Rebranding a bank or credit union often grows complicated and demanding. But it can work wonders for a financial institution if they learn from other institutions’ experiences — good and bad — and execute their changes in a planned manner.

Here are seven key rebranding tips for banks and credit unions that can help institutions plan and execute rebrands for long-term success.

The Truth Behind Rebranding:

People reward brands who “get them.” So when considering revamping your institution’s image, tap into your consumers’ psyche and offer them experiences congruent with their values.

CFPB 1033 and Open Banking: Opportunities and Challenges

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

1. Determine If the Logo Change is Really Necessary

Contrary to a common assumption, rebranding doesn’t necessarily require a logo change. In fact, sometimes consumers connect more with your old logo. Therefore, unless your new logo and other design elements include your brand’s current message, a change in design may be unnecessary.

Take Capital One, which in 2008, in a bid to appeal to a newer, younger demographic, added a “swoosh” to its logo.

The new logo’s typography largely remained the same as the old logo, the new logo containing the swoosh was a complicated mix of colors, gradients, type and icons, which gave it a terribly dated-looking identity.

When stirring elements into a new logo, it’s important to make sure everything has a purpose in portraying your brand or organization. The red swoosh in Capital One’s logo doesn’t say banking at all. It was not only pointless but served to complicate the brand identity.

Read More:

- Is It Time For You To Rebrand?

- Q&A: Real-World Rebranding Lessons From a CMO in the Financial Industry

- Truist Bank: Colossal Rebranding Misstep? Or Long-Term Winner?

- AI Powers Citizens Bank’s New Millennial-Focused Rebranding Campaign

2. Ask the Consumers You Serve What’s Important to Them

When considering changing your logo, it’s very important to ask your people who know your brand about the changes they’d like to see. One-on-one interviews, web and phone-based surveys, and focus groups can yield good input.

When Southland Credit Union was considering a logo change, they were originally thinking of keeping the old logo. They thought it remained relevant and still looked good. But through focus groups they discovered that while people loved the Southern California vibe in their old logo, they felt that it was too dark and the font dated.

The company decided to retain the old Southern California vibe — palm trees evocative of a relaxing environment — but added more vibrant and fresh colors to the design, giving the logo a fresh and young look and appeal.

3. Conduct an Audit to See What Needs Changing

By conducting a performance evaluation for your brand, you can obtain information factors that can be changed to strengthen it. Examine every aspect of your bank or credit union through consumers’ eyes and determine what really needs to be changed.

When Matt McCombs, the president and CEO of Vibrant Credit Union, joined what was DHCU Community Credit Union in 2011, it was losing members, loans and deposits. Over the course of two years, McCombs had every department determine what needed refreshing. By 2013, McCombs and his team found out that legacy core technology was hindering the credit union’s ambitious transformation plan. Management switched to a modern core platform.

Read More:

- How Big Do Credit Unions Have to Be to Survive?

- Marketing Helps PenFed Rack Up Major Growth Under Open Charter

4. Avoid Legal Headaches By Diligent Research Beforehand

An essential step to rebranding is doing the critical homework first to avoid legal risks when rebranding. For example, often, a rebrand involves a logo change.

Don’t Skimp on this Stage:

If you plan to redesign your logo, make sure it is an original design and does not copy or closely resemble another brand’s logo. Similarities can expose your business to trademark and copyright infringement claims.

Case in point: In 2019 Facebook and others announced the launch of the Libra Cryptocurrency and Calibra digital wallet. The wallet’s logo was unveiled, which stirred up a controversy. Another mobile banking app, Current, alleged that the Calibra logo was too similar to Current’s logo, which the fintech firm had been using since 2016. Current sued. Since then Facebook renamed both its cryptocurrency project and the associated wallet, now called Novi.

While avoiding copying others’ designs is important, it is also important to protect your own logo to ensure no other businesses can use that logo for similar goods or services.

- Make sure the company designing your logo assigns ownership in the copyright in the logo to you.

- Also, don’t forget to file a trademark application and arrange for trademark searching before commencing the rebranding so that the new logo can be protected.

Read More: Financial Institutions Face Huge Legal Risks When Rebranding

5. Rebranding Process Should Not Be Rushed

Revamping a financial institution’s image should be a well-researched, thoughtful and deliberate investment. It’s a long-term effort that requires constant and intense communications. It requires a brand to consistently tell its story across hundreds of touch points, requiring careful planning.

