Do you remember how, in January 2018, the people of Hawaii were threatened with a ballistic missile attack? All Hawaiians received an official warning on television, radio and their cell phones of the impending danger. Panic immediately broke out on the island. A month earlier North Korea had announced that it had developed missiles capable of reaching American bases in the Pacific. The people thought the rogue nation attacked.

Jim Carrey reported on his Twitter feed: “I woke up in Hawaii today and I have 10 minutes to live. People left their cars and sought refuge, and children rushed into manholes for safety, waiting to hear the rumble of an explosion and the smell of burning.”

It turned out to be the operator’s fault. Instead of a training alarm, he sent a real warning.

Two years later, another very tragic story took place: A student at the University of Nebraska was so shocked by his performance in buying and selling shares of stock that he committed suicide. The student was absolutely convinced that he lost and owed $730,000. It turned out he had misunderstood the balance of his account when he viewed it in his mobile app. He did not owe anyone anything.

Why Did These Things Happen?

The Hawaiian authorities officially apologized for the human error. But, in fact, we each have similar “missiles” that appear from time to time on our smartphones or other devices. These are everyday situations in which we, while interacting with any digital solution, are confused. What do I need to do now to solve the problem? What does this mean? What is required from me? What am I doing wrong? What should I do next?

Often, in such situations, we blame ourselves, but the cause of the problem are typically found elsewhere. And, this “elsewhere” has a frightening effect on our daily lives — especially when the digital environment is evolving so fast. And, unfortunately, this could have even more serious consequences in the near future.

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Instant Messaging. Instant Impact.

Both of the tragic stories I mentioned above are actually about awful and unfriendly digital design caused by human “indifference.” The solutions in use were designed in accordance with years of industry legacy, but were not focused on the people who actually use them. The result is that users of such non-intuitive and badly designed digital solutions make very costly mistakes.

How many more services of these types do we have around us, especially in the banking industry?

Read More: 6 CX Developments Banks & Credit Unions Can’t Ignore

The Main Enemy: Indifference

Recently, I was very unpleasantly surprised by my bank’s attitude toward me. The bank has the ability to remotely add users to the company’s account for the co-owner of the company or an accountant. But I was refused, despite the fact that I have been a client of the bank for more than ten years and have multiple accounts.

This happened at the moment when I left the hospital after suffering a bad bout of Covid-19 and was not able to visit the branch. Attempts to get an explanation did not pan out. The bank employee replied that the bank was a private enterprise and had the right to refuse service to any user without cause.

That is a terrible explanation.

After several calls, letters and negotiations, the bank finally remotely opened access. Despite having been long-time clients of this bank, but we did not receive any apologies. Complete indifference.

Rhetoric Vs. Action:

Banks often are very vocal about how customers are the most important thing to them. In reality, their mobile apps haven’t been updated in years, customer complaints are ignored and employees are arrogant toward customers instead of being supportive.

Such institutions show by their actions that they do not serve customers. Rather, customers serve the banks.

Why do financial institutions so often lose sight of people and their needs? How can there be such indifference inside the culture of an organization despite the slogans about customer-centricity? Why isn’t customer-centricity in the service details, avoiding destruction of the brand reputation?

I believe that this is a consequence of the institution’s legacy and an important sign of the company’s failure to adapt.

It’s All About the Details

Imagine arriving at an expensive luxury hotel in a great location with a reputation for excellent service. You go to reception and notice a bit of a mess there. You also notice a little dirt on the concierge’s shirt. You are welcomed to sit down and chill with a drink, but your glass has tiny scratches on it.

Customers notice all these little details and thus get the impression that they are not valued at this establishment.

Several years ago, a bank came to UXDA searching for innovative ideas that could supercharge their existing mobile application, and make it the best. When we opened the existing application, we realized that it was lagging too far behind users’ needs and industry standards. Therefore, we recommended creating a completely new version to ensure at least the minimum required experience level.

Several years have passed, but the institution has not followed our recommendations and they are still the lowest-rated app on the market. The small details kill.

Indifference to the details of customer experience is related to an incredibly influential factor that is not easy to spot. According to our observations, more than 80% of companies suffer from it. We call this the “experience gap.”

