Over the past year and a half, many bank customers got a lot more comfortable with digital interactions, and they spent less time in branches. What if they never come back?

We’ve been looking into the minds of U.S. financial services consumers since 2012, surveying groups about their banking, borrowing, payment, insurance and investing habits and preferences. PwC’s 2021 Digital Banking Consumer Survey canvassed 6,000 retail consumers. We found important changes in both how they do their banking and where they do their banking. These shifts hold important implications for financial institutions of all sizes.

Specifically, we believe that few banks and credit unions can continue to excel on the basis of their pre-Covid geographic footprint alone — and, in fact, that virtually every financial institution now should be thinking about implementing a truly national deposits strategy. Fortunately, the market shake-up is also introducing a lot of new opportunities for institutions far beyond the large market leaders, if they understand what their target customers need and offer them real value.

Consumers Are Changing How They Bank

The pandemic has altered the way in which U.S. consumers tend to interact with their financial institutions, with an overall shift toward digital. While this is the continuation of a trend we’ve been following for years, this shift was dramatic.

There’s now a large and growing customer segment that has no interest in branches at all. These digital natives — consumers who are digitally engaged, with a preference for avoiding branches altogether — now represent 32% of those we surveyed, up sharply from 26% in early 2020. Meanwhile, there was a sizable and offsetting decline in digital adopters: consumers who are primarily digitally-engaged but like having the option of using a local branch. This year, many of these consumers dropped the need for the branch security blanket or, to a lesser extent, reverted to using a nearby branch for most of their banking activities.

We’ve identified two types of consumers who like going to branches: those who are “phygital” — active users of both digital and branches — and those who are branch-dependent. As a result of this growing digital comfort and availability, 25% of U.S. consumers now identify as phygital, up from 17% a year ago. This shift neatly mirrors the reduction in branch-dependent users: 35% of the total, compared to 42% pre-pandemic as more consumers grew comfortable using web and mobile apps.

Where Consumers Bank Is Also Changing

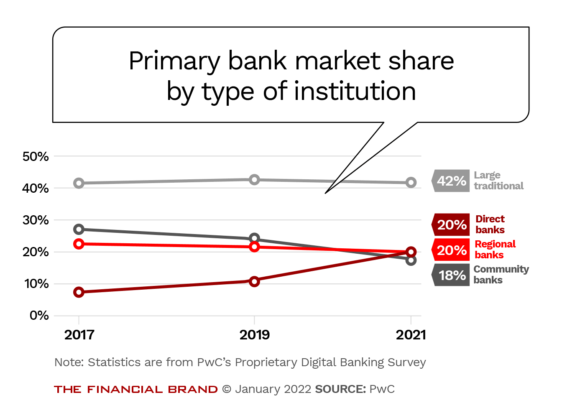

The pandemic has accelerated the most recent trend of primary bank relationships shifting away from regional and consumer banks to direct banks. This suggests even more challenges for traditional financial institutions because consumers are increasingly open to rethinking everything about how they manage their financial lives.

Digital or direct banks now make up 20% of all primary bank relationships in the U.S., up from 10% in 2019. Large traditional banks have continued to hold steady at around 42% of consumer relationships. Those in the middle — regional banks, community banks and credit unions — continue to be squeezed. Customers who are staying with their community banks value low fees and customer service, while customers choose digital banks for a diverse product set and as a result of friend and family referrals.

We’re also seeing a generational shift in the definition of a primary bank, with checking accounts less dominant and advice and social support growing in importance. For instance, while 60% of Baby Boomers (consumers over 55) assume that their primary bank is where they hold their primary checking account, only 34% of Gen Z consumers (ages 18-24) say the same.

There’s even a small but growing share of consumers who say their primary bank is the one that acts in the best interest for the environment and society: 14% of Gen Z and 12% of Millennials (ages 25-39) feel this way, though just 2% of Baby Boomers do.

Notable Trend:

The share of account holders who cite a non-bank as their primary financial institution has doubled in the past year.

Nontraditional providers of banking services like retailers, social media providers and automakers have been rapidly gaining traction, especially among younger consumers. This may be happening faster than many bankers think: 57% of Millennials and 64% of Gen Z consumers now say they have a financial account with a nontraditional institution. In fact, 17% of those with accounts with nontraditional financial institutions now identify this as their primary financial institution, double what we saw just a year ago.

