Millennials should be the focal point of any financial institution’s marketing strategy in today’s world. They’re the consumers at the brink of starting families (if they haven’t already), buying a home and setting up their long-term savings and retirement plans.

Hispanic Millennials specifically should be no different — they represented a quarter of all American Millennials in 2018, according to Statista. Yet, it seems segmentation strategies for this demographic are failing in the banking industry as this group gets lost in the balance.

Even though they are a key target audience for financial institutions, almost nine out of ten Hispanic Millennials (88%) say they have a financial stress point and another 83% say there’s a primary barrier to their financial success, according to Bank of America’s Better Money Habits survey.

To make the situation worse, nearly one in five Hispanic Millennials reported being unemployed, Bank of America says, compared to 14% of all Millennials. The bank’s report is based on a survey conducted by Ipsos of 1,015 general population adults and 515 Hispanic adults (ages 18 and up). Of the latter, 394 were Hispanic Millennials (ages 24 to 40).

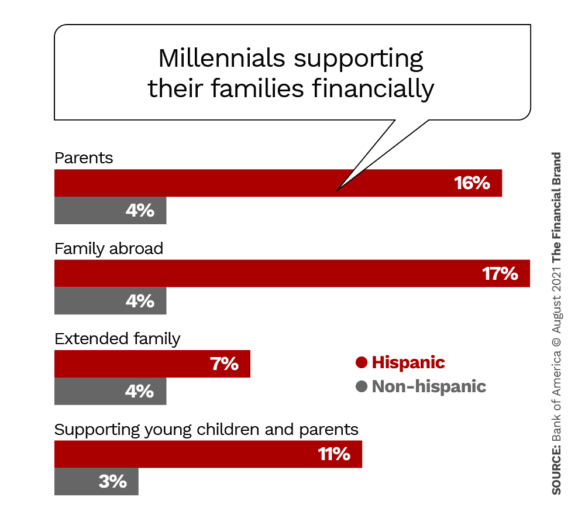

A big cause of the financial stress of Hispanic Millennials is that almost three quarters of them (72%) are providing financial support to their family, compared to 53% of non-Hispanic Millennials, Bank of America found. On top of that, global research company Mintel says six in ten Hispanic households reported a loss of income because of the Covid-19 pandemic.

Another cause is that over half (51%) of Hispanic Millennials say they don’t have a “financial role model or anyone to turn to for financial advice” — notably more than non-Hispanic Millennials (39%).

Don’t Miss a Big Opportunity:

Even though Hispanic Millennials have more than their share of financial struggles, they are optimistic and ready to learn about what they can do.

“Despite the challenges they’ve been facing, Hispanic Millennials are very future-focused and taking actions toward their financial goals,” Christine Channels, Head of Community Banking and Client Protection at Bank of America tells The Financial Brand.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Where The Gaps Are

The Covid-19 pandemic hit many consumers hard. However, the Hispanic Millennial demographic specifically struggled to keep up: 40% maintain they didn’t have an emergency fund and 27% say they didn’t have enough saved to weather the impacts of the pandemic (versus 34% and 17% of non-Hispanic Millennials, respectively).

Read More: Bank of America Grabbing 1 in 3 Gen Zs and Millennials with Mobile

Many individuals in this demographic (38%) are struggling to save, and still others are living paycheck-to-paycheck (24%) while also running into problems paying essential expenses, such as rent (13%). The pandemic, specifically, has impacted 72% of this population’s ability to save in comparison to 59% of non-Hispanic Millennials.

Additionally, Hispanic Millennials say these factors have kept them from achieving their financial goals:

- Reduced income (26%)

- Unable to save (25%)

- Job instability (19%)

“We’ve seen in our research that diverse communities in particular have been heavily impacted by the pandemic,” says Channels, adding that Bank of America initiated the survey to find out where this population lost ground in 2020.

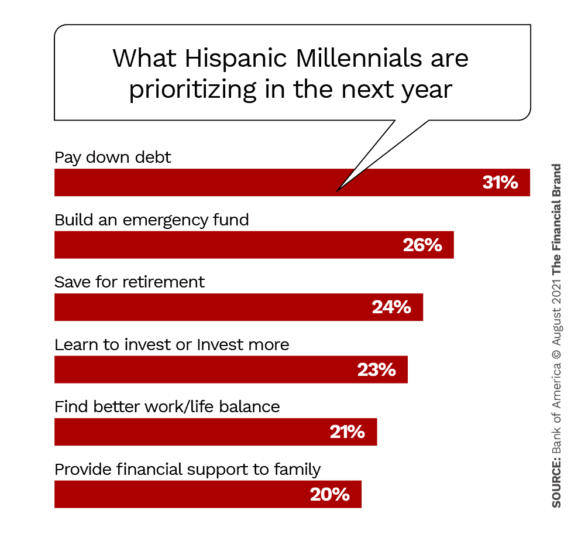

That doesn’t mean Hispanic Millennials aren’t looking to improve their financial situation. Nearly a third (31%) of them say they’re focused now on paying down their debt in the year ahead and almost half (48%) say they’re focused on building an emergency fund. Just over one in five Hispanic Millennials (26%) are also now contributing to an emergency fund (in contrast to 16% of non-Hispanic Millennials).

