Financial institutions have come to the realization that legacy mainframe databases are ill-equipped to meet the demands of digital banking, personalization, and real-time analytics. As a result, more banks and credit unions are actively pursuing data modernization initiatives. The goal for these changes is faster access to data, scalability and seamless integration across the organization, all of which form the foundation for digital banking transformation.

New research, conducted by the Digital Banking Report and sponsored by IBM, has found that data modernization efforts, while often still in formative stages, are moving rapidly. And, while determining the appropriate tools and finding ways to transport business rules and logic from legacy systems are challenges, the biggest hurdle often is finding people with skills in data conversion and data migration in a highly competitive marketplace. This is why many organizations are exploring partnering with third-party providers.

The payoffs extend beyond better customer insights delivered almost instantly across the organization. There are also benefits related to increased productivity and reduced maintenance costs. The good news is that financial institutions of all sizes can create a new data management paradigm and gain the benefits it brings.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Momentum Builds Around Data Modernization

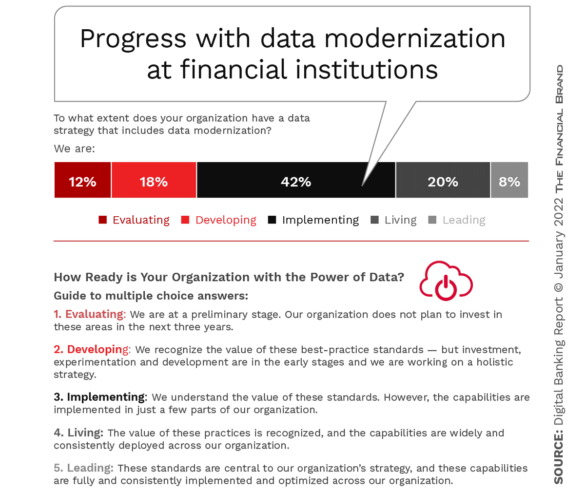

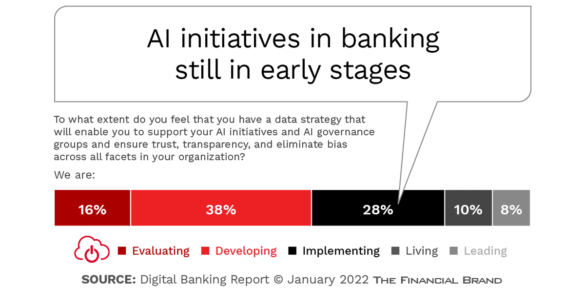

The shift from a legacy data architecture to a modernized form of data hub, data fabric, or data mesh concept allows for vast levels of disparate data to be shared automatically, intelligently and securely across the organization for new business applications. Our survey results reveal that most banks and credit unions have initiated their strategy for data modernization, with a focus on accelerating the delivery of unified insights.

Almost a third of organizations (28%) are well along the way in their data strategy efforts, with over four in ten indicating that they are implementing modernization at least in certain parts of the organization. The organizations furthest in their progress are the largest financial institutions, but many of the smallest organizations are also making significant progress.

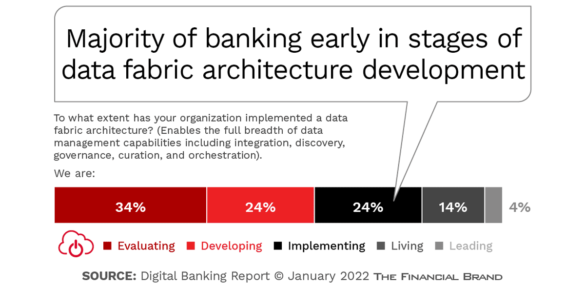

While there is momentum for building a strategy around data modernization, most firms are still in the early stages of developing a data fabric architecture. The concept of a data fabric architecture combines multiple data sources in a large data platform that can automate processes, workflows and pipelines to create insights for varied users, in real-time, across the organization.

The benefits of a data fabric, according to IBM are:

- It connects varied data sources and provides virtualized access

- It automates data discovery

- It enables the building of a data catalog,

- It creates an automated data pipeline.

According to IBM, “A data fabric helps users connect to data irrespective of what the data is, where it sits, whether in a traditional datacenter or a hybrid cloud environment, in a conventional database or unstructured data. By offering virtualized access, developers no longer need to write specific code to access certain data.”

