In the 2010 Consumer Billing and Payment Trends report, Fiserv, a leading financial technology company, shares the results of its survey involving 3,029 internet consumers. The 2010 survey shows online banking, bill payment and e-bill usage continues to grow, and that the online bill payment population has changed over the last decade. Furthermore, the study confirms that online bill pay is both sticky and a strong correlating indicator of profitability.

Online banking and bill pay becomes mainstream

Currently, 72.5 million U.S. households, 80% of all households with per access, use online banking, while 36.4 million households, 40% of all households with internet access, use online bill payment.

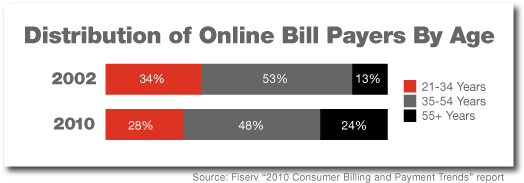

Between 2000 and 2010, the number of households that use online banking increased more than six-fold, and the number that use online bill payment increased nearly eight-fold. Online bill payers now represent a wide cross-section of the U.S. population, and women have edged out men as the primary users of the service.

In 2002, men represented the majority of online bill payers, at 61%, and they maintained the lead in usage of the service through 2009. In 2010 the tables turned, with women edging ahead to represent 51% of online bill payers.

“The face of online bill payment has changed significantly over the last decade,” said Geoff Knapp, vice president, Online Banking and Consumer Insights, Fiserv. “Early users were tech-savvy and tended to be young and male, as is typical with new technology. Now it’s moms and seniors and people at all income levels using the service. Online bill payment has become mainstream, and there’s still room to grow.”

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

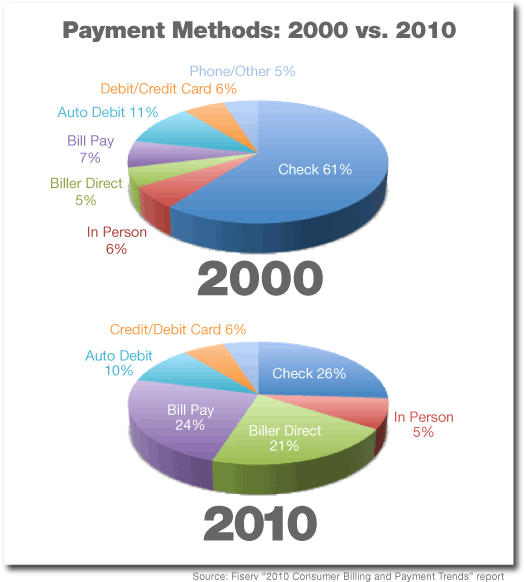

Online bill payment has grown substantially during the last 10 years, corresponding with a massive reduction in the use of paper checks. While utilization of other forms of payment have remained relatively stable, paper checks have declined from 61% of all payments in 2000 to 26% in 2010, while online bill payments have grown from 12% to 45% of all payments.

Bill pay is sticky, leads to higher-value services

Consumers who pay bills online have consistently used more services from their financial institution than the average customer, with usage of additional services becoming even more pronounced in recent years. The connection between online bill payment and consumer loyalty has remained strong as well.

In 2005, consumers who used the online bill payment service at their financial institution were 8% more likely than the average customer to have a savings account at the same institution, and by 2010 that number had increased to 13%. The percentage of customers who used online bill payment and also had a mortgage with their financial institution increased from 2% in 2005 to 10% in 2010. In addition, 49% of customers who use online bill payment said they were less likely to switch to another financial institution as a result of their experience with the service.

In just two years, the number of mobile phone users who conducted one or more banking services via their mobile phone increased from 23% in 2008 to 30% in 2010. The number of mobile banking users who receive or pay bills via their mobile phone jumped from 18% in 2008 to 30% in the same time period. This is most likely due to the increasing adoption of smart phones.