorp brand, which was first designed to signify the sun, rainforest and earth. The feature ceiling canopy is constructed using bamboo with gives the space a warmth and uniqueness not expected in a banking environment.

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team. Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape. Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Move the Needle from Attrition to Acquisition

9. First National Bank Kaleidoscope Branch

While not a new branch (built in 2009), this First National Bank of Omaha facility illustrates the power of unique material integration combined with illumination and color. In this case study, RDG Planning and Design employed a 160 foot point supported glass cavity wall that is internally lit with colored RGB LED’s. Patterns of local prairies grass and flowers shine through the glass, attempting to ground the building to its site.

While the original intent of the building extension was to be a billboard, the lit glass wall solution helped to blend and differentiate the building from the surrounding strip mall. The glass cavity also cuts through the interior of the building creating a continual element running through the building.

Although the glass feature is striking, the rest of the interior uses rich, dark wood tones which are both contrasting as well as complementary, creating the feel and aura of traditional bank design.

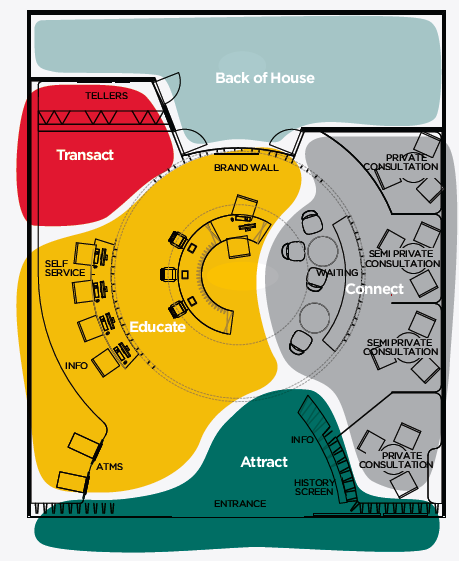

10. First Tech Credit Union Introduces Consultative Branch

Like many organizations, First Tech Federal Credit Union realizes that foot traffic is declining across the banking industry as customers turn away from traditional branches to online banking. They still believe that the bank branch remains a vital resource for customers, especially those seeking more complex banking products and services. That’s why First Tech is evolving the in-branch experience away from the teller row to be more consultative with a ‘Central Relationship Center’ akin to a lounge for more comfortable, collaborative interactions along with private member suites for the complex, private conversations.

“The most notable difference in the Bellevue branch design is that we’ve replaced the traditional teller row and new accounts desk environment with a central Relationship Center,” said Brad Calhoun, vice president, retail branches. “The Relationship Center is where our members and reps can grab a comfortable couch or stool together and conduct face-to-face conversations or transactions in a comfortable, collaborative, flexible environment. We’ve armed our financial reps with mobile technology that allow them to move with our members around the branch versus making our members come to us.”

The second key difference is the addition of four private Member Suites. Calhoun reports that First Tech members are increasingly managing routine transactions online and are more often visiting branches to discuss complex financial needs, such as home loans or investment portfolios.

Stephen Owen, First Tech’s chief retail and marketing officer. “To be a true partner, we believe we must transform from a servicing environment into a stronger consultative environment where we’re collaborating with our members, determining their needs and recommending solutions that help them move forward financially.”

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

11. Baoshang Rebrands Bank and Branch

In recent years, Baoshang Bank established the strategic vision of “To Become a Modern, World-Class and High-Quality Bank.” The bank was challenged, however, because it lacked in development of ideas and a positive brand experience.

To address these challenges, the bank worked with various agencies to formulate a new brand strategy with a logo and design system reflecting a modern and fashionable global image. Part of this redesign is reflected in the bank’s newest branch.

The new brand is helping in the Bank’s development and positioning within the industry and around the world.

12. Historical Eastern Bank Goes Digital

This modest 2,100 square foot branch serves as a new model for interactive technology for the 195-year-old Eastern Bank, benefiting both staff and customers.

As one of the oldest and largest banks in New England, with close to 100 locations, Eastern Bank first selected Margulies Perruzzi Architects to help it design a more self-sufficient, technologically-supported environment.

The layout for the Cotuit location updates the traditional teller counter, opting instead for multiple kiosk type stations on the branch floor. The kiosks are staffed with employees who can assist customers with all their banking needs or direct them to a virtual expert in a private room for more information on a banking product or service.

An interactive table with a touch-screen keyboard is available to customers who want to independently complete a transaction and a community wall with multiple touch screens offers alternate access points to information on banking products, tips for setting up banking apps, local news feeds, and video games like “Design a Dollar” for children accompanying their parents to the bank

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

13. Bank Muscat Shares Space With Other Trusted Brands

Bank Muscat wanted to create a unique new head office where customers are introduced to a new multi-sensory branding experience where they can literally see, touch, smell and hear the brand. The bank wanted to make a statement for contemporary Oman, integrating modern architecture with the latest technologies.

Key service roles were created to assist customers, lead them towards alternative channels, use touch screens to learn about product information and directly manage their accounts online. To build deeper relationships, the bank connected with OmanTel, Oman Air and The Ministry of Education to add to the in-branch retail experience and to provide unique financial offers.

14. Three Story Bank of China Branch Serves Range of Customers

Cutting-edge design and advanced digital technology combine with a unique three-story format to make the Bank of China branch unique in many ways. The impactful streetscape facade, inspired by the enduring symbolism of bamboo in ancient and modern Chinese arts and literature, delivers a refreshed expression of the trusted BOC brand that is instantly recognisable, highly visible and memorable.

“The banks’s aim was to optimise their customers’ banking experience within an open and cordial setting,” explained One Space co-founder, Greg Pearce. The new branch uses a multitude of materials, low-energy lighting, strong graphics and digital technology. Re-conceptualised customer meeting rooms were developed to better engage relationship managers and their customers in a relaxed setting, to encourage open dialogue and foster trust.

The street-facing entrance hall can accommodate exhibitions, financial planning seminars or community events, alongside 24-hour banking.