1. Attrition will rise, loyalty will decline

The good news? There have been marked improvements in the measurement of customer retention, loyalty, and advocacy. The bad news? There’s been a notable rise in customer churn. The J.D. Power and Associates study found an increase of two percentage points in the number of customers who say they “probably will” or “definitely will” switch banks in the next 12 months. The trending increases in less-than-loyal customers had abated somewhat in 2011, but today is 4-percentage-points worse than 2009.

What can banks anticipate from this wavering consumer loyalty? Increased switching and attrition, obviously. But consumer utilization of banking products will also drop. The study found that a higher number of customers are reluctant or unwilling to reuse their bank’s products and services in the future, nor are they comfortable recommending their bank to family and friends. This erosion in confidence will also have a notable impact on future organic growth, whether based on share-of-wallet from existing relationships or new acquisitions. After all, fewer fans of your brand means fewer evangelists advocating for your brand.

While these trends are common across banks of all sizes, it is clear that Big Banks (defined as the six largest financial institutions based on total deposits as reported by the FDIC, those with $180 billion or more) face the greatest challenges in retaining and growing their current customer base, while also struggling to tap those customers as sources of new/additional revenues in the future.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

2. Generating fee income gets even harder

On the heels of changes to non-sufficient funds/overdraft fees due to the implementation of Regulation E, banks felt yet another revenue pinch in late 2011. Beginning in Q4 2011, the Durbin Amendment of the Frank-Dodd legislation capped debit card interchange fees for banks with more than $10 billion in assets. This cap represents a significant loss of income to retail banks and was a hard felt one-two punch to the bottom-line revenue they had relied on for the better part of the last decade.

The demise of totally free checking was rapid, with banks scrambling to replace at least a portion of the lost income with new sources of revenue.

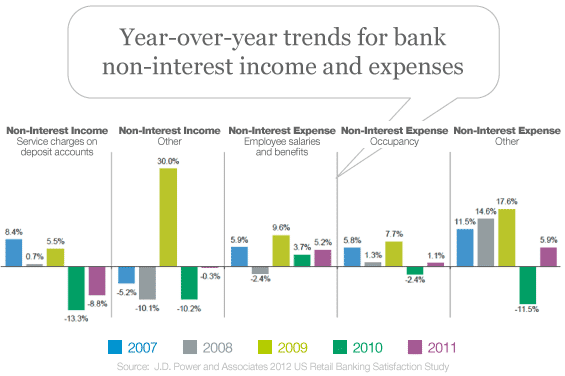

As a result, non-interest income has declined from 2009 highs, in conjunction with the enacted legislation, while non-interest expenses such as salary, occupancy, and other overhead expenses have risen annually.

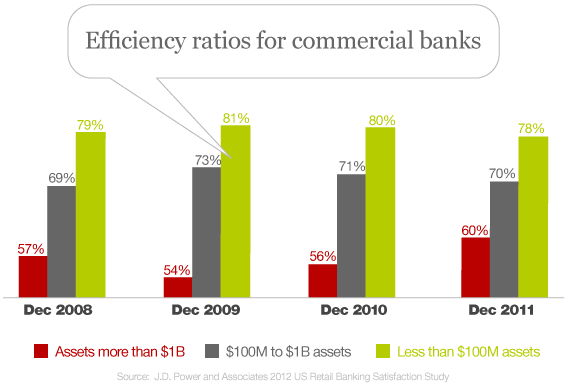

It doesn’t leave banks with a lot of options. Without new and sustainable sources of revenue, the only remaining option for improving bottom-line profitability that is within the direct control of banks is reversing the expense trends of the past 3 years through cost containment and reduction. The result has been a significant and steady rise in the efficiency ratio*, particularly for those banks with more than $1 billion in assets. What else can banks do? If they can’t boost one side of the ledger, cuts have to be made on the other. When organizations start focusing on costs, seldom does the service experience improve. As Big Banks shift their attention to costs, you can anticipate more disgruntled and disloyal customers.

(*Note: “Efficiency ratio” for commercial banks is calculated based on non-interest expenses divided by total revenue. Source: FDIC.)

3. Cost containment will become the primary lever for improving the bottom-line, it just needs to be done right

While nearly two-thirds of non-interest expense is attributed to primary distribution networks, including branches and call centers, the remaining one-third is in staffing and technology expenses. The challenge for banks will be to resist the temptation to take the traditional route of cutting costs in the latter two areas. With customers embracing new technologies associated with mobile and online, banks need to invest in new, innovative, and more cost-effective products and services.

Instead, cost containment initiatives should focus efforts on the costs of service delivery through the branch and call center channels. Developing approaches to reducing the support infrastructures associated with aging brick-and-mortar facilities and manual processes will help banks improve bottom-line net income. The risk is how to downsize distribution channels and streamline the services performed through those networks, while at the same time not sacrificing customer satisfaction in the process. Identifying, prioritizing, and managing customers’ expectations regarding their retail banking experience is a necessary and key component in order for banks to minimize additional incremental attrition that might result.

The Bottom Line:

Banks need to be extremely mindful of the key priorities necessary to improve both customer satisfaction and underlying profitability, and should establish initiatives that address the following areas.

Improving satisfaction with fees, especially maintenance fees

- Customers need to better understand the terms regarding when and why they are assessed fees, and know that they have available options to avoid those fees.

- Offering customers multiple product discounts also provides an opportunity for banks to benefit through increased satisfaction, loyalty, and advocacy, and potentially lower attrition.

Mitigating attrition by reinforcing low-cost drivers of satisfaction

- While fees provide customers with a motivating reason to switch banks, study findings show that fees are not the main reasons customers switch banks, but rather are a contributing factor among customers who were already dissatisfied due to substandard service.

Focusing resources on enhancing the relationship with affluent customers

- The value that Affluent customers bring to the bottom line is extremely tangible and attractive for banks, but keeping those customers satisfied requires more than just a standard approach.

- Banks need to create programs that include tailored products, services, and support that meet the specific needs and expectations of this group of customers.

Implementing a focused and strategic cost containment strategy

- The need to cut overhead is a given, and most banks have the excess capacity available to lower costs.

- The easiest option of cutting staff across the board should be resisted.

- Even when banks are considering a comprehensive program involving staff reduction, changes in branch hours, and/or network consolidation, it is possible to maintain or even improve service quality and customer satisfaction if the bank takes the necessary planning steps ahead of time.

The 2012 U.S. Retail Banking Satisfaction Study, now in its seventh year, is based on responses from nearly 52,000 retail banking customers regarding their experiences with their retail bank from January and February, 2012. Customer satisfaction with the retail banking experience was measured in six factors: account activities, account information, facility, fees, problem resolution and product offerings.