Many consumers blamed large institutions for the financial collapse of 2009. Movements were born like Bank Transfer Day to encourage consumers to move their business to smaller, more “customer friendly” banks and credit unions.

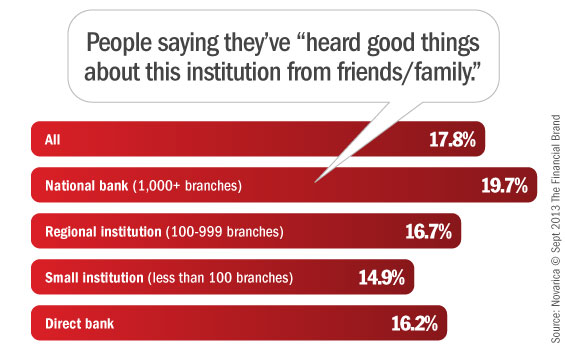

That’s water under the bridge for many consumers. In Q2 2013, more active bank shoppers on FindABetterBank selecting a national bank indicated that recommendations from a friend or family member influenced their decision, compared to shoppers that selected a smaller institution.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Read More: Consumers Icy Feelings Toward Bankers Finally Starting to Thaw

This positive vibe is despite the fact that most national banks have abandoned free checking can carry higher fees. For example, today, the average NSF from national banks is $2.10 higher than the average NSF from community banks and credit unions.

In a recent survey of active bank shoppers on FindABetterBank, the percentage of shoppers who are switching banks due to high fees has declined by 1/3 in the last 12-months alone. And shoppers on FindABetterBank indicating convenience of branch and ATM locations are important select a national bank 62% of the time.

Reality Check: Many consumers are more interested in the convenience provided by national institutions, even if they must pay extra for it — despite whatever flaws, faults and hard-feelings consumers may attribute to banks.

How can small institutions retake the momentum? It’s critical to hyper-focus on convenience features like surcharge-free ATM access, mobile banking and shared branches in the case of credit unions. Forget about toppling the big banks; focus on beating regional institutions — the $10B to $20B asset-sized banks — because they aren’t as agile as smaller institutions and don’t have the technology resources of the larger institutions. Many of these regional players have been slow to roll-out new services like mobile check deposit and don’t offer surcharge-free ATM access.