Payments are the lifeblood for banks and credit unions. Yet this vital source of revenue, data and customer engagement increasingly stands at risk.

Even though financial institutions responded quickly to the unprecedented demands of COVID-19, ramping up digital banking capabilities including contactless payments faster than anyone imagined, the pandemic slashed payment revenues due to sharply curtailed economic activity. Simultaneously, COVID accelerated trends already happening in payments leading to new competitors, new consumer needs and expectations, and a faster pace of digitization than anyone could have predicted.

“No part of the payments ecosystem will escape the effects of the pandemic,” Accenture asserts. The consulting firm predicts that a total of 2.7 trillion transactions worth $48 trillion will shift from cash to cards, interbank payments and alternative payment instruments such as person-to-person (P2P) and point-of-sale finance (buy now, pay later). This represents a $300 billion opportunity for payment providers. However, Accenture states that banks are scrambling to respond as the scale of disruption and tempo of change have grown dramatically.

All is not gloom and doom, however. Incumbents still have significant advantages of scale and trust, particularly since the risk of fraud has jumped sharply in an increasingly digital payment environment. But the need to modernize legacy payments infrastructure has never been more important for traditional institutions. “Reimagining the post-COVID world in payments could offer new opportunities to reignite performance,” observes Zachary Aron, U.S. Banking & Capital Markets Payments Leader for Deloitte Consulting.

In the seven trends below, the scope of the challenge is presented, along with advice in how to meet it in the year ahead, including a further-out development that could be transformational for payments at many levels.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Trend 1: Digitization, E-Commerce and Changed Payment Habits

Spurred by the pandemic, consumers shifted their buying habits from in-person to e-commerce channels — not totally of course, but significantly. Black Friday shopping numbers, for example, showed in-store traffic down by half from 2019 with online spending up 22%.

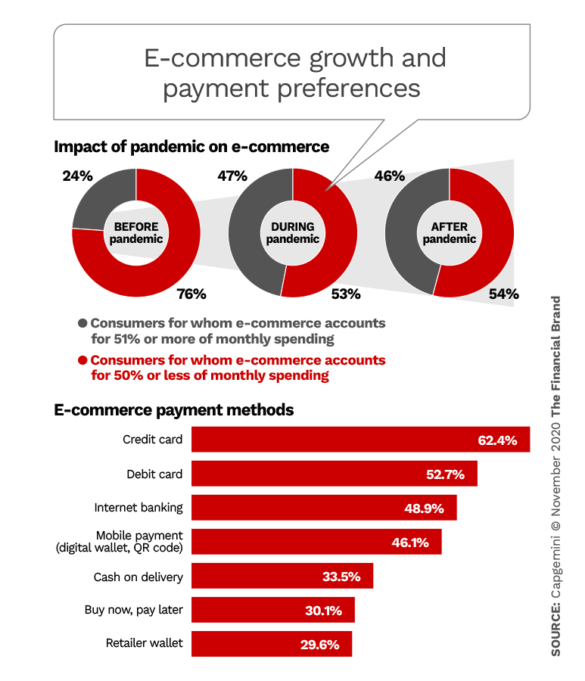

Even before the holiday spending season, the number of consumers who make half or more of their monthly purchases via e-commerce nearly doubled during the pandemic, according to Capgemini research conducted in August 2020. In addition, consumers expect the transition from retail to e-commerce will continue even after the virus has been contained.

As the chart also shows, new players are becoming more popular with 30% of consumers worldwide using a big tech for payment services and 50% already using a challenger bank for some payments.

“The longer term impacts of the use of ‘touchless payment’ solutions may be the biggest impact of COVID-19.”

