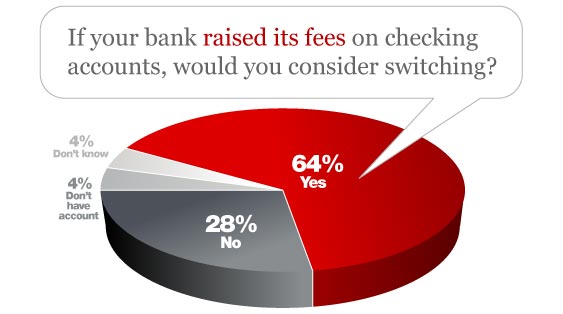

Americans are so stressed about their financial situation that one more bank fee may be all it takes to get them to switch. According to Bankrate’s national Financial Security Index, an overwhelming majority say any increase in checking fees would force them to think about moving their account. 64% of consumers would consider switching if faced with new fees.

The least loyal segment are those under 30, where a stunning 71% say they would look elsewhere. That number drops to 68% among those ages 30 to 49. Seniors are the most loyal, with slightly less than half of those 65+ saying they’d consider switching over a higher fee.

This leaves retail banks and credit unions in a pickle, since most are seriously considering a wide range of new fee options to replace lost income.

“With restrictions on overdraft fees and a proposed cap on debit card swipe fees, financial institutions need to recover that revenue elsewhere,” said Greg McBride, CFA/Senior Financial Analyst at Bankrate. “Anything that was once free is now fair game.”

Fractional Marketing for Financial Brands

Services that scale with you.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Bankrate says financial institutions should think twice about the competitive pitfalls facing those who try to squeeze consumers for more.

“For one thing, they risk losing lucrative high-income customers,” notes Claes Bell at Bankrate. “Of those making between $50,000 and $75,000 annually, 73% would consider moving their account. For those earning more than $75,000, the figure rises to 75%.”

Among those making $30,000 per year or less, only 60% would consider switching.

52% of Americans have more emergency savings than credit card debt. About 23 percent have more credit card debt than savings. And 19 percent say they have no credit card debt, but they also have no savings.

Those 30 to 49 years of age have higher ratios of credit card debt to savings. “This might be because of a singular event — like a job loss — that depleted their savings and caused the debt to file up, or from a pattern of several years of overspending,” observes Bankrate’s Kristin Arnold.

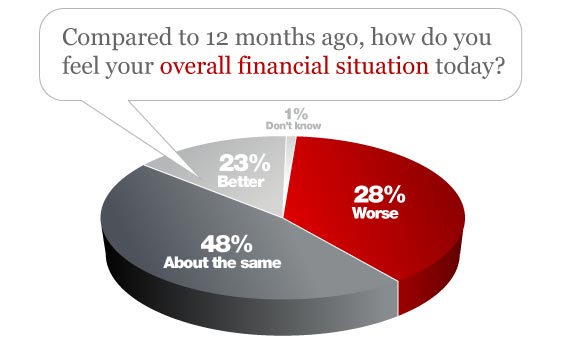

Bankrate’s study also found that Americans are increasingly uneasy about their debt levels. One in five Americans say they are less comfortable with their debt load now than they were 12 months ago. Meanwhile, people’s sentiments about their net worth is unchanged, despite strong gains in the stock market over the last 12 months.

“In 2007, the market was going gangbusters and everyone had equity in their home they could tap into if they needed to use it,” observes Greg Stevens, Senior Financial Counselor at Cabot Money Management. “Equity in your home has a huge impact on how you feel about your wealth. Too many people got really comfortable tapping their home equity to pay for things like vacations, cars and boats. That is gone now. People don’t have the equity they had in their homes, and it makes everyone less comfortable.”

“In these economic times, Americans are particularly sensitive to higher bank fees,” says Bankrate’s McBride. “Every dollar counts.”

Key Strategic Questions

- How can you scratch what itches for consumers? If they are prickly over fees, worried about debt and anxious about the future, what can you do to reassure and help them?

- For all their big talk, will consumers really walk?

- If every financial institution introduces new fees, where can consumers go to escape paying more?

- How many banks and credit unions will be able to resist implementing new account charges? Will the remaining holdouts be victorious in what’s starting to shape up as an upside-down fee war in the retail banking sector?

- Will a financial institution that charges less for the same fees have a competitive advantage? Are ads touting things like “ATM fees only $1” around the corner?