Rather than become more relaxed about data privacy, consumers are getting more uptight and many are taking action to protect their data. Cisco found that seven out of ten consumers will spend time and money to protect their data. Consumers are already widely using ad blockers (47%) and browser extensions (35%), according to a survey by AppsFlyer and MMA Global.

Financial institutions without strict data privacy protections can lose consumers to their competitors. Pew Research found that half of consumers have decided not to use a product or service because of privacy concerns.

Technology firms have increasingly come under fire for how they handle consumer data (looking at you Facebook). But Apple, which does not share personal data with third parties for marketing purposes, has largely stayed out of the data privacy conversation. Of course. Apple’s revenue isn’t dependent on using personal data, unlike firms like Facebook or Google.

Apple has long stated that privacy is a fundamental human right — and has upgraded their operating systems to give users more control over how their data is used and whether or not they can be targeted or tracked.

These new privacy features are making consumers happy and marketers cringe.

Fractional Marketing for Financial Brands

Services that scale with you.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

iOS 14.5 Ushered in App Tracking Transparency

In April 2021, Apple announced it was adding App Tracking Transparency, a new privacy feature, to iPhone operating system iOS 14.5 or higher. Now, apps must explicitly get consumers’ permission via popups before they can track consumer data across apps or websites owned by other companies.

If consumers say no to app tracking, Apple doesn’t share their Identifier for Advertisers (IDFA), a unique, random, and resettable device identifier assigned to a consumer’s iOS device that is sent to third-parties. Advertisers use IDFA to target and measure the effectiveness of advertising at the consumer level.

Key Change:

If a consumer opts out of app tracking, the app owner can’t sell that consumer’s data to advertisers or share it with data brokers.

Sure, Apple consumers have always been able to go into Settings>Privacy and turn off app tracking. But release 14.5 reminds users that they are in control. According to Flurry, fewer than 15% of mobile phone users opt in to app tracking when prompted. For the $189 billion global mobile advertising industry — and app developers and advertisers that rely on targeted mobile advertising revenue — this is bad news indeed.

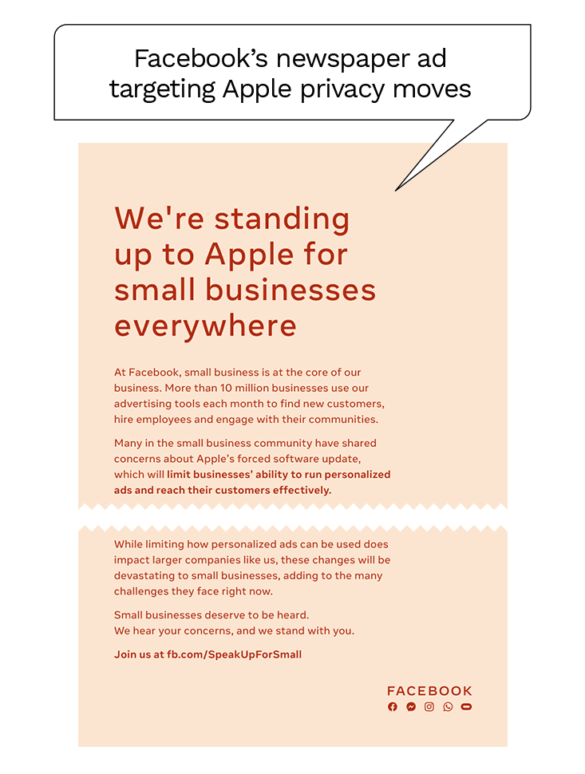

Facebook was so upset about the hit on their revenue from App Tracking Transparency that the tech giant took out full page ads in newspapers warning that Apple’s privacy control would hurt businesses that use Facebook ads for audience targeting, lead generation, and other marketing tactics.

As a result of App Tracking Transparency, advertising on Apple iOS devices is down 32% from its peak in 2021, notes Singular. Conversely, Android device advertising is up by a healthy margin.

Why it Matters:

iPhone users made up 53.6% of the U.S. mobile phone market as of June 2021, according to GlobalStats data.

Upping Privacy Further in iOS 15

Just a few months later, Apple announced it was raising the privacy ante with additional new privacy features with iOS 15, iPadOS 15, macOS Monterey, and watchOS.8. Here’s an overview of the changes that were rolled out in September 2021:

- Mail Privacy Protection: Apple’s native Mail app will now have an option that allows consumers to prevent marketers from knowing when or where they open an email. Consumers can also block email senders from viewing results from mask pixels and mask their IP address so their address can’t be linked to other online activity or used to determine their location. (Mail privacy protection is not available to consumers who use Gmail, Outlook, or other mail programs on an Apple device.) Advertisers will no longer be able to gather data by tracking pixels.

- Burner emails: Consumers who use iCloud+ can use the Hide My Email feature to create alternative iCloud+ emails that will auto-forward to their real accounts, essentially creating a “burner” (disposable) email account.

- Intelligent Tracking Protection: Safari, Apple’s browser, has long had Intelligent Tracking Protection using technology such as on-device machine learning to stop trackers, but it’s getting even stronger. Safari now hides consumers’ IP address from trackers. Marketers will no longer be able to build a consumer profile using IP address to connect consumer activity across websites.

- App Privacy Report: Consumers can easily see how each app use their location, photos, camera, microphone and contacts in the last seven days — perhaps giving them a nudge to change their privacy settings. Consumers can also see who else is accessing their data by viewing all third-party domains an app is contacting.

Consumers: “Good Job Apple”

It’s little surprise that consumers welcome Apple’s privacy protections. When SellCell asked iPhone and iPad users which new feature of iOS 14.5 they liked the best, the number one response by a wide margin was App Tracking Transparency (36%). Consumers really appreciate the ability to choose whether or not apps can track them across other apps and websites.

Seven in ten consumers also said they agree with Apple’s new privacy policies. Only 18% wonder if Apple is going a bit too far with its privacy protections, and 9% don’t know what to think about Apple’s privacy stance.

Read More:

- People Love Digital Banking, But Will They Surrender All Their Data?

- Study: Banks’ Mobile Apps Could Leak People’s Private Financial Data

- Why Data Privacy Could Be Banks’ Next Big Competitive Battleground

How Banks and Credit Unions Can Adapt

Apple’s privacy settings make it more difficult for financial marketers to get their hands on third-party and geo-location data. The settings also make it more difficult to know who is really opening an email. And that email that you just captured? It could be fake.

So, some changes in marketing tactics may be required.

Here are two actions to take now to work within the confines of Apple’s newest privacy protections.

1. Get data up front

Because many consumers won’t automatically opt-in and allow you to track email opens and location data, do your best to get as much information as you can up front. Ask consumers for additional personal identifiers, phone numbers, and social handles that you can use to create segments and profiles. Offer discounts or loyalty points in exchange for information.

Make it quick and easy for consumers to sign up for your mailing list and to scale back the number and types of emails they get from you. It’s much better to have them scale back frequency than to totally opt out.

2. Accept that open rates will be less accurate

Email service providers measure opens by counting the number of times an image is loaded. Because the Apple Mail privacy change will download all images when an email is opened by a device, open rates will likely go up. Marketers won’t know if a specific user has really opened an email or not.

Open rates — once a standard metric for measuring email success — will become less useful over time. Instead, gauge email performance by measuring deliverability and engagement. To drive engagement, make subject lines compelling and deliver valuable content. Consider other communication channels in addition to email, like SMS text. If you want people to engage with you, say so and provide them with a concrete call to action.