Consumers have become far more demanding than they were just a year ago. With big tech firms and major retailers leading the charge, audiences are increasingly expecting video, audio and other interactive forms of rich media to not only inform them about products and services, but to entertain them at the same time.

People are tired of having to wade through websites for product pages that don’t relate to their individual situation or needs. Consumers want highly personalized ways to learn about services and engage throughout the customer journey. This is where personalized videos and other forms of rich media come in, and why this mediuam increasingly dominates the digital marketing world.

Video content will make up 82% of all online traffic by 2022, according to Cisco. In another study, it was found that 86% of marketers utilize videos in their marketing campaigns, with the most common uses of video being product knowledge (73%), social media content (67%), presentations (51%), for direct sales (41%) and digital ads (41%).

And consumers are responding. Roughly 50% of internet users consult a product video before making a purchase, according to Hubspot. With these statistics as the foundation, it is not surprising that the best performing form of videos are those that are personalized. Using insight from various sources, personalization can reflect full name of the viewer, demographic profile, geographic location, stated financial goals, recent transactions, banking relationship history, device being used, search keywords, etc.

Read More: The Digital Ads Banking Consumers Hate Most (And Why)

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Use Personalized Video

A personalized video is any video content that is customized and contextual to an individual or group of consumers, including prospects, customers, or even employees or influencers. The personalization can be as simple as using the recipient’s name, or as complex as reflecting the stage of the customer journey, recent interactions made on other channels, or any personalization that can be deployed using real-time insight.

In the banking world, where consumers are shopping for services on digital channels as opposed to visiting branch offices, the process of finding product alternatives, features, benefits, fees and other information is often archaic and arduous. Rich media options, like personalized videos, address this challenge. Not only can contextual and interactive videos show the best product alternatives for the consumer, they can initiate the close of the sale with a greatly enhanced customer experience.

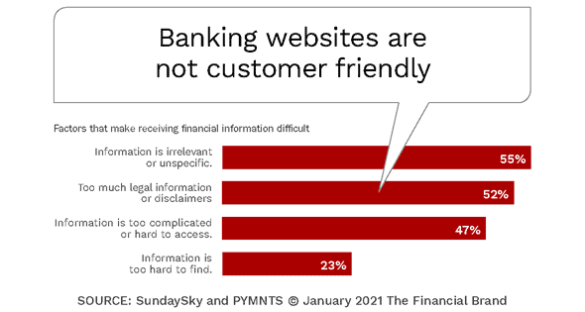

In research from PYMNTS, in collaboration with personalized video platform provider SundaySky, roughly half of consumers find financial websites almost impossible to navigate. When information desired is hard to find, consumers abandon the purchase process and find other alternatives.

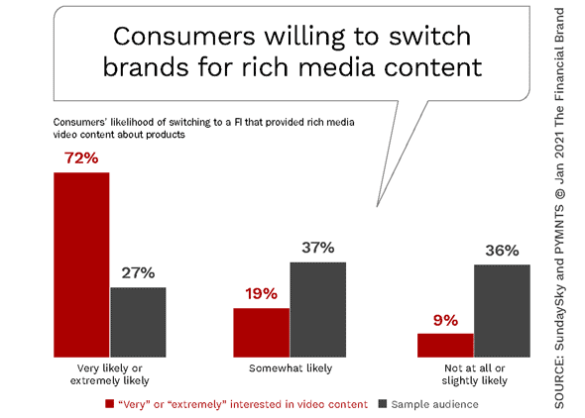

On the most fundamental level, one of the key reasons for considering personalized videos is that 52% of consumers, as well as 65% of business buyers, will switch brands if they don’t receive personalized communication from vendors, according to Salesforce. In research specific to the banking industry, it was found that 72% of consumers who are “very” or “extremely” interested in video content say they would switch to another financial institution if it provided access to this kind of content on its products.

The reason why personalized videos work is because they drive engagement. This includes a higher click-through rate, a higher interaction rate, and a longer period of time viewing the communication … all resulting in an extraordinarily higher sales conversion rate. There are also studies that indicate that personalized video can increase brand trust and loyalty.

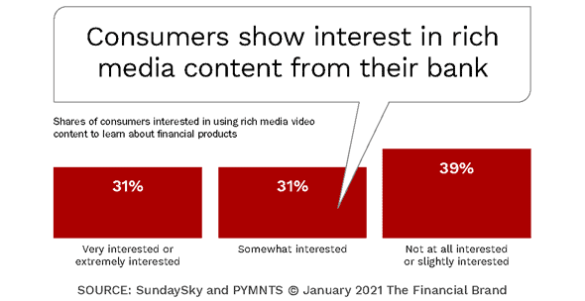

Over 30% of all consumers believe that personalized, on-demand video content is appealing for accessing relevant yet complex information about new financial products and services. Access to better experiences and stronger engagement are reasons why 47% of customers are interested in rich media solutions, according to the research from PMNTS and SundaySky.

