Coming out of the 2020 pandemic period when credit card spending was down and repayments picked up, U.S. card spending volume has been building with a vengeance.

That is helping to encourage issuers to spend more on marketing of cards at the same time that new incentives and other innovations are being added to the usual card menu. Many of the fresh credit card twists are being added by neobanks and fintechs, but traditional issuers are joining in.

Many Consumers Seek New Cards:

Research by J.D. Power finds that nearly three out of ten U.S. consumers have shopped for a new card — and that only 13% of those shoppers did not open a new card.

About half — 49% — switched to a new primary credit card, and one in five of those people closed their previous primary card. Also, 38% of the shoppers opened at least one new additional card. (The study survey was conducted in the first quarter 2021.)

As America engaged in more and more summertime “revenge spending,” Federal Reserve figures indicate that outstanding revolving debt increased at an annualized rate of 22%, almost twice the rate seen in May.

Major bank card issuers noted how card spending levels were increasing, during quarterly earnings calls.

“On the consumer side, it’s really Card that’s going to be the big driver,” as payoff levels decrease as a more normal economy returns going into 2022, according to Jeremy Barnum, CFO at JPMorgan Chase. For its part, Citibank reported that spending levels increased 38% through its entire global card system, promising loan growth in the second half of 2021. At Capital One, card purchase volume for the second quarter 2021 was up 48% from the year earlier and 25% from the second quarter of 2020.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

More Bucks Going into Marketing Credit Cards

As a consequence of growth and expected growth, some of the large bank issuers — Chase is #1, Citi is #3 and Capital One is #4 — have already told analysts that they will be stepping up card account promotion.

“We are leaning further into marketing to drive future growth and continue to build our franchise,” says Rich Fairbank, Chairman and CEO at Capital One. “We feel really good about account originations.” He told analysts that card marketing was the bank’s biggest driver of marketing trends.

“Given the faster recovery we are seeing today, we are accelerating investments in areas like card marketing to capture this upside,” says Mark Mason, Citigroup CFO. “All of these investments will have significant benefits over time.”

“We think the pace of credit card marketing will accelerate,” says Andrew Davidson, SVP, Chief Insights Officer, Mintel Comperemedia, during a webinar. “We think we’re moving into an intense period of competitive activity.”

A taste of what will be seen: In the second quarter, #4 issuer American Express told analysts, it invested $1.3 billion in marketing “to build long-term growth momentum.” Payoff was seen in 2.4 million new cards opened, up 20% from the previous quarter. That level of origination was just 4% off the level seen in the first quarter of 2020, which was pre-Covid in the U.S. Meanwhile, American Express has been adding short-term value enhancements to certain premium cards in order to retain customers it already has.

During the pandemic “there was a lot of risk aversion,” according to John Cabell, Director of Banking and Payments Intelligence at J.D. Power. However, heavier promotion has been coming back, with growth seen in balance transfer offers and reward offers.

And some areas of card marketing defied expectations. In a J.D. Power blog, the company noted that for the year leading into June 2021, 11% of all new credit card co-branded acquisitions were travel cards. This equaled the rate seen the previous year, before Covid.

“Travel reward cards might as well be made of Teflon.”

— J.D. Power

The firm’s Credit Card Shopping Study found that the leading reason consumers choose a given card is rewards, with 22% citing that factor. While many travel cards offered alternative redemption choices during the height of the pandemic, J.D. Power found that travel points are what continues to drive popularity of this type of reward.

Battles of the Credit Card Titans Intensifying

Newcomers pushing innovative new approaches to rewards or other features must overcome consumer awareness of brands and institutions that have long been in the market. The J.D. Power card shopping study found that while consumers have an awareness of 11.1 card issuers, they typically consider only 1.5 other brands besides the one they selected.

“In fact, 37% of prospects did not consider any brands other than the one selected,” the study says.

Capital One, Bank of America, Chase and American Express enjoy the highest rates of awareness.

What’s in Their Wallet?

When correlated with their 2020 ad spending, only Capital One is among the top issuers in rankings of both spend and performance in the card sales funnel.

J.D. Power analyzed consumer selection patterns among the top issuers and found that while Chase is the player that Capital One must typically beat to win over a consumer. But Capital One is the nemesis for most of the other top brands.

