The events of 2020 probably caused more upheaval in the credit card industry than had been experienced in quite some time. The payments industry had to quickly adapt, and banks and credit unions that were slow to respond found themselves losing share in a highly competitive market.

The three new trends that are shaping the credit card industry in this time of rapid change are:

- The need for enhanced digital capabilities.

- A changing rewards environment.

- The uncertainty of future credit trends and losses.

It is imperative that banks and credit unions looking to offer a competitive credit card program be aware of these trends and implement any adjustments needed to remain relevant to card members. Here are details for each of these trends.

1. Increasing Need for Enhanced Digital Capabilities

Financial activities, along with many other categories, were already on a trajectory to be more frequently conducted via digital channels. However, the events of 2020 greatly accelerated the rate at which the digital transformation was occurring. Activities and processes transitioned out of necessity and in some cases, overnight.

Increase in online shopping

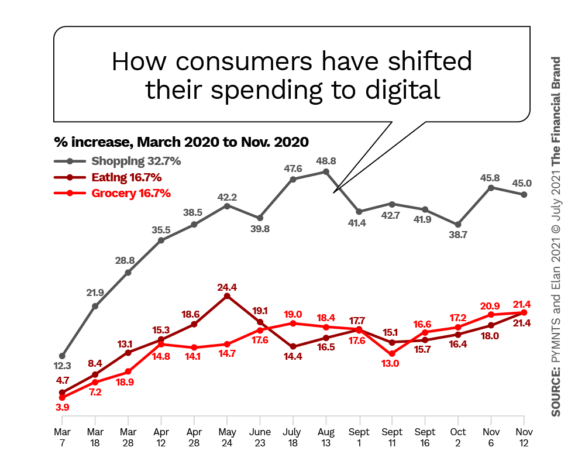

As people quarantined at home, one category of consumer behavior that experienced a notable rapid shift to online channels, was shopping. A recent report, “Online Security and The Debit-Credit Divide” by Elan and PYMNTS, found that 45% of people transitioned to digital shopping channels to purchase retail products, a fourfold increase since the start of the pandemic.

The chart below details the increase in retail along with two other main spend categories: groceries and restaurants. Both groceries and restaurant purchases were on a steady incline to a peak of 21% by mid-November.

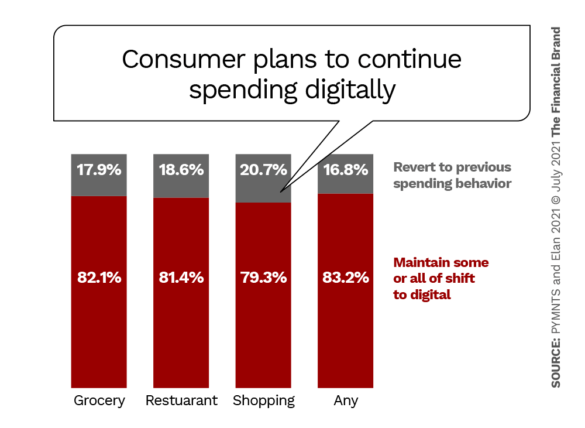

As you can imagine, the increases in spend via digital channel are not going away anytime soon. The findings from the Elan and PYMNTS report discovered that a majority of people plan to maintain their digital shopping habits going forward. As shown below, 82.1% of grocery spenders indicated that they would stick with digital channels, followed by spending at restaurants at 81.4%, and retail shopping at 79.3%.

In addition to where and how consumers shopped, they also changed the manner in which they made their payments. When purchases via online channels increased, 41% of consumers reported a preference to pay with credit cards, versus 35% who opted to use debit and 15% preferring digital wallets.

Key Point:

As card users are more concerned about potential fraud when shopping online, banks and credit unions must build robust security features and fraud detection into the infrastructure of their credit card programs.

Shift to contactless payments

More than half of Americans report they are now using some form of contactless payment. This rising payment method exists in two main forms – e-wallets and contactless technology embedded into a card.

E-wallets and contactless cards allow consumers to pay by hovering their phone or card over the payment terminal while their card information is passed to the terminal via near-field communication (NFC) technology. The use of contactless payments exploded exponentially in 2020 as people sought protection against possible transmission of the virus.

The New Reality:

It’s vital to offer contactless payment options to your cardholders. If you don’t you risk losing them to credit card programs with more robust digital offerings.

