As branch banking facilities closed globally, digital channels frequentlly became the only mode of engagement for financial institutions. While most of the largest banks were able to shift transactions rather seamlessly to digital channels that were already operational, many smaller organizations were far less prepared to accommodate digital-only engagement. This lack of digital maturity negatively impacted customer experiences.

Regional mid-cap banking organizations are often caught in an identity Catch-22. They often do not have the local loyalty of community banks, and are usually not seen as “digital banking leaders” compared with the largest financial institutions, digital banks, fintech firms, or even big-tech organizations encroaching on traditional financial product strongholds.

While outsourcing provides an alternative to building digital solutions internally, there is the challenge of being at the mercy of vendors who may not be agile or flexible enough to respond to needs quickly. Alternatively, the M&A option may not provide the level of scale required, and may not result in the leadership or cultural paradigm shift needed to support digital transformation.

While being bigger is not always better, there is an advantage to scale from the perspectives of innovation, product development, data and analytics, advanced technology and capital. This is because the back-office operations, processes, and technology required for digital services and engagement are at least a generation behind – with the ability to “catch up” shrinking daily.

Read More:

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

- Banking Must Bridge the Growing Digital Transformation Skills Gap

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Mid-Cap Challenges

Competition for every banking product is increasing, with innovative digital products and services being offered by traditional and non-traditional providers. For some regional banks, remaining competitive for consumer payments (e.g., credit cards, peer to peer, etc.), lending, digital deposit acquisition, and even small business relationships has become overwhelming. In addition, the ability to switch providers, or reduce relationship reliance on a traditional provider is easier than ever.

“Tectonic shifts have radically changed the banking landscape. These disruptions aren’t going away, and will most likely accelerate … impacting business models, priorities and careers across entire organizations.”

Beyond the expanded banking battlefield, consumer expectations have risen faster than ever before. During the shutdown period of the pandemic, consumers and businesses have become increasingly aware of digital alternatives across industry segments, including media and entertainment, hospitality, food services and grocery, retail, telecommunications, education, and of course, financial services and payments. Not only have consumers shifted to the alternatives that provide the best quality of life benefits, they have also become aware of the value of personalization, speed, simplicity and contextuality.

These tectonic shifts have radically changed the banking landscape. And, these disruptions aren’t going away, and will most likely accelerate … impacting business models, priorities and careers across entire organizations. For mid-cap regional banks and credit unions, there needs to be a paradigm shift in strategies, organization structures and mindset. To compete with the most progressive financial services providers will require better deployment of data and analytics, advanced technology, multichannel distribution, context-aware engagement, and humanized experiences that meet customers’ specific needs in real-time.

The Marketplace Impact

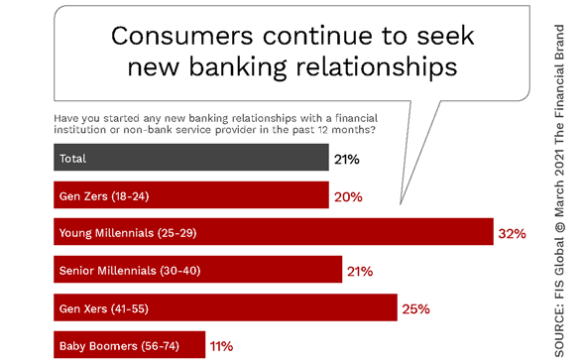

According to consumer research from FIS, regarding banking and financial habits in the 12 months since the pandemic began, one in five people started using a new banking provider during the period. The most active demographic group starting a new banking relationship in the year following the start of the pandemic were Young Millennials (aged 25-29), followed by Gen Xers (aged 41-55). Considering the overall populations of these different demographic groups, the impact of Young Millennials is even more impressive.

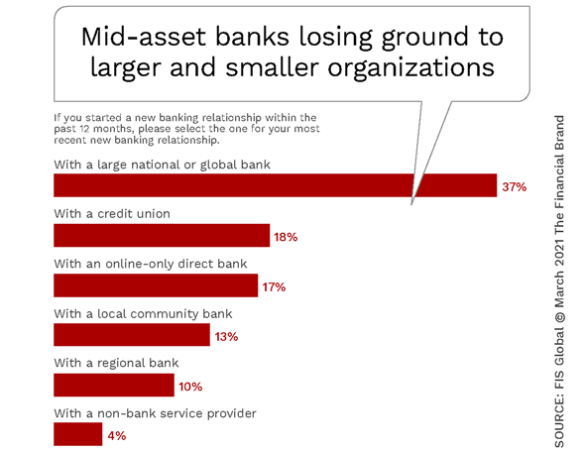

Of those consumers who started a new banking relationship, 37% selected a large national or global bank. Credit unions were the second-most popular choice for consumers with 18% opening accounts at these institutions, while direct banks were selected by 17% of respondents. Regional banks only garnered 10% of new banking relationships according to the FIS study. This is despite mid-cap regional banks having a 30% overall market share.

When consumers were asked why they opened a new banking relationships, 33% percent stated that they were looking for better benefits, such as higher savings yields and rewards. while seven percent of consumers said they did so to access COVID-19 relief according to the survey. These reasons appear to have benefited the direct banks (that often use rate incentives for savings and promised rapid disbursement of government checks) and community banks and credit unions (that performed well in reaching out for new customers for PPP loans).

