According to the 2013 Efma Marketing Survey, 84% of banks actively use Facebook as part of their marketing strategy, and most everyone else plans to do the same in the near future. As social media marketing continues to gain steam in retail banking, financial marketers need to pause and think about how they use social channels and whether this activity is really adding any value.

If approached with a clear-cut plan, commitment, and creativity, social media can be a great tool for banks. You’ll get out of social media only what you put into it, so if your objective is to use social media marketing to have the greatest possible impact on your financial institution, take a look at these 7 best practice tips.

1. Go All-In

It may only take five minutes to create a Facebook page or Twitter account, but merely entering or dabbling here and there in the social media space a few minutes a week won’t produce results. If you’re looking to get anything of social media, you should first consider the amount of time and effort that it requires to be effective with social media marketing. Finding social media success requires dedicating resources, and not just assigning a social media intern! If you are ready to make the commitment, you should develop a team within your institution, evaluate how many resources you’re willing to devote to social media, and proceed from there.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

2. Get That Strategy Ironed Out

Social media marketing is slick and trendy. And while it can also be a great tool for banks, that doesn’t’ mean you should jump on the bandwagon without a clear purpose. In the early days, you could get away with strategy statements about “engagement,” “listening” or “testing the waters.” Not any more. You have to go deeper. Much deeper. Why are you really in the social media space? What do you hope to get out of it? Answering these questions will help you to refine your plan, which honestly most financial institutions haven’t revisited since they launched their social media accounts. It’s time to start taking social media seriously with a purpose-driven strategy focused on outcomes.

Read More: Keep Cocktail Talk Out of Your Social Media Content

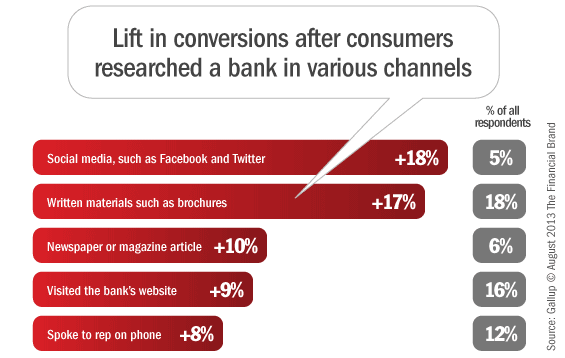

Where are the best prospects? The results of this Gallup research suggest banks can find tasty leads in social channels. While fewer consumers use social media to research banks, those that do are more likely to take the next step and convert.

3. Don’t Just Inform… Entertain

People don’t want to hear only about banking. Instead of boring readers with posts exclusively about your bank’s hours, rates, or services, try to entertain them. Post content that people respond positively to. Use a casual, conversational tone. Post content in varied forms — text, photos, videos. The goal is to strike a balance between information and entertainment. People will go to your bank’s website for specific information, so although some informational content on your social media profiles may be necessary, it’s high-quality entertaining content that will generate buzz and widen your online network.

4. Build Your Community Through Personal Interactions

Social media is all about connecting with people, so it’s the perfect tool to show your customers that you’re human. Build trust and add a personal touch to banking by interacting with readers, offering advice and asking questions (not necessarily related to banking). By initiating friendly conversations on your social media platforms, you can establish a virtual community and better connect with consumers.

Read More: BofA’s ‘Tone Deaf Robot’ Replies To Consumers With Boilerplate Tweets

5. Resolve Customer Issues Publicly

Don’t fear customer complaints in social media. Instead, embrace using social media as a customer service tool and let your customers know that you’re there to help them online. If a customer posts about a problem they’re experiencing with your products or services, reply to them and help them work through the issue. By engaging with customers online, you can ensure that customer grievances are addressed promptly, and by doing so, convey your commitment to high-quality customer service. Customer privacy is paramount, though, so be sure to keep conversations private if sensitive information is involved. On Twitter the easiest way is to follow the customer and have them send a direct message.

6. Get Creative

To establish a strong social media presence, you need to be bold, take risks, and think creatively. Don’t swim in the same sea of uniform and uninspired bank Facebook profiles. Instead, experiment with your page to see what resonates with people. For example, you could hold contests, have giveaways, or talk about your community work. Whatever you do, don’t be afraid to experiment and tweak your approach.

7. Monitor and Measure

Monitoring and measuring your social media success is key to calculating the impact of your social media presence. To decide how many resources you should commit to social media, you need to have a gauge on your return on investment (although calculating ROI in social media is notoriously difficult). For starters, you can turn to any number of online analytics tools, which will give you a sense of how your social media profiles are performing.

Julia Verbrugge is a Marketing Coordinator at Andera, the leading provider of online account opening and lending solutions for banks and credit unions. A member of social media frenzied Generation-Y, she has diverse social media management experience and has worked with non-profits, start-ups, and larger companies to improve their digital marketing strategies. She is an avid writer and blogger, is passionate about innovation and technology, and is constantly caffeinated.