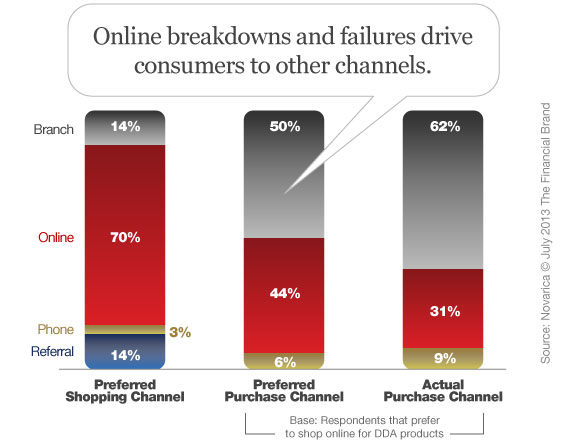

Many bankers today cling to the outdated notion that sales primarily stem from local presence and spontaneous foot traffic. That explains why most banks and credit unions — particularly those under $10B in asset size — have under-funded their public-facing websites. In a recent survey of consumers who opened deposit accounts found that 70% preferred to shop online for these products. However, 71% of these online shoppers reported opening the account in a traditional channel.

Consumer channel preferences play a significant role in their multi-channel behavior – 50% of online shoppers prefer to open accounts in branches. For example, many Gen-Y consumers prefer to open checking accounts in branches because they don’t understand the product enough to be comfortable completing the transaction online.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

But poor online experiences also contribute to multi-channel shopping behavior – more consumers prefer to open accounts online than the number of consumers that actually open accounts online. Why? Websites don’t provide enough information for consumers to feel confident moving forward and the online account opening process can be very clunky.

Banking institutions failure to adapt to consumers’ changing shopping behavior is because the value of their public websites is judged strictly by the volume of business closed and fails to take consumers’ multi-channel preferences into account. Consider this: If most shoppers that walk into branches have already visited your website, how many online shoppers 1) couldn’t find your website when they were shopping online or 2) visited your website and decided to look elsewhere because of a poor experience?