Why should someone choose your financial institution? And would everyone at your bank or credit union answer this question the same way?

Consumers actually see less and less differentiation among retail banking providers — yet it is more important than ever.

Annual checking shopper research by Novantas among those who have switched banks or are considering doing so has documented their perception of a “sea of sameness” in U.S. retail banking. Many institutions that need to stand out cluster together. The ongoing research also confirms that those few financial institutions that are achieving distinctiveness are being rewarded with significantly larger market share.

The concept of differentiation isn’t rocket science — most banking organizations understand the importance of a strategy that brings something to the market that is different, better or of greater value. Underlying such a strategy must be decisions on who to target, the unmet needs of that target group, and where the gaps are in competitive offerings. Dealing with these important factors leads to the points of distinctiveness an institution aspires to.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

So What’s Not Going Right In Retail Banking?

In retail banking, the first hurdle is to convince consumers to even consider a bank or credit union by providing assurance that it offers “table stakes” capabilities that consumers require. These aspects are not differentiators, but they need to be established in consumers’ minds before an institution is even in the running.

Research over many years has pointed out that the key table stakes capability in retail banking is convenience. Up until the last few years, perceived convenience in retail banking has been predominantly based on physical channel availability and achieving it was straightforward for retail banking institutions. The bad news was that the preeminence of physical convenience made it hard to dislodge a customer from their current bank. Often the key way to pry prospects away from current providers was to buy them with cash offers or wait until dissatisfaction sent them searching for a new institution.

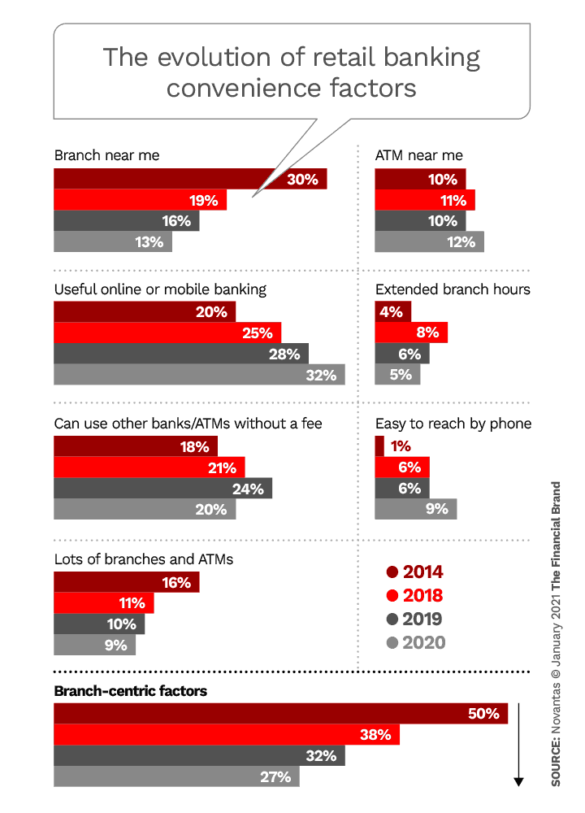

More recently, as shown in the chart below, due in great part to COVID-19 concerns, the elements of perceived convenience have been changing, with branch-related factors declining in importance and digital capabilities moving higher.

Establishing perceived convenience based on digital requires all the digital capabilities are actually built and available, of course. But it then requires that message to be taken to the marketplace with sufficient marketing voice. New digital-first neobank entrants are rapidly growing and point to the importance of establishing a banking brand’s digital capability.

Unlike branches, which consumers could easily see in-market, digital capabilities are not self-evident, and this has led to growing importance of Marketing. Its task is to not only communicate the table stakes availability to get consideration, but to establish a layer of meaningful differentiation to drive business. Investing heavily in brand marketing that establishes distinctiveness is still new, but the chart above bolsters the argument that it will work.

Read More:

- Differentiate or Die: Financial Institutions Must Rethink Brand Mission

- Why Financial Institutions Must Overhaul Their Retail Banking Strategies

Setting Your Retail Banking Institution Apart from the Pack

Many banks and credit unions now working to apply five building blocks that create brands that achieve differentiation. A drawback is that these building blocks go beyond what CMOs can do on their own. Those banks making progress on differentiation have aligned around:

1. Making hard choices about who to target. Only the very largest national banks can try to be all things to all people. For all other retail banking institutions, focus is required on precisely who to win over. Abundant consumer profiling data now allows refinement of targeting, going beyond demographics and behavior, into attitudinal, lifestyle and personality characteristics.

Examples of focused targeting in retail financial services:

• USAA: USAA’s targeting of the military affinity group allows the company to come across with deep empathy to their unique needs and provides insights to tailor products and experiences. USAA’s testimonial ad messaging calls out specific examples of how understanding veterans beats “all things to all people” banking.

• Chime: “Banking That Has Your Back”. Chime was founded based on insight that there is a large addressable market in the U.S. that is not well served by traditional retail banks. This target is younger, mobile-oriented, anxious about finances, against fees and looking to simplify their life. Chime’s proposition is to be clients’ main bank with simplicity and sensitivity by removing as much friction as possible for day-to-day finances.

2. Choosing brand positioning that is different from competition by addressing the target market’s needs which are not adequately met.

Such needs are not limited to product functionality. They can even be emotional in nature. Examples of distinctive brand positioning that successfully created emotional connection :

• Huntington Bancshares. “Do the right thing.” Coming out of the Great Recession consumers were particularly incensed with bank policies that were judged to be arbitrary and unfair. Huntington adopted a positioning to be “un-bank like” and empathetic to consumers’ distaste for bank-centered policies. Huntington’s “Fair Play Banking” modified policies to give customers the benefit of the doubt. For example, its “24 hour grace” policy, gives those who overdraw their checking account until the next business day to make a deposit and avoid overdraft fees. Huntington has been among the highest performing banks ever since.

