At the end of 2019, some people predicted an impending recession. However, none of them suggested that it would come at the tiny, spiked hands of a virus known as corona. Coming into 2020, most community financial institutions had healthy loan portfolios and were hungry for deposits. A few months later, those same institutions were flooded with deposits as investors pulled back from the stock market and stimulus checks arrived.

As a result, net interest margins and return on assets came under a ton of pressure. Suddenly financial institutions needed loans — and a lot of them. There wasn’t an easy path to acquire those loans, certainly not 68% more. Even PPP lending was isolated to commercial clients, not the kind of healthy long-term growth that financial institutions need to weather economic storms.

Rebalancing the Balance Sheet: Easier Said Than Done

The Board of Governors of the Federal Reserve System saw this situation developing and provided guidance. They recommended that institutions should cut costs, increase non-interest income, and raise lending volumes. This is like having a gym trainer tell you to exercise more and eat less if you want to lose weight. Every bank and credit union leader understands the theory, but the practice is a different challenge.

The traditional tactics for accomplishing the Fed’s recommendations are simple enough and painful:

- Reduce headcount

- Increase consumer fees

- Close branches

- Delay product or technology investments

These are not the tactics that will help your institution become more resilient. Each of these four actions will compromise your team’s ability to serve consumers and establish yourself as a primary financial institution (PFI). They definitely aren’t the road to generating 68% more loan volume from your checking accounts. There’s another way, a different strategy that can make you the primary financial institution for not just deposits but loans as well.

Consumer Shifts Offer Important Clues

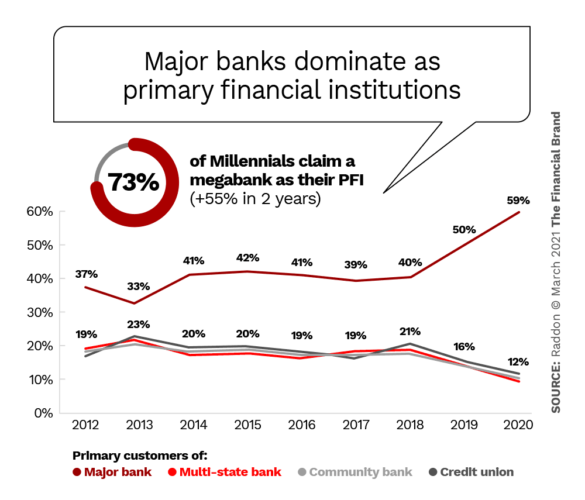

Whatever you see as the long-term prospects for your institution, the graph below should alarm you. Consumers are moving their primary banking activities to the megabanks. In 2013 the numbers seemed to be moving in favor of community financial institutions, but the trend has flipped hard. And it’s even more pronounced with younger consumers such as Millennials. That doesn’t even consider the growing dominance of fintechs and big tech companies like Google and Apple moving into the deposit and lending markets.

The uncomfortable truth about this trend is that unless you take serious action, these younger consumers will never bring you their financial needs. It doesn’t matter where their parents and grandparents bank if they can’t find the products and services that fit their lifestyle.

Once upon a time, you could talk face-to-face with account holders to learn what they want. Now the game is being played online.

Keeping Up With the Megabanks

Megabanks are using data to predict what consumers want and offering it as conveniently as possible. They have vast resources that community institutions can’t possibly compete with.

That’s not to say you need to offer all the same products and services that megabanks do. But you need to provide parity wherever possible and look for ways to outclass the megabanks. What can you offer that megabanks or your competition can’t? Just like the Fed’s advice on battling margin compression, this may sound like a nice theory without any evidence or real-world examples. Remember that 68% loan volume increase mentioned earlier? We’re getting to that.

Cultivating a PFI Ecosystem

Becoming a PFI depends on more than a single product or service. It works best when you adopt an ecosystem strategy that provides consumers with multiple ways to deepen the relationship and fulfill their financial needs.

At Kasasa, we directly power 3.5 million reward accounts worth $19 billion in deposits, with visibility into 27 million non-Kasasa accounts, with more than 76 million monthly transactions. That translates into a volume of data that compares with any regional or megabank.

We’ve helped our clients generate $43 million in monthly non-interest income while paying just $17 million in monthly rewards. That’s not a typo — they bring in more than 2.5X the non-interest income as they pay out in rewards. Of course, the economics of the reward accounts are more complicated than that, but at face value, those numbers are astonishing.

