Is it time for banks and credit unions to bring back all employees into the office? While there is consensus that the emergency remote-work set-up forced upon all financial institutions (and all businesses) has generally been successful, employers and employees alike understand that it isn’t sustainable. At the same time, the value of work-from-home arrangements has been acknowledged, to the benefit of employees — allowing more flexibility and better time management — and for employers — reduced operations costs, facility maintenance, and talent recruitment.

What is emerging is a sense that the old office paradigm where everybody is in the office all the time needs to shift, likely to some sort of hybrid arrangement of combined in-office and at-home working schedules. Many factors go into what is a complex situation.

As management expert Robert Pozen, senior lecturer at MIT Sloan School of Management and co-author of “Remote, Inc.“, told Bloomberg, “You have to think about the nature of your work. If it’s collaborative or involves brainstorming, then probably you need to be in the office a little more. If it’s concentrated work where you can do it on your own, then being at home makes more sense.”

But hybrid arrangements have their critics. In a Wall Street Journal article, Denise Rousseau, a professor of organizational behavior at Carnegie Mellon University, notes that hybrid arrangements could inadvertently disadvantage women, who are more likely to seek home-based arrangements.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Urgent Need to Foster Collaboration and Creativity

JPMorgan Chase CEO Jamie Dimon, in his annual letter to shareholders, admitted that his company was caught short by the onset of the global pandemic, but added that “We learned that we could function virtually with Zoom and Cisco and maintain productivity, at least in the short run.”

Looking forward, he said the bank will pursue a model that “will find many employees working in a location full-time … Some employees will be working under a hybrid model (e.g. some days per week in a location and the other days at home). And a small percentage of employees, maybe 10%, will possibly be working full time from home for very specific roles.”

Dimon articulated what many industry leaders and observers have noted: “Performing jobs remotely is more successful when people know one another and already have a large body of existing work to do. It does not work as well when people don’t know one another. Most professionals learn their job through an apprenticeship model, which is almost impossible to replicate in the Zoom world.”

Unintended Consequence:

Over time, the drawbacks of remote work could dramatically undermine the character and culture you want to promote in your company, says Chase CEO Jamie Dimon.

The need for creativity and innovation in banking has never been greater, observes Jeffrey Pilcher, CEO and Founder of The Financial Brand. “Having managed creative people for nearly 20 years I can say that teams need the energy of working together in offices. Innovation is extremely difficult when you’re working in isolation. If banks and credit unions ever hope to be innovative,” Pilcher emphasizes, “they need people to feed off of each other in offices. Collaboration is hard enough working remotely; creativity is next to impossible.”

Studies and anecdotal evidence suggest that employees are experiencing pandemic fatigue and would appreciate the chance to adopt some sort of home-office combination, if not an outright full-time return to the office.

“It seems like everybody is really itching to get back,” said Emily Terlau, Director of Design at DEI, a financial institution workplace design firm, in an interview. “People are eager because there is something to be said about the collaboration that can be done in person.”

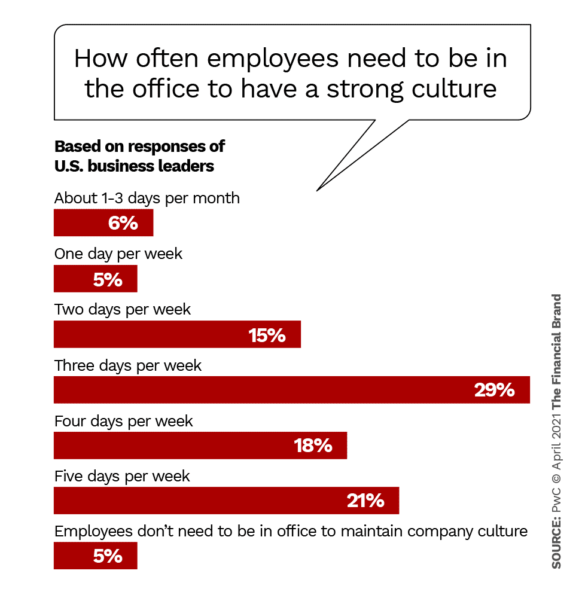

A survey by PriceWaterhouseCoopers concluded that U.S. executives and employees are “converging around a post-pandemic future with a lot more flexibility, yet few are prepared to completely abandon the office space.”

A few results from the PwC survey are instructive:

- Most employees would like three days a week at home, while most employers would like three days a week in the office.

- Employees with the least experience are most likely to value in-person meetings and training.

- Most executives expect to make changes to their real estate strategy over the next year.

Read More: Will Banking Executives Ever Return to the Office?