The “experience gap” is the negative difference between customers’ expectations and the experience they gain from a service or product.

If the experience is significantly worse than expected, it can have many unpleasant consequences including reduced customer loyalty, increased negative feedback and even customers switching to a competitor’s product.

Read More: Mobile Banking Apps Failing in Key Areas of CX

Don’t Ignore Your Blind Spot

The experience gap is usually not recognized, and company managers and employees do not understand what and how to improve, even if they feel that something is wrong. The reasons are not obvious and can be found at several levels of the organization at once. Moreover, this effect is so hidden that it leads to devastating consequences quite unexpectedly. Often, no one understands the reason until it’s too late and the product fails.

Poor View from the Top:

The main cause of an experience gap lies at the top of the hierarchy. The higher an executive is in the organization, the more difficult it is to detect the experience gap.

At the lower levels of the hierarchy, employees are closer to the customer and more aware of problems and bottlenecks. But often they do not have the authority or ability to address them because they are constrained by the company’s culture and rules.

The experience gap is caused by the same mechanisms that, in the past, contributed to the survival and growth of the company, and are now its legacy. Any organization has inertia, and these mechanisms are underpinned by internal beliefs and values. So, they resist attempts to recognize and bridge the experience gap. This results in the inability of the company to be flexible enough to adapt to market user requirements.

As a company grows, it implements numerous procedures and regulations to formalize its operations. This standardizes the quality of service and protects the company from costly mistakes at the lower levels of the hierarchy. But, it also blocks initiatives to improve adaptation in the marketplace and significantly slows decision-making.

As a result, users receive a product that meets all regulations but does not match their expectations.

7 Blind Spots of the Experience Gap and How to Overcome Them

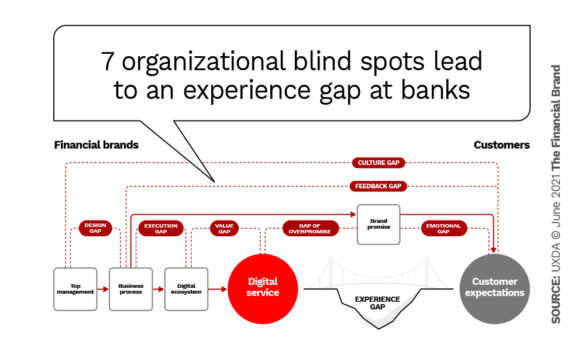

There are 7 blind spots that can lead to a gap in experience: poor company culture, insufficient feedback, lack of design in the company, inefficiency of the execution method, lack of value, inappropriate brand promises and lack of emotional connection. We’ll examine each, including how to overcome them.

1. Cultural gap

The lack of customer-centricity at the top management level prevents financial institutions from bringing their service closer to customer expectations because of a “cultural gap.” Processes and activities that establish customer-centricity in a company with a “cultural gap” will not be prioritized, and, hence, resources will not be allocated to them.

For example, in a company with a sales-driven culture, employees will not pay much attention to the little things that upset customers and do not meet their expectations, because the main focus of top management is meeting their sales goals.

How to overcome:

When it comes to customer-centric culture, transformation begins with a switch in the top management mindset, spreading this impact to the entire company and internal values. At the management level, an experience mindset could be implemented to adapt more quickly and easily to the digital world.

The experience mindset prioritizes service quality over sales activity, focuses on an emotional connection rather than rational arguing, provides a solution rather than multiplying functions, disrupts the market rather than defends itself and creates a smooth, connected experience rather than fragmentation.

2. Feedback gap

If business processes in a financial institution lack or do not use data on customer preferences and their experience with a product or service, it creates a “feedback gap.” Banks collect this data, but it is not analyzed properly, and not enough actions are taken to improve a product or service. The “little things” are just perceived as noise and are ignored.

How to overcome:

To close this gap, collect and analyze the most common complaints that appear on social media, the App Store and Google Play, and also from the support department. You need to understand which customers are most affected by the gap.

In fact, they may have more ideas on how to prevent it than management does, and they want to actively share their emotions. If the institution is open enough and ready for constructive criticism, it can use this data to bridge the gap and improve the brand’s reputation.