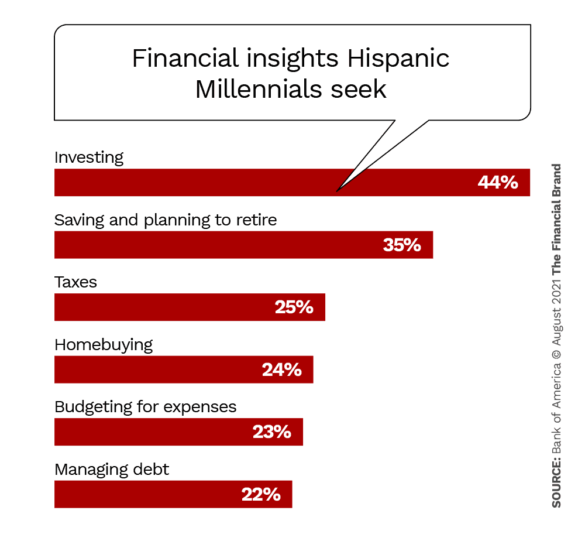

Millennials (as a whole) are considered resilient and willing to learn how to overcome financial obstacles. For instance, only 14% of Hispanic Millennials say they feel confident in what they know about personal finance, but many more are looking to their financial institutions for advice.

One of the best ways to meet people in this demographic is through social media marketing, according to a new study released by Amanda Vitrano at Mintel Comperemedia, who points out in a blog that all Hispanic consumers naturally gravitate toward the legacy social platforms, such as YouTube, Facebook and Instagram.

Vitrano cited Mintel’s research, which found that for 28% of Hispanics social media is an integral way for brands to market. Effective marketing efforts across channels is an easy way to nab the attention of Hispanic consumers, the firm believe

Yet, there are dos and don’ts to consider when marketing to this Hispanics, Vitrano writes. She points to a campaign JPMorgan Chase ran in September 2020 during Hispanic Heritage month, called “Our Path Forward.”

Some of the initiatives were on point, Vitrano says. For example, Chase promised to make 15,000 small business loans to Black and Latinx communities, along with 20,000 home refinance loans and 40,000 additional home purchase loans to Black and Latinx households.

Other initiatives, however — such as creating 100,000 new affordable housing units in underserved communities — are not so ideal, Vitrano notes. She says Hispanic people don’t want to be “eternal renters” and would rather take the initiative to buy or invest in a home.

What They Really Want

Hispanic populations don’t necessarily want new apartment buildings and affordable housing units. Instead, they want to buy their own homes, and financial institutions can help with that.

Another very different financial institution, Varo Bank, was also active on social media during Hispanic Heritage month in 2020, says Vitrano. Varo engaged with followers by posting infographics about the month and its history. But the neobank also creates products for the Hispanic market and publicizes them on social media year round, she adds, which ensures their messaging strategy is highly effective.

Catering To The Demographic At Hand

It’s a stereotype that the bulk of LatinX groups are unbanked, according to social change technology company Everfi. It argues that less than one out of five Hispanic customers (19.6%) are unbanked, attributing it to “issues of convenience and bank accessibility.”

Yet, Hispanic populations are still paying abnormal fees compared to non-Hispanic White populations. According to a Bankrate survey (conducted in December 2020), Hispanic consumers are paying more than double the fees than those of non-Hispanic White customers ($13.96 and $5.37 respectively, on average).

On top of that, nearly 80% of White respondents are dishing out nothing for monthly bank fees in comparison to half of Hispanics surveyed. Outside of monthly fees, Hispanic populations are also paying higher ATM fees (as a result of limited access to in-network ATMs), minimum balance fees and account overdraft fees.

Despite that, over half of Hispanic Millennials (51%) are actually quite optimistic about their financial future. Instead of deterring them from working on their financial status, Hispanic Millennials are saying the pandemic actually helped them better understand their financial values, inspiring them to keep track of their spending habits. Almost a fifth of Hispanic Millennials (18%) affirm they value living a more frugal lifestyle (in comparison with 13% of non-Hispanic Millennials).

Read More: Expand Your Base By Serving the Unbanked and Underbanked

What Financial Institutions Can Do

Banks and credit unions alike, Everfi suggests, can take additional steps to create — and improve — a sustainable relationship with Hispanic populations in a mutually beneficial way. Here are two it highlights:

Entrepreneurship Investment

Hispanic populations are 1.5 times more likely to launch a new business than any other demographic, Everfi says, adding that the bulk of financial institutions in the United States are “focusing on small-scale loans for Hispanics, rather than creating valuable entrepreneurship programs.”

Everfi advises that banks and credit unions start designing financial literacy programs, focused on bookkeeping, business management, finance management and money management for small Hispanic business owners. There are dozens of fintech apps that provide business support tools for these functions.

“Taking a combined approach of offering education and entrepreneurial loans could help you to drive engagement and capture this rapidly growing demographic,” Everfi says.

Mobile Banking

Everfi estimates that nearly 70% of banking transactions from Hispanic populations are conducted on a mobile phone or tablet, but another 30% would switch from their primary banking provider if another offered better mobile banking solutions. Everfi suggests it wouldn’t take much to retain them: just upgrade language support and security.

“If consumers can easily access and use digital banking services in a language they are most comfortable with, they will go to your bank,” the company maintains. “Catering financial marketing to the Hispanic community by offering strong digital solutions in several Latinx languages will help you to reach your audience, and in a way that will market itself.”