— Margaret Weichert, Accenture

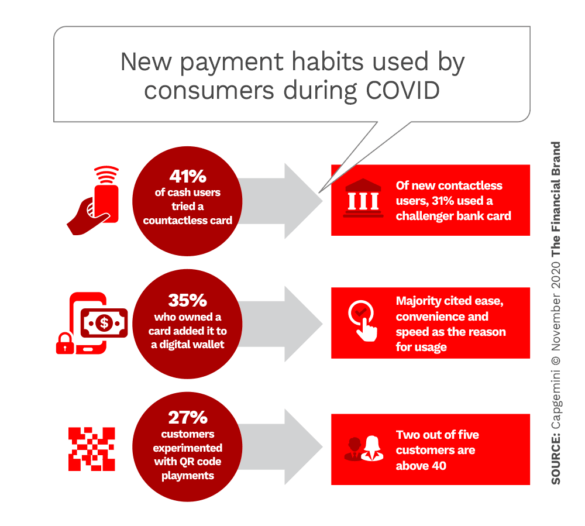

“The prevailing COVID 19 environment catalyzed a cross-generational shift toward digital channels and digital payment methods,” Capgemini states. “Even Baby Boomers (aged 56 and over) said they made payments through digital channels a lot more during the lockdown, emerging as late majority adopters.”

The firm also found that nearly two thirds (64%) of consumers said they had used contactless cards during the pandemic (distinct from digital wallets or QR code payments). 41% of consumers said they used contactless cards for the first time during the crisis.

“The longer term impacts of the use of ‘touchless payment’ solutions may be the biggest impact of COVID-19,” states Margaret Weichert, who leads Accenture’s North American Payments Practice. “In addition to contactless chip cards,” she adds, “consumers and merchants are exploring a range of new solutions, including ‘in-aisle’ checkout, QR code scan solutions and completely contactless solutions like Amazon Go stores.”

The QR code payment statistics shown in the above two charts are based on worldwide data and thus are impacted by heavy use of this form of mobile payment in the Asia-Pacific region. Interest in the U.S. is picking up, however. A survey by Mercator Advisory Group reported an 11% increase in QR payment use in the U.S. through October 2020. PayPal, Square and Uber Eats have all introduced QR code payments capability.

Cash use is moving in the opposite direction. McKinsey says it expects a drop of four to five percentage points by the end of 2020 in the share of global payment transactions conducted in cash, which stood at 69% at yearend 2019. “This is equivalent to four to five times the annual decrease in cash usage observed over the last few years,” the firm states in a payments report. In the U.S., cash usage as a percentage of total transactions fell from 51% in 2010 to an estimated 28% at year-end 2020, according to McKinsey.

Read More: Four Trends That Will Finally Make Cashless a Reality

Trend 2: Incumbents Face Big Payment Revenue Squeeze

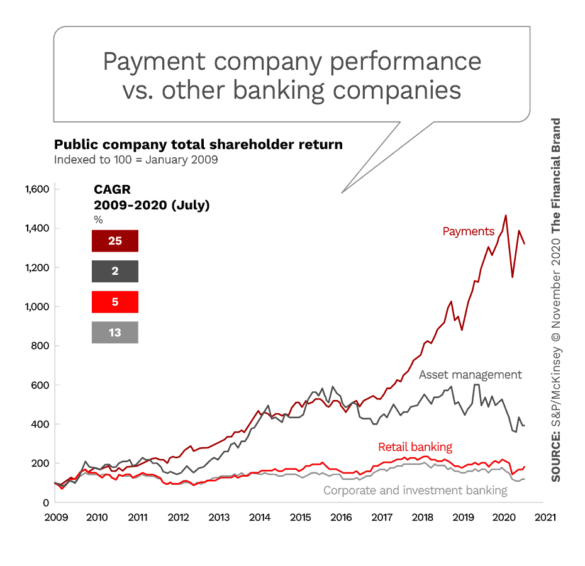

Payments attracts many players because it can be a lucrative business. McKinsey plotted total shareholder returns for four industry segments involved in payments worldwide.

Unfortunately for traditional financial institutions — historically the main providers of payments services — the rising returns shown above do not extend to most of them, McKinsey observes. That’s because traditional payment revenue sources have been hammered by low interest rates, higher credit-card losses and pressure on interchange and other payments fees due to regulation and competition. The firm does not see a near-term improvement in this picture.

