When are you going to see the most online applications for deposit accounts this year? Data from Andera says that should happen roughly on Monday, August 18th around 11 am.

By Melanie Friedrichs, Analyst at Andera

Bank marketers spend a lot of time figuring out how to convince consumers to apply for deposit accounts. They use targeted offers, promotional interest rates, cash rewards, and many other strategies to get consumers to switch. Some institutions get really creative. Sometimes creativity backfires. Wouldn’t it be easier to catch consumers if you knew when they wanted to apply?

With over 500 online account opening customers attracting more than 2 million applicants every year, Andera has a unique insight into account opening trends. We took a deep dive into our data to produce our decennial report, The Future of Account Opening, and uncovered some interesting insights about when applicants apply for accounts.

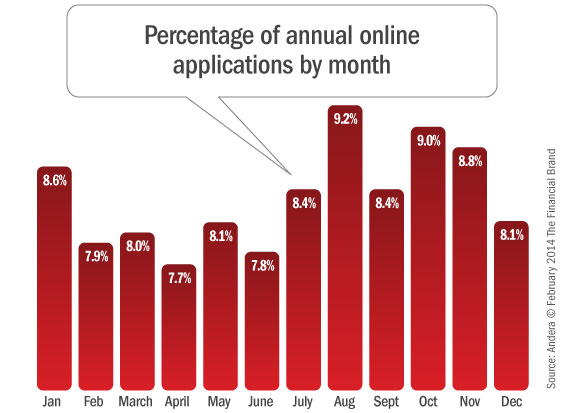

First we looked at application volume by month. We found that application volume is relatively constant throughout the year, with slightly fewer applications than the average, 8.33% in the late winter and spring, and slightly more applications than average in January and in the late summer and fall. July and October are the most popular months to apply, producing 9.2% and 9% of application volume respectively.

( Read More: 10 Tips To Drive More Online Applications )

Note: All data from 100,000+ application starts, drawn from a representative sample of Andera clients, January through December 2013.

Fractional Marketing for Financial Brands

Services that scale with you.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The summer increase in applications may be correlated with moving; consumers are more likely to move in the summer to conform to school calendars and lease constraints, and new movers often apply for a new account shortly after relocation. The increase in applications in the fall may be related to the large number of accounts opened when freshman go to college. These trends might be even more pronounced if financial institutions did a better job of targeting marketing spend on the months that matter most.

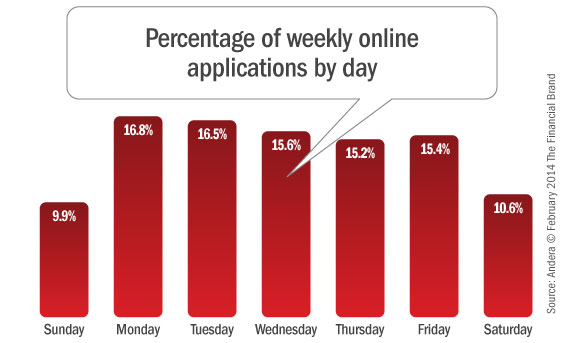

Second, we looked at application volume by day of the week. Our platform is live 24/7, so there are no constraints posed by hours of operation. We found that more consumers apply during the week than on the weekend, although each day of the week receives a sizable chunk of applications. Monday produces the highest application volume, 16.8% of total volume, while Sunday produces the lowest, 9.9% of total volume.

Weekly trends in application volume are similar to weekly trends in eCommerce: check out this chart from Windsor Circle, whose ecommerce platform processes about a quarter of a billion in transactions annually.

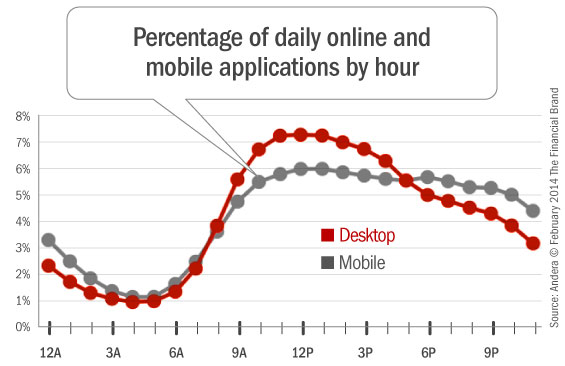

Third and finally, we looked at the time of day consumers apply. We found that online application volume peaks around midday and then slowly tapers into the evening, with about half as many applications submitted at 8:00 PM as at noon. Most online shopping sites, in contrast, see a spike in the evening when normal office hours end. Perhaps financial products are “serious” enough to justify sneaking some personal time at work?

( Read More: It’s Time Online Account Applications Got A Major Facelift )

Although the data shows that a significant number of consumers apply for accounts during the day, a majority of consumers, about 58% still apply outside of normal working hours, when it’s not usually possible to visit a branch. The 42% who apply when most banks and credit unions are open have the choice to apply in the branch or online, but for some reason, be it time, location, or simple preference, chose to apply online.

We were also able to parse applications started on mobile devices from applications coming from a traditional desktop or laptop devices. We found that mobile applicants apply more consistently throughout the day, reflecting the more frequent use of mobile devices outside of normal working hours.