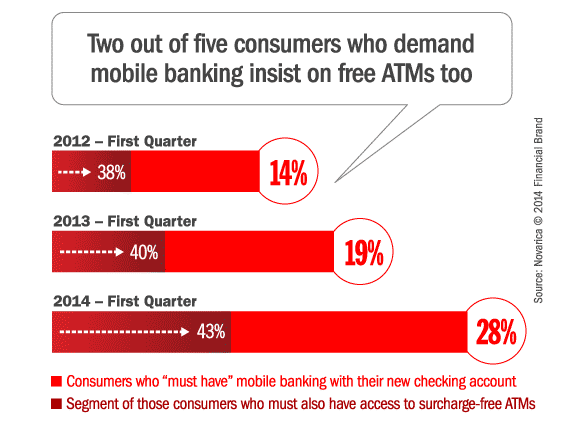

In the first quarter of 2014, nearly 28% of checking account shoppers on FindABetterBank indicated they “must have” mobile banking — a 47% increase from Q1 2013. A trend that we’re seeing with shoppers interested in mobile banking is an increased interest in access to surcharge-free ATMs. Mobile banking apps provide them easy access to their account information wherever they are, so it makes sense that many of these shoppers want broader access to cash too. Demand for mobile banking will continue to grow, as will shoppers’ interest in having easy, free access to their money.

We have found that most shoppers that must have mobile banking with their next checking account already use mobile banking with their current institution. And we can see that mobile banking experience changes shoppers’ overall requirements as well as which institutions they’re willing to consider. Shoppers that must have mobile banking:

Want other digital features too. Compared to other shoppers, they’re also much more likely to indicate they must have mobile check deposit (of course), online billpay and email alerts.

Select direct banks more frequently. Shoppers that must have mobile banking are 40% more likely to select a direct bank than all shoppers are FindABetterBank.

Still want to open accounts in branches. Most shoppers that want mobile banking with a traditional bank or credit union prefer to open their accounts in branches. In fact, only 10% of these shoppers said they prefer to open the account on their mobile phone.