According to Forrester, a video is 50x more likely to land on the first page of search results as opposed to a text-based page. That’s because Google considers videos more impactful for users. As a result, the more video content you place online, the higher your chances will be of growing traffic to your pages, not to mention the brand awareness, impact, and loyalty you will generate by showing up higher in industry-specific search results.

How You Can Use Personalized Video

Personalized videos can be used in almost any way that insight-driven personalized marketing is used today. Google provides a comparison of rich media such as personalized video and standard media. While traditional media is still effective, rich media has engagement advantages as discussed above.

Where you can use both types of media are very similar, but the creative used is very different. Traditional media is usually static, with images in .jpg, .png, or .html format. While movement can be used in a .gif file type, no personalization is possible. This type of creative can only track a single click-through link.

Alternatively, rich media content is able to incorporate multiple file and media types, such as video. It is able to track multiple click-through links at a time, with far more detailed tracking possible compared to standard media. Some ways to use personalized videos include:

- Website. As mentioned, the way banking websites are built today is not optimized for consumer search behavior. Rather than make the consumer dig through pages trying to find the right product fit, you can place different personalized videos on your product or landing pages. As part of this process, you can gather user data by gating your video. Since a marketing automation system can recognize returning customers through email addresses and cookies, the personalization can change each time the consumer visits.

- Sales Support. Banks and credit unions can find common problems and/or opportunities faced by prospects or customers. Once this information is known, organizations can create personalized videos addressing this issues. One-to-one videos can also be used for reminders, product announcements, and even highly targeted brand messages to target audiences.

- Customer Care. Personalized videos could either supplement or replace many of the chatbots already in place. Using the same data components, videos will be more engaging than most automated response options. In addition, videos are highly effective for onboarding new customers. What better way to make a new customer feel welcome and to help them navigate what they should do next along the customer journey? These real-time communications can also be used for new product introductions, payment reminders, and even holiday or birthday wishes.

- Enhancing Impact of Email or Texts. Personalized videos an integral part of email and real-time text message campaigns in the future. By providing a link within other communications to personalized videos, engagement and conversion rates will increase. Financial institutions have used this strategy for supplementing e-invites to events, for special promotions and for limited time offers or opportunities.

Ride the Wave of Rich Digital Content Success

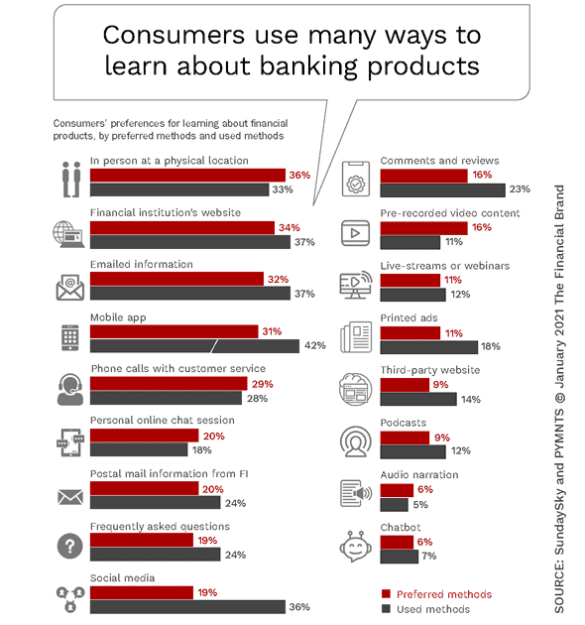

Digital channels are being used by consumers as a viable alternative to in-person interactions for accessing information about financial services. These channels have become more important since the onset of the pandemic. According to the research by PYMNTS and SundaySky, 42% of respondents report using mobile apps as their main tool for financial education and 36% report using social media.

The research also found that organizations that use digital tools that replicate the personalization of real-life interactions will increase their brand appeal and sales results. According to the research, “Consumers like digital alternatives that give them personal experiences and allow them to engage with real employees who can help them with complicated questions. Consumers’ increasing use of options, such as mobile apps, social media and personally relevant video, means that financial institutions will have to continue to offer these digital capabilities to enhance their brand stickiness even after the pandemic ends.”