Bankers understand the importance of personalizing customer experiences. It’s been a stated objective for years, but strategies have been limited to particular creative executions and the use of names and credit offers in dynamic emails. In truth, financial marketers are hamstrung by data silos, conflicting product goals and resource constraints, all of which combine to make personalization very difficult.

To overcome these challenges, banks and credit unions have historically relied heavily on applications and technology solutions to bridge the gap between their customer data and their customers. For example, digital marketers leaned heavily into data management platforms (DMPs) to execute targeted, quasi-personalized digital messaging. DMPs are expensive, and as it turns out, rely on third-party cookies.

Remember The Exciting Promise Of DMPs?

All that data ready to be activated and analyzed. Boundless opportunities for the anonymous audiences waiting to be released into the wild and drive conversions. And then one day Firefox started blocking third-party cookies. “Okay,” we said, and moved along because Firefox’s browser market share ranked fourth at about 13%. Then in 2020 Apple’s Safari began blocking cookies by default. That was a little scarier, because its market share was around 40%.

At that point, most of the browser share overwhelmingly belonged to Google’s Chrome, and even before the recent extension there was a long runway left before sunsetting those cookies. So, what did marketers do? We got complacent.

We’d made huge investments in DMPs, it was a safe bet — everyone was doing it. And then we realized just how much of our investment was simply rented. We plan for obsolescence in hardware, and we expect incremental investment in software when feature sets expand. What we cannot plan for is a tectonic shift in our marketing stack driven by outside influences.

In an amorphous landscape constantly generating new acronyms, calibrating your investment in the future is daunting. Leaning on the DMP example, the point of failure is external — a change in the way identity is distributed and interpreted within the ecosystem. The good news is that upstream your first-party data remains your most stable asset atop your hierarchy of marketing needs. Protecting that investment means safeguarding its ability to enter any ecosystem regardless of technological means.

Modularity among your marketing stack’s components is the key factor for preparing for the changes you can’t see coming. Foundational interoperability lets you cut ties with losing solutions.

Keep an Eye Out:

The ‘walkaway cost’ should be a strategic principle in evaluating any new marketing technology — there will always be something shiny and new.

The core of your bank’s marketing stack isn’t your technology, however, it’s your customers. Those relationships must outlast the service lifetime expectations of today’s technology.

What Decisioning Engines Need to Perform Well

Decisioning engines are the newest shiny object to capitalize on first-party data to deliver better customer experiences.

These are large investments that promise to deliver personalized touchpoints. The challenge is that they are just one part of the modern marketing stack that will underperform without the other essential components, especially the first-party identity graph.

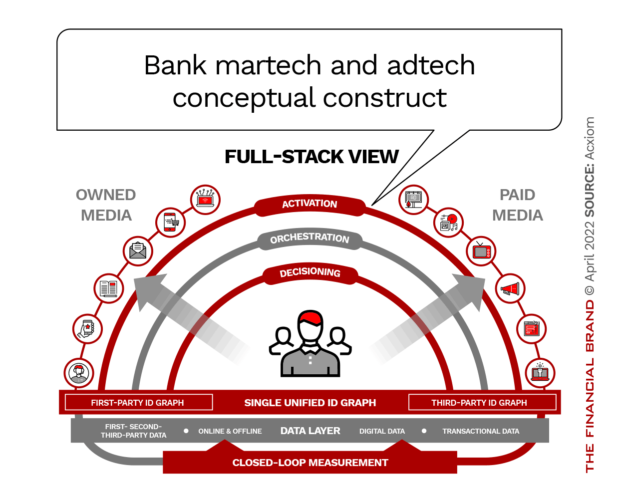

The identity graph lives in the unified data layer of the stack and, simply put, is the 360-degree view of people. As shown in the accompanying diagram, the identity graph is fed by signals customers and prospects emit on their journeys across paid and owned media. These signals are captured by a first-party tag and pulled into the identity graph to build out the view of the person, and to enable recognition of them even when they have not identified themselves.

The identity graph works hand in hand with the decisioning engine to recognize and act when people are interacting with the financial institution’s brand. Without the identity graph, brands will have significant gaps in their ability to execute personalized journeys.

The other critical components to personalization are data and models. Most decisioning tools are made smarter by data, especially if they are using artificial intelligence for optimization. This data could be CRM, product, customer experience signals, third-party data, credit data, or other enterprise information. Bringing this disparate data together and unifying it for marketing use also happens in the data layer.

Personalization Drivers in Banking:

Data and decisioning tools are crucial if any bank or credit union is looking to upgrade its personalization efforts.

What is Identity Resolution?

Identity resolution is a process by which people’s signals are collected in a centralized repository at the individual level. Data indicating life changes — moving, getting married or divorced and other details can be tied together to build a more complete view of a person. The newest thinking on identity is that people’s digital personas should be as robust and vital as their offline personas and should be stored and managed in a privacy-compliant manner within a first-party identity graph.

Clean and complete data when resolving identity gives marketers the best chance of reaching people where they are now. This isn’t just a point-in-time solution, it is the backbone of the modern marketing technology stack and critical to orchestrating relevant, personalized experiences.

For more information, visit acxiom.com/financial-services.