Read More: 5 Digital-First Strategies That Can Turn Banks Into UX Disruptors

3. Design gap

Even if a customer-centric approach is a priority, and a large amount of data on customer preferences is collected, there may be a gap in the competence and methodology of developing a digital service or product. Top management could have some issues in integrating a customer-centered design approach across the whole business process, thus compromising the ability to meet customers’ expectations.

Lack of proper knowledge and methodology does not allow for the creation of an effective system that will provide the best possible service according to customer needs.

A non-banking example makes the point: To ensure that hotel cleaners do everything perfectly, a checklist is needed that takes into account all the nuances and helps the employees to not miss anything. But, at the same time, the cleaner must understand why his work is important. The same is needed for an effective customer-centered digital product design. Deep competence and a proven scheme of work is needed so that all business processes provide the best service to customers — especially in the “little things” — and do not spoil it.

How to overcome:

A business process can be greatly improved by integrating a design-driven approach into the company to create a strategy that bridges this gap. Design integration will significantly increase the overall efficiency of the company if it is achieved at five levels: process, team, operations, results and value.

To bridge the design gap, we need to prioritize product design-related features at each level. We need to make sure that we have the right design processes that are customer-centered and the appropriate design and user experience and customer experience executives, experts and specialists on our team. They must be have enough power to make the right actions that help to achieve design-driven results that provide ultimate value for our customers. Take a look at Apple; they nailed it perfectly.

4. Execution gap

This gap is due to poor execution of the product or service. It is not enough to have a great idea; we need to execute it correctly in order to delight customers. If user-centered design is not a priority, decisions and efforts to create the best experience will be of low quality and efficiency because there will be many awkward “little things” that will ruin it. This largely determines a company’s ability to create competitive services and products in the digital age.

How to overcome:

You need a proven design execution approach, such as user experience design methodology, which is based on customer needs and is able to eliminate the lack of quality execution. Using this approach, it is possible to create a holistic digital ecosystem that will delight customers at every touchpoint, providing clear and smooth service flow.

5. Value gap

A value gap occurs if a brand’s digital ecosystem does not match users’ expectations at any of these five levels: functionality, usability, aesthetics, status and mission.

How to overcome:

Creating value for customers starts with product functionality and evolves by providing good usability and further attractive aesthetics through a visual brand identity. Then a status is needed that personalizes the experience based on audience specifics and lifestyle. Finally, it ends with a mission that forms a like-minded community around important values.

6. Overpromise gap

If a company aggressively advertises its service, promising something that the product fails to provide, it will cause even more frustration for users. As a result, the reputation damage could double, because the service outcome does not match the promises that were advertised.

How to overcome:

Customers in the digital age demand transparency, honesty and open communication. Due to the network effect, it has become almost impossible to sell a poor quality product because anyone can immediately share a negative experience on social media. Therefore, it is important to only make promises that can be fulfilled and even exceeded.

Read More: Data Reveals a Surprise Driver of CX Satisfaction in Banking

7. Emotional gap

If brand communication is purely informative, focused on functional characteristics, then it will be difficult to establish an emotional connection with users. Because people make decisions based on emotions, creating value for a service on an emotional basis is the only way to create a brand that will positively impact customer perceptions and experiences.

How to overcome:

In the digital age, empathy and customer care are becoming more important than ever. Creating an emotional bond between a brand and its customers is essential to ensure long-term loyalty and demand.

Bridge well all the previous gaps: employing the right customer-centered mindset; collecting feedback and making improvements based on it; using the right tools and methodologies to create product design and ecosystems; creating true value that matches customer expectations; and, finally, adopting honesty and keeping promises.

Eliminate Indifference in Your Company

Each customer subconsciously evaluates the received service according to their own expectations.

The emotions generated by the user experience build the brand’s reputation. In today’s world, digital services have become the main marketing and PR of the financial brand. Therefore, a negative experience with a mobile application can ruin any effort to promote a brand, even if the brand has a good reputation spanning a hundred years with excellent service in other channels.

The digital age is dominated by mobile channels, and, for some, it is becoming the only way to interact with the brand. This is why it is so important to know how to bridge these seven digital service experience gaps and avoid indifference to your customers’ expectations.