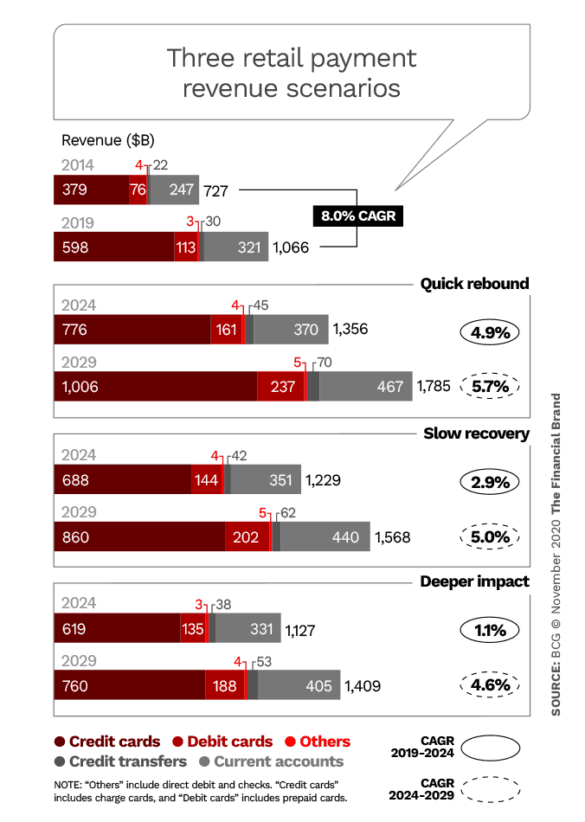

Looking further ahead, Boston Consulting Group (BCG) analysts projected retail payment revenue growth under three post-COVID scenarios. Globally, retail payments revenues would continue to grow, albeit well below the 8% rate of the 2014-19 period.

The projected revenue growth figures for North America specifically are little lower than the worldwide figures in the chart: “Quick rebound” 2.0%; “Slow recovery” 0.9%; “Deeper impact” -0.2%.

All this points to a quandary for bank and credit unions in the payments business. The “cost of ownership” of payments services, as McKinsey puts it, will remain high, leaving little to invest in new products to improve customer experience. Yet the need to do so is growing.

Trend 3: Disruption Accelerates – Credit Cards at Risk from ‘BNPL’

The payments business has been “disrupting” long before the term became a buzzword in the fintech era. But even though many of the earlier disruptions turned out to be more like evolutions than revolutions (like the disappearing checks that didn’t, or the glacial uptake, until recently, of mobile wallets), all the sources tapped for this article agreed that payments disruption has picked up dramatically in 2020 and will continue.

The U.S. is one of the countries most susceptible to this transformation, according to Accenture. The firm even created a “Payments Disruptibility Index” in a new report. It points to credit cards as the payments segment with the highest susceptibility to disruption. The primary cause: Point-of-sale lending, also known as “buy now pay later” (BNPL).

These solutions, pioneered by fintechs such as Affirm, Klarna and Afterpay, enable consumers to select a credit card or installment plan either at the time of purchase or in some cases, such as with Chase’s My Chase Plan, after the purchase. These plans typically charge only a flat fee. Accenture says that POS lending has already achieved 15% market penetration in the U.S.

Debit cards not immune from disruption. On the one hand, debit cards have benefitted from consumers’ decreased use of credit, in an effort to stay out of debt during the recession. On the other hand, they are becoming increasingly vulnerable to disruption from person-to-person (P2P) transactions which have grown rapidly during the pandemic and are being used more often to pay for services previously paid for by card. “Peer-to-peer schemes have seen growing adoption and more diverse uses,” notes BCG. “App downloads for Square, Zelle, Venmo, and PayPal all rose by more than 50% in April and May 2020, compared with the year before,” the firm states.

Trend 4: B2B Payments in Fintechs’ Sights

While corporate payments and trade finance have seen much less disruption so far, due to the complexity of these transactions, fintech entry into the small and mid-size business (SMB) payment market is now in full swing. Fintechs, after all, thrive on reducing complexity and small businesses need all the help they can get.

“New-wave fintechs are eager to take on more B2B functions,” says Capgemini. “First-generation fintechs disrupted the front-end of the retail payments value chain and assertively stepped into cross-border payments, invoice discounting, and SMB financing. Now, they are targeting pivotal B2B middle- and back-office functions.” The consulting firm mentions several: Dutch company Adyen, U.S. based Stripe, the U.K.’s Rapyd and Iwoca among them. Not to mention U.S. powerhouse Square, rapidly expanding its scope as indicated by its QR code announcement mentioned above.

