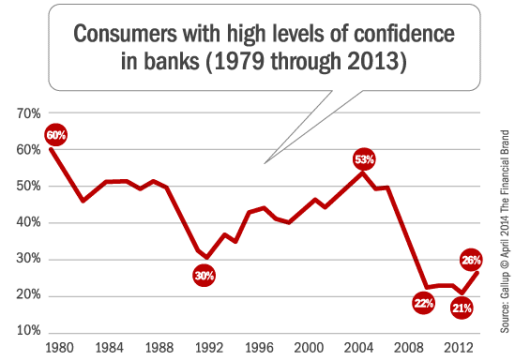

After nearly a decade of sharp declines in confidence in banking, several industry surveys have found that customers’ loyalty, engagement, and satisfaction with their own banks is on the rise. According to Gallup, Americans’ confidence in U.S. banks increased to 26% in 2013, up from a record low of 21% a year earlier. As a result, the percentage of Americans saying they have “a great deal” or “quite a lot” of confidence in U.S. banks is now at its highest point since June 2008, but remains well below its pre-recession level of 41%, measured in June 2007, or the 53% in 2004.

Interestingly, the percentage of Americans saying they have a great deal or quite a lot of confidence in banks is now about the same as those expressing little or no confidence (28%), moving closer to a net-positive confidence for the first time since 2009.

While it is definitely not time to break out the champagne, how can banks build on this momentum and leverage a stronger confidence level to build loyalty and to serve as a defense against new market entrants?

Using data collected during Gallup’s latest Retail Banking Study, there are four areas of opportunity for banks to increase customer confidence.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Advocacy

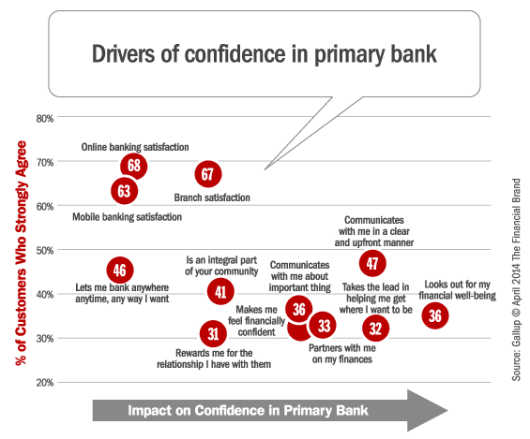

The component that has the biggest impact on confidence according to Gallup is customer advocacy. “Partnering with customers on managing their finances, making them feel confident about their financial future, and taking the lead when necessary helps them believe you are on their side and looking out for their best interests,” according to Beth Youra, Senior Consultant for Gallup. “This manifests itself in customers feeling like you are looking out for their financial well-being, which, in turn, makes you seem more selfless and gives customers the confidence that you are in it for them and not yourself.”

Clarity

Clarity, simplicity and transparency all have a strong impact on confidence in a customer’s primary bank. According to Gallup, customers are more likely to agree that their banks always communicate with them in a clear and upfront manner than they are to agree that banks communicate with them about things that are meaningful. As a result, there is still room for improvement in both of these metrics. It is important to note, however, that there seems to be a positive impact from the work done by banks and credit unions over the past couple of years when it comes to simplicity and clarity in customer communications, since these numbers were significantly lower in previous studies.

Every interaction in every channel is an opportunity to demonstrate simplicity, clarity and transparency, which is particularly important when consumers are searching for a financial services provider or interested in understanding fees, rates, etc. With most consumers beginning their search online, financial institutions have control over how they present themselves to these shoppers.

Positive Customer Experience

Customer experience is not only a key driver of confidence, but also a key driver of both attrition and retention. According to Youra from Gallup, “If customers are not having a consistently exceptional experience every time and every place they interact with you, you are not even in the game.” Unsurprisingly, the branch has been found to be better at driving confidence than digital channels, with a positive personal interaction more likely to inspire both confidence and engagement. Alternatively, Gallup found that the lack of satisfaction in digital channels is more likely to drive a negative outcome than satisfaction with these channels is to drive a positive outcome.

“People still like people and trust people more than technology, even if customers are increasingly interacting with technology,” says Youra.

Read More: Millennials Desperate for a Better Banking Experience

Delivering on Promises

Variations on the following themes are prominent in today’s financial institution marketing.

- “We let you bank anywhere, anytime, anyway you want”

- “We are an integral part of your community”

- “We reward you for the relationship you have with us”

While the Gallup research found that these attributes do positively impact the confidence people have in their bank, the majority of customers don’t agree that their bank is delivering on these promises. And while “lets me bank anywhere, anytime, anyway I want,” is the highest scoring attribute in the survey, “Rewards me for the relationship I have with them” is the lowest scoring attribute at 31%. Maybe the feeling of being rewarded for the business brought to the bank is not resonating, or maybe the rewards are just too hard to take advantage of. Either way, institutions need to step up their game when it comes to paying off on the promises made in today’s marketing.

Read More: Who Cares About Debit Reward Cards?

Banks have the opportunity to benefit from the recent momentum in increased industry confidence. Focusing on customer advocacy, clarity, the overall customer experience and delivering on promises made can build engagement, loyalty and provide a defense against new market entrants. The overall improved feelings of financial well-being will also assist in further building confidence, but more needs to be done.

The use of customer insight to better understand the customer and their needs can have a significant impact on confidence as can the focus on a consistent experience across channels. These initiatives are important since in the end … it’s all about the customer.