One would think those with the lowest balances are most likely to overdraw their accounts. Yet, only 56% of Q2 2013 shoppers on FindABetterBank whose lowest balances of $1,000 or less indicated that they overdrew their account one or more times in the last year, compared to 66% of shoppers whose lowest balances were in between $1,001 and $2,000. Only 11% of shoppers with low balances greater than $2000 said they’ve overdrawn their account 1+ times in the last year.

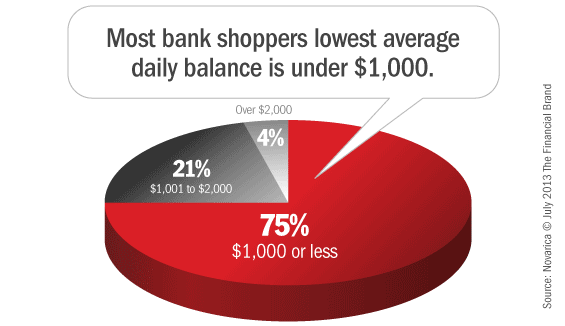

In Q2 2013, 75% of shoppers on FindABetterBank indicated their lowest minimum daily balance is $1,000 or less, 21% maintain lowest balances between $1,001 and $2,000 and the remaining 4% keep their balances over $2,000.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Fractional Marketing for Financial Brands

Services that scale with you.

Heavy ATM usage also generates fees for banks and credit unions. Again, we find those with balances between $1001 and $2000 are more frequent ATM users and more likely to use foreign ATMs.

Given that overdrawing accounts and using ATMs a lot causes bank customers to pay fees, we wanted to see if these shoppers were more likely to pick an account because of low fees. Yet, only 31% of shoppers with low balances between $1,001 and $2,000 indicated they chose an account because of low fees, compared to 39% of shoppers with low balances of $1,000 or less. Twenty-four percent of shoppers with low balances greater than $2,000 chose accounts because of low fees.

Clearly, many consumers don’t consider ATM and overdraft fees as much during the purchase process as monthly service fees. This is partly because people aren’t particularly realistic about their future behavior when making these decisions.