Walmart has announced a strategic partnership with leading fintech investment firm Ribbit Capital. The goal of the joint effort is to create a new fintech startup designed to develop and offer modern, innovative and affordable financial solutions.

This is part of a broader trend. I believe in the near future we will see more acquisitions of fintechs, or joint ventures, by major financial services and retail players. Many fintechs have the ability and nimbleness to create new capabilities faster than the giant corporations can.

Walmart offers a huge staff and customer base plus massive retail delivery channel in its stores. Ribbit offers fintech expertise to deliver tech-driven financial experiences tailored to Walmart’s customers and associates.

Walmart has long sought a foothold in financial services, but regulations have limited those efforts, as have some implementation challenges. For Walmart to build a truly integrated financial services offering, the retailer will eventually want to acquire a bank charter, and that has proven to be a challenge. Without a charter, Walmart has had to limit the scope of its financial services to the basics: check cashing, money transfers, bill payments and prepaid debit cards. These consumer services have been delivered in partnership with authorized service providers.

But there’s another gambit Walmart has tried, which comes to the fore with the news about the fintech. It brings up the question, will the Walmart-Ribbit fintech become a ubiquitous presence in every Walmart community?

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Roots of Walmart’s Bank Branch Network

To work around regulatory restrictions, exploit its network, and to monetize storefront space that isn’t as useful for retail purposes, Walmart began leasing space in many stores to retail banks. In 1996, Walmart partnered with Woodforest Bank, based in Texas, to operate branches in Walmart locations. Over the years that partnership expanded, and today Walmart hosts over 700 bank branches — three quarters of them run by Woodforest.

Now, Woodforest isn’t the only bank player with branches in Walmart. They are just the one with the most Walmart locations. In total 58 banks operate branches within a Walmart store. As recently as late 2020, Walmart continues to expand this banking partnership program.

All this activity makes one wonder how successful these efforts has been. Let’s look at the facts.

Read More: Walmart’s Fintech Deal Threatens a Much Deeper Banking Incursion

The In-Store Branch Movement and How Walmart Branches Rank

FDIC reports branch deposits for banks once annually, as of mid-year. Credit unions have no comparable, publicly available data so we’ll just use the bank data for the last two years.

In-store branches are notorious poor performers in gathering deposits, due to their limited size and lack of privacy. I’ve studied them in great detail over the years and found that much of the promise once hoped for just didn’t pan out. They perform poorly as loan generators, for example. They tend to be more convenient transaction centers for shoppers than sources of major business for institutions. Because they aren’t strong producers, the number of bank in-store branches has declined by 60% from their peak numbers.

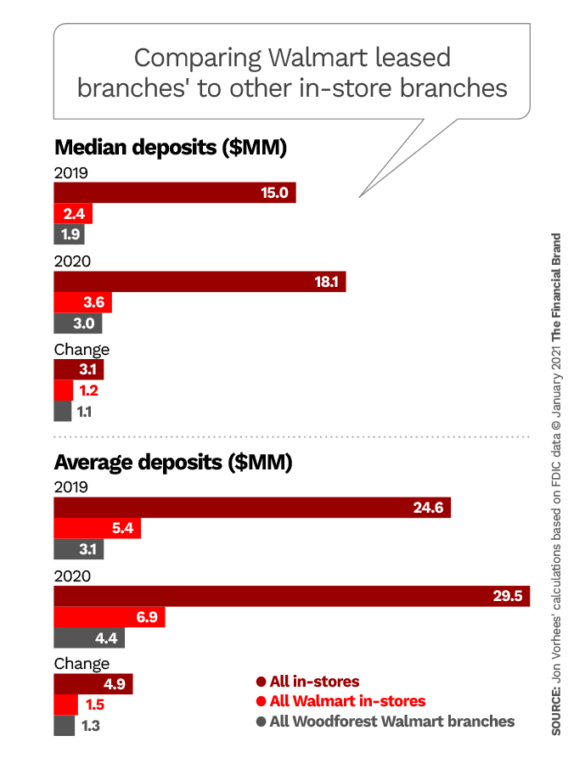

For all bank in-store branches, the median branch deposit level is a paltry $18 million, and the average comes in at just under $30 million. Those numbers are about one-third of levels reach by traditional branches. Even when you take into account the reduced expense levels due to their limited size the median deposit level doesn’t support profitability. (And don’t forget, the host stores charge for the privilege of being there, offsetting their own costs.)

The average deposit level of $29.5 million translates into about $800,000-900,000 in annual revenue, given current spreads. That level provides limited profitability at best. Because the sites are smaller (approximately 500-750 square feet), so occupancy expense is lower. On the other hand, staff expenses reflect that these locations operate between 70-80 hours per week, versus the typical traditional branch week of 45 hours.

Not a very appealing picture, and looking just at Walmart in-store branches, the story gets worse.

Examining all Walmart locations, they have a median deposit level of only $3.6 million and an average of $6.9 million, or around a quarter of the total in-store branch levels. Certainly, at that deposit level most of these sites are unprofitable.

I am sure Walmart loves them for bringing some traffic into the stores, and for the lease payments from the various banks for relatively dead retail space.

Now let’s dig even deeper into just the Woodforest Walmart branches. Actually, the situation is still worse, on the surface, with median deposit bases of only $3 million and average levels of $4.4 million. From looking at Woodforest P&L statements it’s clear to me that they rely on very high non-interest income levels (2X net interest income levels) to turn a profit, so perhaps those branches reach breakeven through such fee-based services. For most banks, non-interest income is about only 25%-33% of net interest income.

Walmart-Ribbit Fintech’s Home May Be A Virtual One

Walmart’s customer base is middle-class, so many of those people are likely already banked at traditional branches and competitors. I can only imagine that the in-store branches appeal to a smaller sub-segment of the retailer’s base that may not have accounts elsewhere.

Consider this: The deal with Ribbit reflects Walmart’s desire to engage more deeply into financial services, rather than being solely a distribution partner. Walmart has relationships with millions of customers and associates, so obviously the combination of its retail operation and financial services presents huge potential. Walmart has the physical footprint to reach people.

Yet, Walmart has had hits and misses in previous attempts in this space. The current hosted branches underperform even the other poor-performing supermarket branches and that’s saying a lot.

On the other hand, Walmart has poured huge amounts of time and capital into developing its ecommerce muscles, attempting to rival Amazon in its drive.

All of which gives these points to ponder:

- If Walmart is successful at getting a bank charter directly — the future of fintechs and fintech charters remains to be seen, with a new administration now in place — would it leave its current leasing program in place? Or would the retailer exit the current leasing arrangements with other banks in favor of offices for its fintech partnership?

- Should Walmart take that second option, and open their own in-house bank brand at these sites, what would they do to change performance levels and improve profitability? In other words, how would Walmart outbank the banks that have already tried this?

- Would Walmart open more traditional branches in select communities and use the big Walmart stores as satellite transactional centers?

In financial services, every locational decision is important, as it represents a long-term commitment, both financially and to your staff and the local community. As the Walmart-Ribbit story plays out in the future, make sure that any response your institution makes to the partnership’s moves is the result of data-driven informed decisions.