This research study asks if consumers really want to “join the conversation” with banks? Are they even “listening?” Has the financial industry’s rush to social media paid off? Or not?

In the last five years, banks and credit unions have increasingly relied on social media as a communications channel. Most if not all of the largest U.S. banks have a presence on one or more of the top social media sites, and they are using this channel to communicate product changes, service enhancements and other happenings that are of relevance to customers.

A relatively small segment of consumers have reciprocated, using social media to contact (or complain about) their financial providers. A sliver of consumers utilize social media to find a new bank or credit union, primarily by asking their Facebook and Twitter friends for recommendations.

A relatively small segment of consumers have reciprocated, using social media to contact (or complain about) their financial providers. A sliver of consumers utilize social media to find a new bank or credit union, primarily by asking their Facebook and Twitter friends for recommendations.

But has the financial industry’s rush to social media paid off? Is it worth it? And are consumers interested? Do they even care? These are some of the questions that payments provider TSYS has tried to frame in its report, “Banking & Social Media: Customer Communication Boom or Bust?”

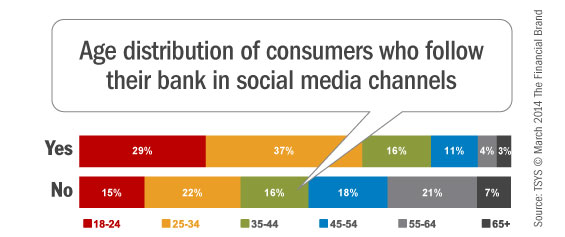

TSYS surveyed 1,000 U.S. consumers who own a credit and debit card. Four out of five say they use at least one social media site — Facebook, Twitter, LinkedIn, etc. – and unsurprisingly, most are younger.

The study primarily focuses on one foundational issue: Do customers want to “join the conversation” with banks? And are they even “listening?”

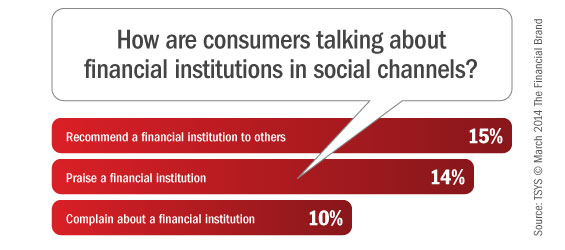

Researchers asked participants if they had used social media in any way to “talk” about their bank or credit union. Most of them (71%) had never used social media for this purpose. 29% say they’ve used social media to make a complaint or publicly comment on the service of their bank or credit union.

One in ten respondents say they have used social media to complain about their bank or credit union.

( Further Reading: Banking Consumer Social Media Sentiment Report )

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

During one focus group session, participants scoffed at the notion of connecting with their financial institution through social channels, dismissing it as silly. The discussion question evoked a sarcastic response or two, but the group collectively saw no real need to answer a question they found funny. They didn’t take it seriously.

“I’ve honestly just never even thought about it,” said one participant. That sentiment seemed to reflect everyone’s position.

( Read More: Lessons From 2 Million Bank & Credit Union Facebook Conversations )

One half of participants say they do not pay attention to ads on social media sites.

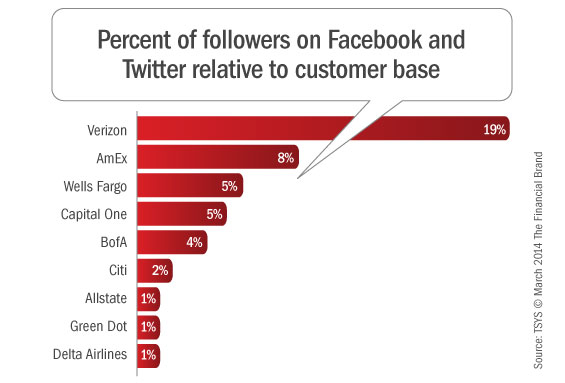

TSYS also examined the number of ‘Likes’ or endorsements for a group of banks and other service companies, they found that capital one and American Express have the most out of the banks listed — around half the number of ‘Likes’ that Verizon has. They also looked at the number of Twitter Followers, comparing banks against various service companies.

The TSYS study isn’t the most intensive research project ever fielded on the subject of social media in banking — only four questions, and a handful of other charts/datapoints — but it does contain a number of insights that financial marketers will find fascinating.

You can click here to download a summary of findings from the TSYS study for free after completing s simple contact form.