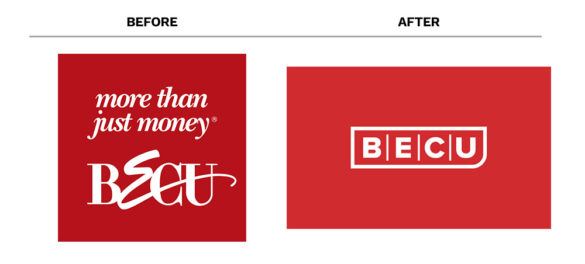

Consider Boeing Employees’ Credit Union. In 2017, BECU initiated a rebranding and logo redesign to better reflect their dedication towards members and the significant changes that have occurred in the industry. The previous logo, launched nearly three decades ago, was created with an aim to highlight the letter “E,” signifying the credit union’s role in providing financial services to Boeing Company employees.

However, since 2002, Boeing Employees’ Credit Union has been open to all Washington state residents, and its membership has grown substantially, with more than one million members and more than 50 branches throughout Washington and South Carolina (where Boeing’s maintains its major eastern assembly operation).

The organization’s new logo features the letters, “BECU” separated by vertical lines and surrounded by a rectangular box with a rounded lower-right corner, highlighting the letter “U,” which stands for “you” — the members of the credit union.

The logo changes may appear simple at first — something they might think could be achieved in a day or two. However, the credit union invested much time, effort and research to come up with their new logo. An extensive process was conducted, where they interviewed all the stakeholders, including employees, members and even nonmembers to gain insights into what the BECU brand represented.

After reviewing over 200 alternatives, a new design was approved, which had the original elements of BECU’s history and heritage, with a call-out to the members and Boeing employees via a single rounded corner accentuating the “U” in BECU.

Solid Rebranding Takes Diligence!

BECU’s entire process took about a year. Many people had strong reactions to the new brand identity after launch, so BECU had to make special efforts to educate members about the rebranding and the reasons behind it.

Among the outreach efforts: A special landing page was created and social media was used extensively. Finally, after investing a lot of time in educating people about the rebranding, the company started seeing about 86% positive sentiment.

Ultimately, BECU’s rebranding efforts proved successful, and the organization received a Diamond Award from the CUNA Marketing & Business Development Council.

Read More: An Inside Look at The Strategy Behind BofA’s Brand Refresh

6. Bring in Human Resources from the Very Beginning

When you decide to do a rebranding, it can prompt employees to ask many questions about the changes to company culture, organizational shifts and even job security. Therefore, involving Human Resources in your rebranding process is crucial. They will communicate to the employees why the change is happening and how employees will be involved. This will help the employees to get on board with the brand evolution.

HR will also help you get feedback about how your employees perceive working at your company. With this knowledge, you can make your organization better for your employees so that they feel honored to be a part of your organization and wear your logo.

When Point Loma Credit Union rebrand took place, one of the best things they did was to have the HR and marketing teams work hand-in-hand on the initiative. Together they conducted deep studies on focus groups with different types and levels of employees to understand what makes them tick.

7. Don’t Rush the Process — Introduce the Changes Gradually

This allows people to gradually adjust to shifts and note that you are still the same company but with a different aesthetic and message. A slower reveal also allows some buzz to build while you make the changes.

An effective way of introducing the changes slowly is to show people “behind-the-scenes” and “sneak peeks” of changes to remind them of what’s coming. You will also get plenty of valuable feedback, which will help your brand improve even further.

Starting in 2016, Wells Fargo, the banking giant, suffered a series of fake accounts scandals.

First attempt: In order to revamp its image and reassure customers, among many other steps the bank decided to go for a brand refresh with an integrated marketing campaign in 2017. But the bank’s campaign with the new tagline — “Building better every day” did little for the brand’s image.

Second attempt: In 2018, a new campaign was launched with a new tagline — “Established 1852. Re-established 2018.” But this also proved unsuccessful, and loyalty numbers dropped from 65% to 63%.

The first two rebranding efforts failed because they did not reflect a sincere effort to change the way the bank does business. The bank’s new logo also did nothing to turn things around for the bank, and loyalty numbers kept dropping.

Third attempt: In 2019, the company launched a completely new rebranding campaign to gain customers’ faith and trust. Their logo and motto were redesigned. Their advertising and social media campaigns were significantly revamped. Besides that, traditional platforms were also utilized to enhance their credibility by conversation building. For example, they presented a comprehensive description of the “This is Wells Fargo” campaign through a full-page print ad in the Wall Street Journal.

Wells Fargo’s integrated marketing campaign was run over a period of time to communicate to its customers that although controversies had wounded the bank, it was changing.

Wells Fargo still struggles with reputational challenges due to its past actions — regulatory charges and settlements have popped up periodically — but its well-rounded third-wave campaigns over a period of time were successful and received well by its audience.