3. Providing consumers with tangible reasons to believe the brand positioning messaging with real proof points that are impressive.

Advertising slogans and creative messaging are insufficient and self-defeating if the actual experience does not live up to expectations created.

Historical examples of using bold non product proof points:

• TD Bank. – “America’s Most Convenient Bank” began as Commerce Bank in the Northeast markets. (TD acquired Commerce in 2008 and continued to build a network of branches closer together than ever before, and further expanded its branch hours to be open early, late every day and on Saturdays and even Sundays in some locations.) They rebuilt bank operations to accommodate consumers’ preferred hours of operation and established strong convenience differentiation in the marketplace.

• Capital One cafés . “Banking Reimagined.” With a positioning intended to turn traditional banking on its head, so you can “Manage Your Money Differently,” the retail experience needed to be a dramatic manifestation of that aspiration. Thus, the café format and accompanying services were born. Branch employees are “Ambassadors” and free “Money Coaching” is provided. With free wi-fi, and a place to lounge with a cup of coffee provided, the retail experience is fully aligned with positioning.

4. Aligning the entire organization and every function to do its part to deliver on the promise.

Everyone in the company needs to answer the question, “Why should someone choose our bank?” in the same way and understand their part in making the answer true. This requires much more than the typical issuance of branding guidelines. Rather, it demands a consistent filter to the decisions every institutional function makes so that the marketplace ultimately sees consistency in product functionality, customer experiences, policies and pricing, people skills and protocols, marketing messaging, content and advice.

5. Legitimizing the value of Marketing by analyzing its impact and being accountable.

Marketing investment is the means to break through the sea of sameness, establish perception of meeting tables stakes, and set clear and relevant positioning differentiation. Marketing needs to accept accountability to demonstrate the effectiveness and efficiency of its efforts. Marketing mix modeling and attribution analytics have now joined brand tracking research to get at how Marketing is performing and enabling optimization of marketing ROI. In banks and credit unions that have embraced this accountability, Marketing is making solid business cases for resources with CFOs and leadership.

Read More: Tectonic Shifts in Consumers’ Life Views Financial Marketers Must Grasp

Taking a Deeper Look at Making Differentiation Work

Many financial institution CMOs have been pushing their organizations and making progress on these building blocks. A case study is in progress can be seen at Bank of the West, the San Francisco-based subsidiary of BNP Paribas. The bank has more than 500 branches and offices in Midwest and Western markets, competing against the largest national banks in many of those markets.

Ben Stuart joined the bank about three years ago as CMO and has now added Head of Growth and Transformation to his responsibilities. In a recent discussion, he spoke of how he initially faced the realism that a regional bank like Bank of the West (BOTW) would never be able to offer the branch scale nor allocate the marketing budgets of their larger competitors.

Stuart knew that if he could not pinpoint a truly differentiating position, he would be left with little to spur growth. During a strategic exploration of alternatives, it became clear that the sustainability position of global parent BNP Paribas had strong potential in the U.S.

“Quantitative research was overwhelming that this is what could separate us,” he recalls. Building internal support for such a non-traditional positioning required “convincing research data on the front end and data supporting its success on the back end.” With sustainability being a polarizing topic, there were always going to be detractors.

“Regardless of whether it is the right thing to do you have a group who it will not work for,” according to Stuart. Staking out true differentiation is going to be, by nature, controversial.

For a regional bank to execute a non-traditional positioning, breakthrough marketing and compelling proof points are required. The first prerequisite for consideration among prospects was to get marketplace credit for table stakes digital features, so advertising investment was allocated to reassure the market that BOTW offered an easy-to-use mobile banking app.

Simultaneously Stuart and his team developed a creative platform and executions that would allow them to build awareness and understanding of the sustainability positioning. With limited marketing budget they needed outstanding creative that would punch above their marketing budget. Creative testing was used to confirm their ads were performing at double the category benchmarks. Brand tracking research is being monitored to confirm that purchase rate is higher among those who are aware of BOTW advertising versus those who are not. Stuart reports that results are encouraging.

In terms of proof points, one powerful example has been the introduction of a checking account specifically designed to support the sustainability strategy. Offering “The first checking account to give back to the planet,” BOTW contributes 1% of the checking account’s net revenue to 1% For the Planet. A carbon calculator is incorporated into the BOTW mobile app to show the CO2 impact of debit card purchases.

The 1% checking account now accounts for 25% of new checking account openings. But more importantly, according to Stuart, is its billboard effect as a bold manifestation of the banks’ strategy.

“But product is not the holy grail,” observes Stuart. There is bankwide alignment around the sustainability strategy. Lending policies are a strong example. The bank recently announced they would not finance arctic wildlife refuge projects. BOTW does not loan to the tobacco industry.

Experiential marketing is also being deployed to demonstrate bank strategy. An example is an interactive exhibit, deployed across Western cities, demonstrating technology that harvests energy from pedestrian footsteps. Stuart emphasized that partnerships and influencers are important extensions of marketing, contribute to awareness, and prove commitment.

The final observation about Bank of the West’s experience in building differentiation is Stuart’s acknowledgment that sustainability is not likely to stay distinctive for long. With many corporations launching initiatives in the green arena, BOTW will need to evolve how it stands out. Stuart spoke of a three-to-five-year time horizon on distinctive positioning given competitive actions and all the consumer and societal change that is inevitable.

Once established, distinctiveness has a half-life that must be anticipated.