Power of Data Fabric Modernization:

While most financial institutions are in the early stages of data modernization, momentum is building with an emphasis on speed, accessibility and improved business results.

More than half of banks and credit unions are in the evaluation or development stages of building a data fabric architecture. The largest variance between organizations building such a strategy and those actually developing the infrastructure is in the implementation stage. This lag between strategy and development would be expected.

Read More:

- Banking Needs To Prepare For Marketing’s Data Arms Race

- Now is the Time for Intelligent Digital Banking Experiences

- 7 Essentials of Digital Transformation Success

Challenges to Data Modernization Remain

We asked financial institutions globally what were the most common challenges to achieving data modernization and there was a high level of consistency across regions and organization sizes.

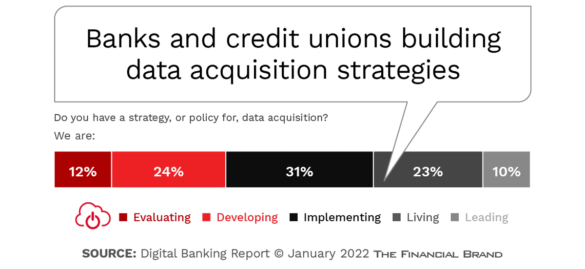

Some of the key challenges mentioned included availability of quality data, limitations of existing infrastructure, availability of talent to implement changes and the speed of transformation required. When implementing an enterprise-wide data modernization initiative, two-thirds of organizations are still in the early stages of developing data acquisition strategies, with just over one-third not yet implementing a data acquisition strategy. In other research done by the Digital Banking Report, we found that data quality also impedes data modernization.

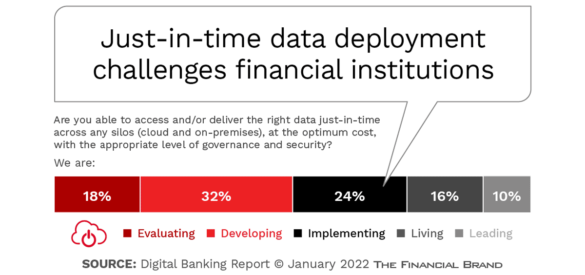

Because many organizations are still in the formative stages of developing data acquisition strategies, there is a significant lag in the ability to deliver real-time data solutions and strong AI deployments. Additionally, the lack of skills to support advanced analytic initiatives puts organizations at a disadvantage.

This inability to deliver the scale of solutions needed to compete effectively in a modern digital banking ecosystem leads to dissatisfaction across organizations with the implementation of these tools. Obviously, the inability to create strong solutions based on real-time distribution of insights and advanced analytics also impacts the ability to deliver improved financial results.

Continuing the Momentum of Data Modernization

Whether financial institutions decide to buy, build or partner for data modernization solutions, speed of deployment (and generating results) is more important than ever. There needs to be a realization of the hurdles that exist within each organization that can negatively impact speed of planning, development and deployment because new technology, by itself, will not solve the data modernization challenge.

It is imperative that an organization has the right skills in place and leadership support to implement the data modernization process successfully. The structure of the modernization process must be flexible and able to handle continuous iterations, and frameworks that can drive value faster. The commitment to change management is required to avoid a derailment of the data modernization process.

The amount and types of data that are being used by financial institutions to build better business outcomes and improve customer experiences are growing exponentially. This is the biggest challenge to legacy data infrastructure. As a result, organizations of all sizes are now seriously considering cloud data platforms that are designed for the types of data sources and analytics processes required to succeed in the future.

Cloud-based data systems expand the scalability of data storage, workload capacity, analytic capability speed compared to traditional systems. Digital security and governance capabilities — long a concern of financial institutions in regard to use of the cloud for essential functions — are now stronger, improving privacy protection and the ability to improve data quality.

Change is happening faster than ever before and will never happen this slowly again. As a result, any data modernization strategy must be future-ready. Banks and credit unions must stay abreast of changes in data and analytics technologies and build an agile infrastructure that allows for evolution over time.

Finally, most organizations will not build a data modernization platform from scratch. It is not only expensive, but the test and learn process of implementation follows a path that has already been taken by multitudes of financial institutions. As a result, most organizations will explore working with a third-party service provider.

Modernizing a data platform is not easy, but it is far less complex and costly than it was in the past. In other words, organizations of all sizes can — and must — begin to implement a data modernization process immediately.