To be sure, “financial institution” still means something. But the nontraditional players — which also have been described with terms like neobanks, personal finance companies, fintechs, direct banks and peer-to-peer lenders — seem to have opened the door to others.

Every Bank Should Build a Specialized National Offering

For decades, most banks and credit unions used geographic proximity as their primary calling card and it worked — until it didn’t. Consumers have been finding their way toward alternatives with little or no physical presence, and the growth in non-traditional financial accounts seems to have come at the expense of both regional and community banks.

Leading financial institutions have been seizing the opportunity to package trusted advice and convenience through solutions rather than products. These solutions are:

- Tied to affinity groups, a particular industry or a particular behavior.

- Specific and specialized, and specifically broader than just financial products and services.

- Offered nationally through marketing that targets well-defined groups of consumers.

- Often delivered through strategic partnerships.

We’re already seeing interesting examples of this at work:

Zions Bank offers a holistic professional practice financing solution for medical professionals aspiring to start their own practice, expand a medical office or buy new equipment, or refinance existing loans. Using an online application, the bank is pursuing dentistry, veterinary, optometry and medical practices.

Valley Bank has announced a specific solution for cannabis-related business with a cashless digital payment platform to address the needs of this largely unbanked sector. Valley Bank expects to serve dispensaries, cultivators, testing labs, wholesalers, CBD/hemp businesses and armored car services.

Nerve is a neobank targeting independent musicians, linked to a music streaming platform. The company is positioning its offering as building strong communities by providing a private networking feature to help professional musicians find each other, make payments and collaborate.

The Capabilities Needed to Support a National Offering

In theory, migrating from a geographic-centric marketing approach to a segment-centric marketing approach shouldn’t be all that different. In practice, we recommend that financial institutions beef up their operations to strengthen some key capabilities.

In-house, dedicated product development team. It isn’t enough to say that your service offering is meaningful for elementary school teachers or locksmiths. You need to demonstrate to your target audience that you understand their needs and that your solution offers benefits that other financial institutions don’t. You’ll want to have a team that is responsible for designing and iterating on offers with the capability to capitalize on customer needs to introduce relevant products and features.

Active team focused on partnerships and experiences. Banks and credit unions have typically been fairly self-contained in their marketing. But as customers gain experience with interconnected ecosystems in other industries, they’ve shown that they’re open to new buying influences.

For traditional institutions, this offers new ways to reach beyond conventional products and strengthen relationships with customers — but it may also raise new issues around business models, cybersecurity and more. You’ll want to build up a competence around navigating these issues as you define the boundaries of your target market.

Robust customer data platform. Customer segmentation has become much more sophisticated in recent years. All customers now expect differentiated experiences, drawing on what they’ve seen from other micro-targeting. There are tools to make this emerging trend simpler for you, such as PwC’s no-code Customer Link product. Customer Link is a customer data solution that unifies your own data with PwC’s extensive third-party data to help you adapt to changing demands.

The goal of these tools is to build an integrated view of your customers, often drawing on AI, including machine learning models to enhance precision.

Modern bank architecture. Legacy bank systems were designed for a very different environment, one where products and channels and volumes were comparatively static. To compete effectively in the national market, you’ll almost certainly need a platform that is API-enabled, allowing you to rapidly adapt to any new opportunities, whether internal or external. Cloud-based systems now make it far easier to develop and test products, scaling up and down resources quickly as demand rises or falls.

Existing Banking Relationships Have Become Vulnerable

As our survey shows, consumers are rapidly getting more comfortable with digital banking tools, and they aren’t looking back. Banks and credit unions have counted on the relative stickiness of their relationships, supported by geographic presence. But if buyers don’t care about that attribute — and increasingly they don’t — then a competitor’s targeted digital offering may make it far easier for that competitor to pick off your most valuable customers.

In this sense, competition is not you versus digital start-ups. You’re now competing with anyone who understands your customers’ needs with more granularity than you do and designs their offerings accordingly. By now, it should be clear that the “anyone” could be a competitor in Maine, Florida, Arizona or Alaska, even if your primary territory is in the center of the country.

There’s still time to adapt, if you’re prepared to rethink geographic limitations to build on the capabilities and specializations you already have. In the wake of the pandemic, consumers have been settling into new buying patterns with long-term implications. How will you respond?

Additional resources:

Tap into data to personalize offers for your customers