Accounts That Grow More Than Just Deposits

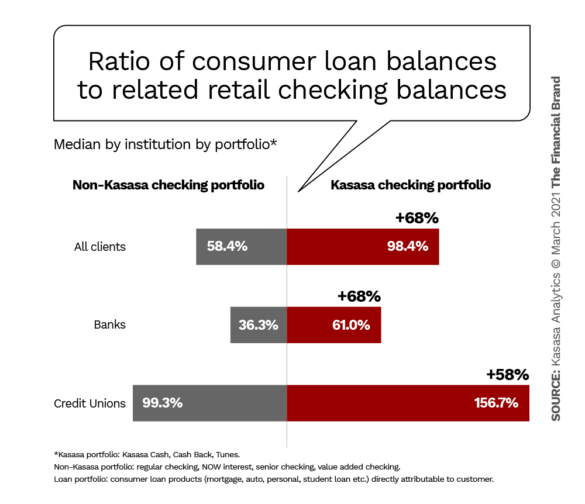

It’s straight from Banking 101: you need deposits to fund loans. But that’s not the dynamic we’re talking about — the data has revealed a phenomenon that you need to see. Good thing we’ve got a chart!

Kasasa account holders have much higher individual loan-to-deposit ratios compared to some of the most common checking (or share draft) account types. The 68% higher loan balances stat proves that with the right type of deposit products, consumers will bring you more of their financial lives and help drive profit on both sides of your balance sheet.

It All Starts with Rewards

Reward checking is a massive driver of non-interest income, rewarding account holders for profitable and cost-saving behaviors like debit card swipes, direct deposit, and signing up for e-statements. None of these activities encourage lending behavior — keep that in mind for later.

These qualifying activities allow your institution to promote a high rate of return and keep costs manageable: not everyone qualifies every month, and few people max out the reward tiers. The account is always free, and the rewards and habits create loyal account holders and a foundation for PFI status. That’s where the script flips, and deposits become a significant driver of lending growth.

Doubling Up on Loan Growth with a New Kind of Loan Consumers Love

The Kasasa Loan is the only loan on the market that allows borrowers to pay ahead on their loan and access that extra cash later if they need it — we call that a Take-Back®. And when an institution offers the Kasasa Loan as their primary lending solution, they see 52% higher overall loan balances originated, just by asking borrowers if they have any other debt they wish worked this way.

People who borrow using a Kasasa Loan report a Net Promoter Score (NPS) of 84. By comparison, USAA, one of the best in the industry, earns a 75 NPS for their entire organization. This score indicates how likely a person is to recommend the Kasasa Loan to their friends and family. Or put another way, the higher the NPS, the more substantial word-of-mouth marketing will be.

We’ve seen this play out where a borrower (we’ll call him Dwayne) opened a Kasasa Loan (after initially saying “no”) and then refinanced his car with an additional Kasasa Loan. Dwayne then told his wife. His wife came in to refinance her car with a Kasasa Loan. Dwayne’s wife then sold a different car and recommended the Kasasa Loan to the buyer. All in all, the institution opened four loans based on the satisfaction of a single borrower, with no additional marketing.

Imagine compounding that word-of-mouth referral power with the loan volume you can realize from the right type of reward checking account. The growth potential is enormous.

Supporting Your Community with Value-Added Offers

Another component of your PFI strategy should be value-added offers. This allows you to diversify your product offerings and support your community with products and services they need access to, like health insurance, Medicare, Life insurance, prescription drug savings, and more.

By aligning with the right partner, you can implement a referral marketing program that will a predict the best offers to your consumers who are most likely to want them. Kasasa’s referral program and online marketplace, called Kasasa Care, is an excellent example of this, allowing you to maximize products-per-relationship without increasing the burden on your marketing team.

Taking Control of the Situation

The Fed may think that community financial institutions can easily trim expenses and raise non-interest income. Still, the reality is far more challenging, no matter how big or small your team is. The benefit of using an ecosystem strategy like the one we just outlined is that it aligns with things your institution is already doing. You already offer checking accounts; why not offer one that drives loan volume? You already offer loans; why not offer a loan that all but sells itself? And whether you offer value-added products or not, wouldn’t it be nice to have a system that runs itself and partners that take care of the compliance and customer support for you?

Ultimately, none of us can predict what kind of economic conditions we’ll face in 2021 and beyond. What you can do is take specific steps to build a resilient institution that continually seeks to deepen your primary financial relationship with consumers.