Key Insight:

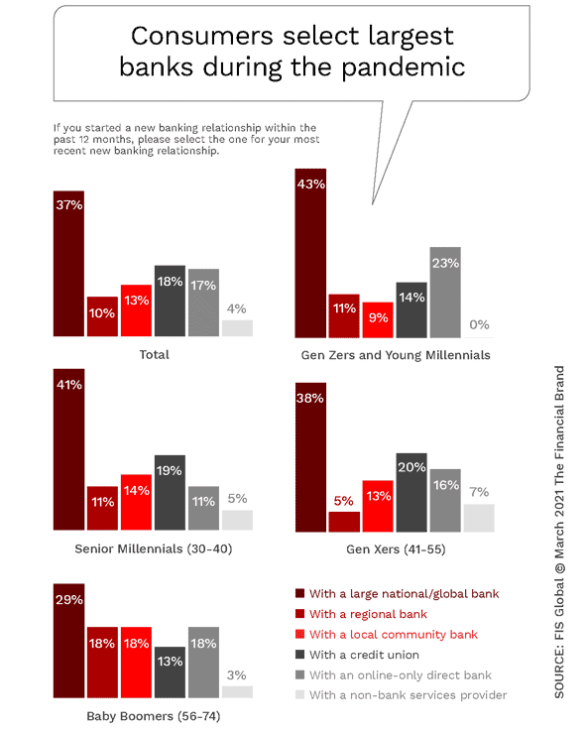

As consumers increasingly seek fast and simple digital banking alternatives, mid-cap regional banks are not the option of choice except for Baby Boomers (who open fewer new accounts).

From a demographic perspective, the youngest consumers (GenZ and Millennials) had a higher propensity to select the largest banks, while Gen Z and young Millennial consumers were the most likely to select an online-only direct bank. Interestingly, Baby Boomers were the least likely to select a large national/global bank, but most likely of the demographic segments to select a regional bank or community bank. Somewhat surprisingly, Baby Boomers were also the second most likely segment to select an online direct bank provider.

“COVID-19 has been a huge catalyst in driving new consumer behaviors, from how they shop to how they bank,” says Rob Lee, Head of Digital and Banking at FIS. “All of this change spells opportunity for banks and credit unions to advance their digital offerings and loyalty programs to meet these changing needs and capture new customers.”

Keys to Regional Bank Survival

The majority of consumers will not go back to the way banking was done pre-pandemic. Instead, they will select banking alternatives that provide the best digital solutions or the strongest support for the community (or both). To respond, legacy financial institutions will need to double down on ways to improve digital banking experiences, increase overall value propositions, decrease operational and delivery costs, support innovation and new product development, and increase agility. Organizations will also need to retrain current staff and find additional talent that can support digital transformation. This is especially true for regional banking organizations.

To be competitive in an increasingly active banking ecosystem, regional banks must focus on the following to avoid becoming a tertiary alternative for consumers:

- Find a “winnable” niche. Trying to beat the biggest traditional banks, fintech firms or big tech players across all service or product lines is not a winning strategy. Instead, resources must be focused on segments or niches where an organization already has a differentiated advantage. This could be a demographic segment, product set, or geographic footprint (although location is a far less defensible position as digital banking alternatives gain favor). Even with a niche strategy, an organization will need to build digital solutions that will improve overall customer experiences.

- Streamline operations. Interest rates are low and margins will remain thin for the foreseeable future, therefore organizations need to focus on all ways to improve efficiency, without negatively impacting the consumer. This includes rethinking back-office processes and procedures for a digital future, deepening relationships with existing customers, increasing automation, optimizing delivery networks and leveraging technology to support marketing and customer service.

- Partner and collaborate. While some organizations will pursue M&A options, it is very difficult to grow out of legacy thinking. If an organization does not have leadership that is willing to embrace the requisites for being a “digital bank,” an acquisition may only lead to a bigger, bad bank. For many organizations, a better alternative is to seek out fintech firms and solution providers who can enable an organization to innovate and transform quickly and remain nimble over time.

- Improve infrastructure. Mid-cap banks will not be able to invest the amount of money in infrastructure upgrades to the degree of the largest banking organizations. As a result, investment my be optimized with a focus on which investments bring the best long-term return. According to McKinsey, “Regional banks need a plan for leveraging tools like cloud computing, scaling agile beyond select pockets in IT, and streamlining key customer journeys.” They also recommend analyzing alternative core replacement alternatives that are customized for the current strengths and challenges of an organization.

- Create a “digital mindset.” The biggest impediment to digital transformation is legacy leadership and culture. This includes employees who are under-equipped to support digital operations, engagement, customer care and the use of data and technology for improved decision making and experiences. Similar to the commitment made by Amazon to train current employees for future digital positions, regional banks will need to hire, retrain, redeploy, and retain talent with digital, analytic, IT and design skills. This reskilling starts at the top, with digital leaders recruited to support the existing leaders.

Being a “fast follower” is not a winning strategy, especially for mid-cap regional banking organization. According to Ron Shevlin from Cornerstone Advisors and senior contributor to Forbes, “Over the past three years, the megabanks’ share of new checking account applications increased from 36% to 51%. Digital banks tripled their share over that period of time. Regional banks, credit unions, and community banks, however, have seen their collective share of new applications drop by half from 51% to 25%.”

Obviously, something must change … especially is an environment where consumers are expecting fast, easy and contextual experiences. Regional banks, more than any other component of the banking ecosystem, are the most vulnerable because they usually lack the community connection of a local financial organization and aren’t large enough to compete with the megabanks. The best option for most would be to collaborate with those organizations that can transform these banks most quickly. Most importantly, though, leadership must embrace the change that is evident, take the risks needed for the long-term survival of the organization and begin by retaining current customers that are redirecting their business to digital banking alternatives.