Despite rapid innovation and the birth of new technologies in recent years, many financial institutions remain constrained by decades of incremental technology, siloed infrastructure and outdated legacy systems. One report by Ernst & Young found more than 40% of banks still use COBOL, a programming language that dates back to the 1950s. As a result, many core banking systems don’t run in real-time, limiting financial institutions in their ability to build the modern digital offerings and capabilities that consumers demand.

Further, the pace of disruption has only increased since the start of the pandemic. Numerous studies indicate that the pandemic pushed consumers closer to digital banking and further away from traditional banks. Consumers are visiting branches less, using mobile and digital channels more and seeking greater engagement from their financial institutions.

It’s no surprise that while many legacy institutions have fallen behind in technology, they’re also losing the battle for consumer trust to fintechs. 37% of consumers across all age segments say a fintech or big tech firm is their most-trusted financial services brand, compared to 33% who name a bank and 10% who name a credit union. The most successful organizations now measure their success not only on balances and product penetration, but on engagement.

Failure to accelerate digital sales capabilities will lead more and more consumers to concentrate their business in the hands of fewer financial institutions, says Vincent Bezemer, SVP of Americas at Backbase. “Consumer expectations for a convenient and smooth banking experience are only going to grow more demanding, and banks’ and credit unions’ future is contingent upon not just meeting, but far exceeding those expectations,” he states.

Re-Architecting the Banking Infrastructure

Now is the time to completely re-architect operations and systems around customers and shift to a platform operating model that puts the user experience at the heart of the business. While a digital paradigm shift presents new opportunities for financial institutions, moving to a platform model also requires changing several business systems.

Many banks and credit unions aren’t sure where to start, what they need to get going, or how to make the transition with the biggest impact in the least amount of time.

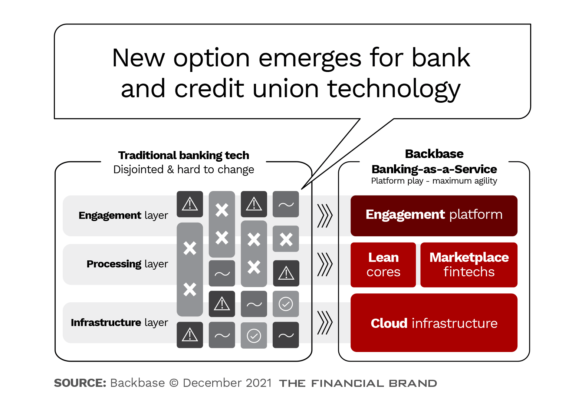

Redesigning and rebuilding the banking infrastructure around the customer requires financial institutions to invest in multiple platforms and technologies across three primary layers:

- Engagement layer: This front-facing element supports all the customer journeys, from marketing and onboarding to banking activities.

- Business apps/processing layer: This includes banking operations and the process-oriented logic and applications to drive the business outcomes.

- Infrastructure layer: This includes the technology stack and security upon which the applications and engagement are built.

Updating and modernizing these three layers enables financial institutions to move away from their siloed legacy systems to a modern, cloud-based and platform-based technology. However, this transition is often easier said than done, observes Jouk Pleiter, CEO of Backbase. “Digital transformation is challenging, requiring institutions to simultaneously modernize a multitude of complex business systems as well as their infrastructure,” he states.

Embracing the paradigm shift and moving to a platform with multiple technology providers can often take several years and carry a significant implementation risk. Legacy platform upgrades are a “serious strategic challenge requiring board and management oversight,” says Ernst & Young. These upgrades are often expensive with a slow return on investment, and the regulation and high level of public scrutiny often tempt financial institutions to move slowly.

Needed: A Fully-Integrated Cloud Stack

To address the challenges described above, Backbase has collaborated with Microsoft to offer the a fully integrated financial services cloud stack. This collaboration results in a curated, comprehensive set of banking solutions. By deploying these solutions through the Microsoft Cloud for Financial Services, banks and credit unions can reduce friction, decrease time to market and leverage a platform approach to re-architect their banking experience entirely around the customer with best-in-class offerings using a standard data model.

“It’s about empowering financial institutions to spend less on legacy and more on innovating and creating value for their customers,” says Bill Borden, corporate vice president of Worldwide Financial Services at Microsoft.

The new platform enables banks and credit unions to:

- Reduction friction and market risk across the ecosystem.

- Accelerate value creation and reduce implementation time.

- Adopt an instantly available blueprint offering.

- Move to a cloud-based operating model.

- Reduce total cost of ownership.

- Enable confident innovation.

- Remove customer friction.

- Create end-to-end value.

This ecosystem of integrated solutions uses a pre-integrated blueprint, enabling financial institutions of any size to reduce implementation times and costs, enabling greater innovation. The new platform helps financial institutions re-architect banking around the customer using industry partners in the three technology layers described earlier, as depicted in the graphic below.

Microsoft Cloud for Financial Services positions the Backbase Engagement Banking Platform as the Engagement Layer. Backbase works alongside pre-integrated business logic and capabilities from Microsoft and other fintech companies within the business apps layer, described below. This offers ready-to-use applications so banks and credit unions can innovate quickly.

The Business Apps Layer contains process-oriented business logic and capabilities that drive business outcomes. Microsoft has workflows that enhance interoperability by communicating through a standard data model. Included are business apps that work with other elements in the Microsoft ecosystem, including Dynamics CRM and ERP, Power Platform (BI, apps) and Microsoft 365. In addition, this layer integrates with core banking systems, third-party fintech providers integrated through the Backbase Marketplace and more.

The Infrastructure Layer is comprised of Microsoft’s cloud services and foundational capabilities. It includes security, compliance and trust components. Financial institutions can utilize all the elements in the Microsoft Azure cloud, including Azure Compute, which powers the Azure data lake, Azure AI/ML, a modern workspace, and Azure security.

Moving into the Engagement Banking Era

Digital transformation is highly challenging, requiring financial institutions to simultaneously modernize their infrastructure and a multitude of complex business systems. The Backbase and Microsoft collaboration was created to help break down silos and take a data-first approach to banking.

Both companies share the vision of unburdening financial institutions to help them move quickly into the “engagement banking era. with a fully integrated technology platform available for any bank or credit union.