Read More: Why Real-Time Payments Are Quickly Becoming Table Stakes

Trend 5: Big Techs on the Prowl in Payments

“Google and Facebook have made not secret that they see payments as a means to gain a foothold into growing markets,” Capgemini observes. While some of their most advanced efforts to date have been targeted at overseas markets (Facebook’s WhatsApp Pay launch in India, for example) activity in the U.S. is also moving forward rapidly.

“Payments are a gateway for big tech firms to encroach further into the financial services landscape.”

— Capgemini

Google updated and expanded its Google Pay digital wallet in the fall of 2020. In addition, the wallet incorporates the company’s new Google Plex checking and savings product offered in conjunction with a growing list of banks and credit unions, with Citibank topping the list.

“Payments are a gateway for big tech firms to encroach further into the financial services landscape,” Capgemini maintains. “Their strategy has been one-stop-shop super/lifestyle apps, around which they have strengthened their ecosystems to get into the larger FS space — wealth management, insurance, lending, SME services, checking accounts.”

Trend 6: Further Ahead – Digital Currencies and DLT Will Reshape Payments

It may be several years before digital currency ecosystems reach critical mass, according to BCG, but much is already happening with several central banks planning to introduce their own digital coins and tokens. Then, too, Facebook is moving forward with its digital currency Libra, planning to launch a dollar-backed digital Libra coin in the U.S. and several other markets, along with its Novi digital wallet, as early as January 2021, according to the Financial Times.

Already several banks have introduced stablecoins (digital currencies pegged to a stable asset, like the dollar) for business payment use — notably New York’s Signature Bank, along with JPMorgan Chase. As BCG sums up, once digital currency ecosystems reach critical mass, “the first-mover advantage will be hard for others to overcome.” The firm urges bank leaders to analyze the potential implications and begin actively exploring what role they want to play and what partnerships they will need to strike.

Trend 7: Modernization, Collaboration and Other Ways Forward

More than four out of five (88%) banking executives in the U.S. and Canada surveyed by Accenture agree that transforming the payments business is a key element of their broader digital transformation efforts. In fact, many have invested in multi-year payments modernization programs. The problem is that most of these investments are not driven by customer needs, but by compliance or governmental factors, which results in a poor ROI, according to Accenture.

Also, many of the investments are for individual payment solutions versus a coordinated overall plan, the firm notes. Some solutions, such as switching to cloud providers, bring benefits, but more is needed to compete in the kind of environment described above.

McKinsey outlines four options for how traditional institutions can rethink their payments operating model:

1. Carve-out and scale-up. A payments business operating within a bank can suffer from underinvestment and lack of scale, due to serving a small set of internal customers. In such cases, McKinsey states, financial institutions should consider whether a carve-out and scale-up of the payments business — operated as a separate P&L — may create more value for customers and other stakeholders.

That would allow the unit to service other banks or credit unions and a broader array of customers. Eventually this could even lead to a spinoff as Fifth Third Bank did with Vantiv.

2. Shared payments utilities. Consider partnering with one or more peers on certain payments functions to improve and expand on offerings to a larger customer base, such as jointly developing a real-time payments solution. McKinsey says this approach is best suited for institutions looking to compete based on service rather than those seeking to be a “payments leader.”

3. Payments-as-a-service. PaaS technology providers, using cloud-based platforms, allow banks and credit unions to expand quickly and modernize their payments capabilities without a high upfront investment. These specialized services would be integrated via application programming interfaces (APIs) that link to core banking platforms. PaaS arrangements also speed time to market for new payments products and allow existing products to be continuously updated.

4. Outsourcing. By outsourcing certain services, institutions that can’t afford to build or upgrade a full payments tech stack can still offer best-of-breed products. While there can be some loss of control over product and service quality with outsourcing, according to McKinsey, banks and credit unions do retain control over customer touchpoints, and, in many cases, transaction data.

In addition, smaller institutions have the option of outsourcing payments completely to bank technology companies.