Where key credit card brands are losing the most new business

| Brand originally considered | Top competitor brand selected | Shoppers considering brand but selecting competitor |

|---|---|---|

| American Express | Capital One | 23% |

| Bank of America | Capital One | 23% |

| Capital One | Chase | 20% |

| Chase | Capital One | 20% |

| Citi | Capital One | 24% |

| Discover | Capital One | 29% |

| Goldman Sachs | American Express | 20% |

| Wells Fargo | Capital One | 22% |

Source: J.D. Power Credit Card Shopping Study

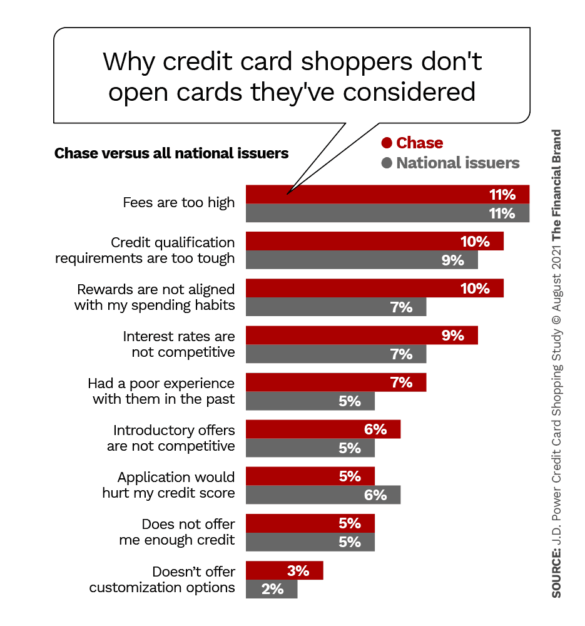

What causes consumers to decide to pick a competitor rather than the brand they first focused on? The J.D. Power analysis focused on reasons people cited in regard to Chase and in regard to the industry overall.

Read More: How Financial Institutions Can Fire Up Their Lending Engine

Innovation, Teased Out During Pandemic, Expected to Boom

“Innovation thrives in a crisis,” says Davidson, with Covid bringing out fresh thinking about what to tie to cards, especially among newer issuers. However, he notes that as the recovery moves forward, with the Covid variant lurking ahead, more can be expected.

“A lot of the bigger players haven’t launched any new cards yet,” says Davidson, “which makes me think that the best innovation is yet to come.” One exception is the Wells Fargo Reflect Card, announced along with other new cards, earlier in 2021. Coming later in the year, Reflect will feature a lower APR and is part of a broad Wells effort to claim more share of the credit card market.

Some innovative cards cited by Davidson that have been announced in 2020-2021:

- Aspiration Zero: Introduced by Aspiration, the pro-environment neobank, the company promises to plant a tree for every charge the cardholder makes. A related app tracks the holder’s carbon neutrality. Every month the consumer reaches a zero carbon footprint, cashback of 1% is given for all purchases.

- Jasper Mastercard: This card starts off with 1% cash back and the holder can obtain another percentage point for a full year for each friend referred, up to 6%. The card features no annual fee and a financial management app. One of its slogans: “If you’re never stuck in credit card debt, we’ve done our job right.”

- Manchester United Credit Card: and additional cards for sports fans go far beyond the old affinity cards of decades ago that simply featured a professional or college team logo. The Manchester United card for U.S. fans features team-oriented bonuses, such as five-times multipliers on cashbacks on charges at bars and restaurants on match days and discounts on team merchandise.

- Varo Believe: A credit builder product that, atypically, does not require a deposit account to secure the debt.

- Laurel Road Student Loan Cashback Card: This no-annual-fee card gives 1% cashback, but if the cashback is remitted to a student loan servicer to reduce debt, the holder gets 2%.

- TomoCredit: A credit builder card with a difference, there are no fees or even interest charges. Credit charges are paid automatically via debit from the consumer’s choice of a deposit account. Debits are made every seven days.

- HMBradley Credit Card: This product adapts its cashback scheme to items and services the consumer already purchases.

“There’s plenty of ‘white space’ in this market, and plenty of opportunity,” says Davidson.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Lessons from Pandemic-Period Marketing

In a company webinar, Davidson gave a series of lessons to learn from marketing done during the pandemic period.

1. Consider a “soft-launch” to learn from for the big rollout. Davidson says that when SoFi did a limited rollout its credit card, it tested behavior and made changes. These included making it easier to see points earned and the option of buying crypto currency with rewards.

2. Amplify digital features of cards — it’s what many people want. The Venmo credit card, for example, even has a Venmo in-app application.

3. Look for emerging opportunities. With international travel remaining problematic in many cases, for example, domestic travel is a trend cards have been hooked to.

4. Define your identity in fresh ways. Davidson points to the fintech Benjamin, which permits card holders to obtain cards in the metal color of their choice. The Petco Pay credit card lets the cardholder put their pet’s image on the front of the card.

5. Take advantage of all the new platforms available to marketers. Certainly exploit the usuals, like Pinterest, Twitter and Snapchat, Davison advised, but also consider using TikTok, Clubhouse and Discord. Davidson also noted that the YouTube Director’s Cut service enables marketers to assemble components that can be used to produce highly personalized messages.

6. Add a twist to the card’s offerings. “You want to stand out in a crowded market,” says Davidson. One example is Bilt Rewards, which turns rent payments in rewards that go towards a home downpayment.

7. Launch with future change in mind. Davidson says the Apple Card exemplifies such evolution. It has changed significantly since its introduction. He says updates, revisions and changes of direction will be hallmarks of credit card marketing from now on.