How to Manage a Transition Back to the Office

The big question becomes: How best to transition from completely remote working to returning to the office? The general answer, not surprisingly, is that there is no uniform solution. This has not stopped various commenters from offering general guidelines of one sort or another. A close reading of these illustrates several commonalities. Here are a few:

Industrious, an executive office provider, advocates what it calls “The 30% Rule.” In short, companies would:

- Resume in-office operations when 30% of staff is vaccinated.

- Modify up to 30% of existing office floor plans to better suit the team’s current needs.

- Bucket employees into two groups, either 30% in-office/70% remote or 30% remote/70% in-office.

- Survey staff every 30 days to evaluate performance.

A McKinsey article offers these guidelines:

- Reconstruct how work is done, putting the burden of proof on those who argue for a return to purely pre-Covid legacy processes.

- Decide which roles must be carried out in-person and to what degree.

- Redesign the workplace to support organizational priorities, applying applicable technologies.

- Resize the office footprint creatively, to foster collaboration, productivity, culture, and the work experience.

Deloitte delves into the subject fairly deeply, concentrating on whether restart plans are likely to be role-specific, geography-specific, or a combination of the two. Other factors to consider are density reduction, sanitation, and employee support measures.

In his Bloomberg interview, MIT’s Robert Pozen notes that if employees are part of a team, it’s very important that the entire team is in the office on the same day.

“A lot will be up to managers, in terms of devising the optimal combinations for their teams,” Pozen states. At a financial institution, he observes, the arrangements will likely vary for areas like a branch with a lot of customer interaction versus employees doing programming.

A Real-World Example Financial Institutions Can Consider

Kevin Blair, president and CEO of NewGround, which has a long track record of designing financial institution headquarters spaces, shares his own company’s plan to return to in-office work. While no two companies, or even financial institutions, have the same situation, there are some commonalities that transcend all businesses.

In an interview, Blair tells The Financial Brand that NewGround’s company culture, like that of many banks and credit unions, centers predominantly on an in-office model. As a result, it is planning a full return to work, but in a phased approach, beginning in July 2021.

“It’s not going to be easy to re-engage employees by just throwing a switch and expecting everybody to be on board.”

— Kevin Blair, NewGround

Before everyone shows up, Blair encourages all company executives to restate their brand promise, vision, and growth strategy. “We think it’s very important that when the re-engagement occurs that there’s a reintroduction to all employees as to ‘Here’s what we are,’ ‘Here’s where we’re going,’ and to create a sense of energy,” he says.

Week one of re-engagement will consist of two half-days in the office when all employees essentially will be re-onboarded, as if it’s their first day on the job to help get everybody reconnected.

Week two will be three days in the office, staggered by department, to help transition to the in-office model.

On week three they will go to a four-day work week at full force, followed by week four, when everybody is full force in the office the entire week.

In addition, each employee will have a “bank” of 50 days per year to opt for working at home — however they and their supervisors agree.

Read More:

- 9 Spectacular Headquarters Designs From Banks and Credit Unions

- 7 Ways Financial Institutions Can Turn Their Offices Into a Recruiting Tool

Attracting and Retaining Top Talent

Even as banks and credit unions have coped with the Covid restrictions there has still been the need to bring new professionals onboard. Counterintuitively, the pandemic has made talent sourcing “somewhat easier than before, since the pool of available talent could have fewer geographical constraints,” McKinsey states. Such remote work could be supplemented, for example, by monthly trips to headquarters or meetings with colleagues at a shared destination.

By the same token, even at an office-centric company such as NewGround, hiring actually has proceeded robustly over the past year. That is because the pandemic has put a lot of talented people out of work, says Blair, and they are actively looking for employment, even in an office environment. During interviews, the company is up-front about its expectations regarding office work and hires only those who express agreement.

What the Office Will Look Like

Industry observers agree that the old “cubicle farm”/executive office model likely will have to be re-imagined to allow for greater separation of employee work space, better ventilation, more multi-use conference spaces, and temporary desk space for workers who come into the office only a few days a week.

Terlau, of DEI, observes that her company’s clients are starting to shrink their permanent workspaces in favor of more collaborative spaces fitted with state-of-the-art technology for communications in-person and remotely.

NewGround’s Blair, while acknowledging the eventual need for revamping office layouts and buying new furniture, offers a note of caution.

“It takes a long-range vision on those purchases because they’re not easily nor inexpensively swapped out. We strongly encourage executives not to overreact and start to make modifications to their entire office,” he states.

Even as many uncertainties remain, there persists a sense of optimism. As an industry leader, perhaps Dimon’s parting words to shareholders express this best:

“We still intend to build our new headquarters in New York City. We will, of course, consolidate even more employees into this building, which will house between 12,000 to 14,000 employees. We are extremely excited about the building’s public spaces, state-of-the-art technology, and health and wellness amenities, among many other features.”