It’s a fallacy to assume seniors don’t want to use digital channels for banking. They just prefer to use personal computers over mobile devices. Low fees and convenient branch locations are the primary drivers for which accounts they select.

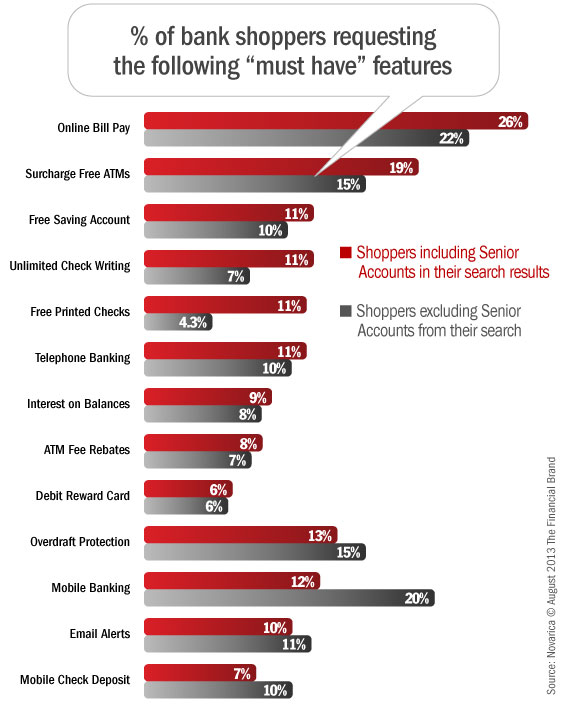

Grandma might use her mobile phone to send and receive text messages from her grandkids, but she’s much less likely to want to use it to check bank balances or do other banking activities. She prefers completing those tasks at home in front of her desktop computer. In Q2 2013, people searching for new checking accounts on FindABetterBank who were requesting that “senior” accounts be included in their search results were 66% less likely to indicate they “must have” mobile banking and 18% more likely to indicate they must have online billpay.

Other features of import include surcharge-free ATM access and traditional checking account features like unlimited check writing and free printed checks. They are also less likely than others to request overdraft protection – which correlates with less frequent ATM use and fewer overdrafts per year.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Fractional Marketing for Financial Brands

Services that scale with you.

In Q2 2013, one-third of the institutions listed on FindABetterBank offer accounts specifically designed for seniors, yet these options are not particularly popular with this older segment. People requesting that senior account be included in their search results ended up selecting a senior account in the end only 12% of the time. Those choosing senior accounts cited low fees and convenient branch locations as their primary motivation for doing so. Seniors selecting accounts that aren’t restricted to seniors also made their decision based more on fees than branch locations as their motivation vs. those who selected senior-specific accounts.