2. Changing Rewards Environment

As a result of the change in where consumers spend their money, the pandemic also necessitated a critical look at credit card rewards. Since people were traveling less, if at all, and spending significantly more time online, the previous credit card rewards environment was upended. With travel nearly coming to a halt, travel rewards decreased in desirability and rewards focused on everyday essentials such as groceries, food delivery and streaming services, which consumed increasingly larger proportions of people’s monthly spend.

Credit card products heavily focused on the travel sector were forced to reevaluate their rewards options to provide cardmembers with more flexibility for rewards. For example, some issuers allowed cardmembers to redeem travel points for nontravel purchases at the same value per point, while others launched products that provided cash back on pandemic-friendly spending categories.

This set the stage for a competitive landscape in which banks and credit unions offering credit cards must keep up with rewards trends, which shift with consumer demands and preferences.

Keep in Mind:

Banks and credit unions should be offering a full suite of rewards to reach the entire scope of cardmembers (consumer, business, young adult, elite, etc.) as these, along with a high level of service, are essential building blocks to score favorably with cardholders.

3. Uncertain Future Credit Environment

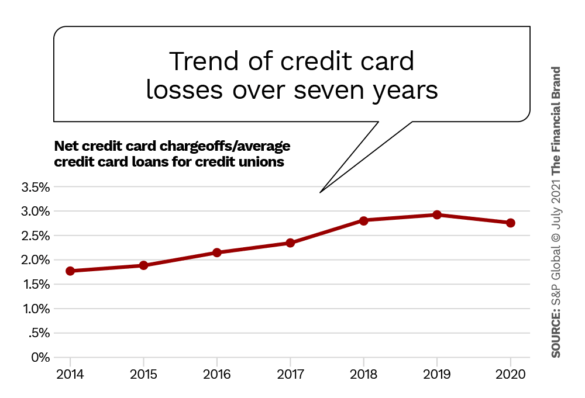

Somewhat surprisingly, Americans paid off a record level of credit card debt in 2020, which amounted to almost $83 billion. This is likely due to several factors, including federal relief through the receipt of stimulus checks and other government assistance, and extended forbearance programs from issuers. Not so surprisingly, however, this situation is not expected to last.

With spending predicted to surge in 2021 as more and more people become fully vaccinated and the nation continues to open more fully, the timeline for recognizing charge-offs (the amount of defaulted credit card balances) has extended beyond initial predictions, and is now expected to begin manifesting itself in the second half of 2021. Financial institutions should be mindful of the potential for varying levels of losses, as it can greatly affect the overall profitability of their credit card program.

Be Aware:

Banks and credit unions running a credit card program may be experiencing low losses and delinquency rates today. They should consider this temporary given the predicted jump in consumer spending and inevitable expiration of federal benefits and forbearance programs.

Elan is committed to staying competitive for our partners

Having a partner like Elan provides banks and credit unions the opportunity to stay competitive and follow market trends.

Digital Capabilities: At Elan, the severity and duration of the pandemic required a fundamental shift in strategy. Elan quickly enhanced digital tools for both self-servicing for existing cardmembers, launched new card products to capture new spend trends, and increased frictionless access to credit card applications for new cardmembers.

Elan also developed an array of new DIY servicing capabilities and implemented several fraud detection enhancements, which were critical as consumers increased their spending in the e-commerce sector.

Additionally, Elan accelerated its overall emphasis on allowing cardmembers to seamlessly apply for credit such as: Text to apply, an area where Elan invested heavily. This functionality enables applicants to text a unique short code, visit a URL, or simply scan a QR code to apply for a credit product from their mobile device. This channel has seen an exponential growth since the onset of the pandemic.

Elan’s investments will help its partners better serve their cardmembers through an improved user experience through modernized device optimization, improved data validation, and streamlined real-time acquisition, onboarding and servicing processes.

Robust Credit Card Products and Rewards: Elan’s full suite of credit cards offer competitive rewards at no cost to the bank or credit union and includes cash back on frequently-used and pandemic-friendly spend categories.

Read the full whitepaper: Three Trends That Are Shaping the Credit Card Industry

About Elan Financial Services

As America’s most tenured agent credit card provider, Elan serves over 250 active credit union partners. For over 50 years, Elan has offered an outsourced partnership solution that provides credit unions the ability to market a competitive credit card program to their members and outsource most major functions such as marketing, servicing, compliance, underwriting, etc. For more information, visit www.cupartnership.com.