According to the Digital Banking Report, the use of artificial intelligence (AI) by financial institutions of all sizes continues to escalate, as banks and credit unions better understand the benefits of the technology in reducing risk, improving operations and enhancing the customer experience. While most organizations recognize that they are in the early stages of development, the pandemic has accelerated this deployment.

Much of the activity around the use of data, AI and machine learning in the banking industry has traditionally revolved around risk and fraud mitigation. More recently, a growing number of organizations have recognized how firms within and outside the financial services industry have used AI to improve personalization, customer communication and engagement.

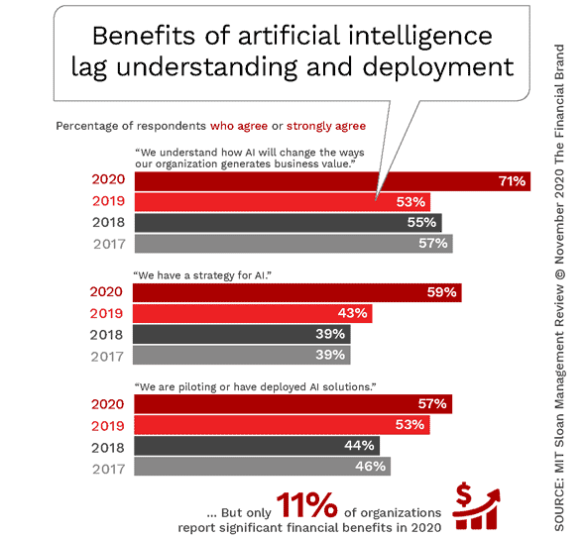

According to research by MIT Sloan Management Review and the Boston Consulting Group, the challenge of achieving data and analytics maturity has moved from understanding the power of AI to actually recognizing the financial benefits of the technology. Unfortunately, the research found that only 10% of companies that deploy AI actually realize significant financial benefits.

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand. Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment Services that scale with you. Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance. Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

Navigating Credit Card Issuing in an Uncertain Economic Environment

Fractional Marketing for Financial Brands

The Power of Localized Marketing in Financial Services

The reason for this performance gap was found to be rooted in a lack of organizational learning – the integration of humans and machines learning from each other. In other words, having quality data, the right talent and modern technology was not enough. Even embedding AI within processes or having the foundation of a strong strategy was insufficient. If the learning process between humans and machines wasn’t strong, financial results suffered.

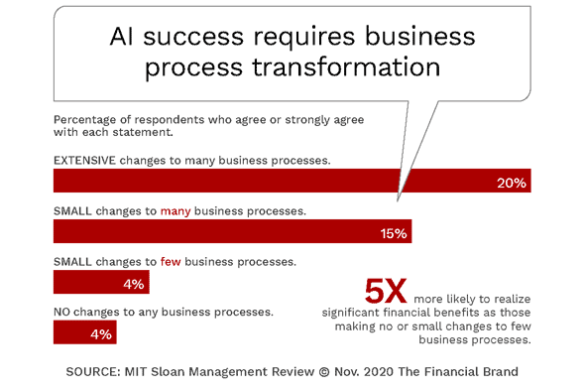

The research done for MIT Sloan Management Review found that there were three essential characteristics required to achieve financial success from AI:

- Machines and humans learning from each other.

- Creating multiple ways for machines and humans to interact.

- Willingness to extensively change processes in response to lessons learned.

The findings from this research should help financial institutions of all sizes to create the foundation for successful deployment of AI for multiple uses. The key will be to allow flexibility in the strategies and processes that underlie the internal transformation.

Read More:

- Artificial Intelligence in Banking: More Hype Than Reality

- Artificial Intelligence, Algorithms, Big Data & The Future of Banking

- How Personalization Strategies Can Backfire on Financial Marketers

Data, Advanced Analytics and Technology is Not Enough

It is clear that financial institution executives have significantly increased their understanding of the importance and power of using data and advanced analytics to respond to market opportunities, especially since the onset of COVID-19. That said, most early deployments have been focused on risk and fraud reduction and cost-cutting through automation.

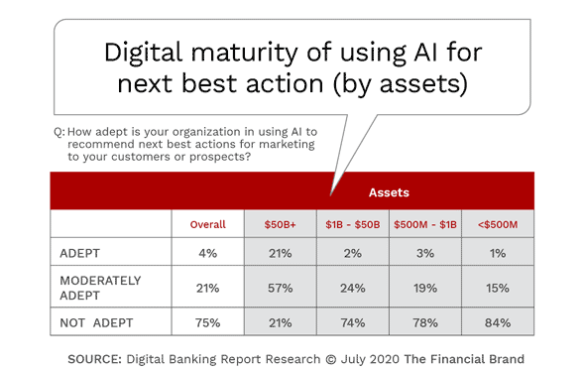

The focus on efficiency as opposed to effectiveness (at least from the perspective of the customer) is evident in research by the Digital Banking Report. A survey done after the pandemic impacted banking found that 75% of financial institutions considered themselves “not adept” at using data and analytics for the determination of “next best action” for marketing purposes.

Much of this shortfall is caused by the lack of speed to recognize and take advantage of real-time opportunities. And the origin of this shortfall is often not the result of lack of investment (even though that is a problem at many organizations) as much as it is the lack of commitment to changing internal back-office processes and overarching legacy culture that that predate digital technologies.

A new generation of technologies is changing the way data is mined and utilized, pulling data from internal and external sources to create solutions and recommendations based on real-time financial and behavioral insights. By integrating customer’s deposit and credit databases, external financial data, credit scores, social media insights and internet of things (IoT) devices, financial institutions can build customized solutions that positively impact both customer’s and prospect’s lives.

Four Stages of AI Maturity

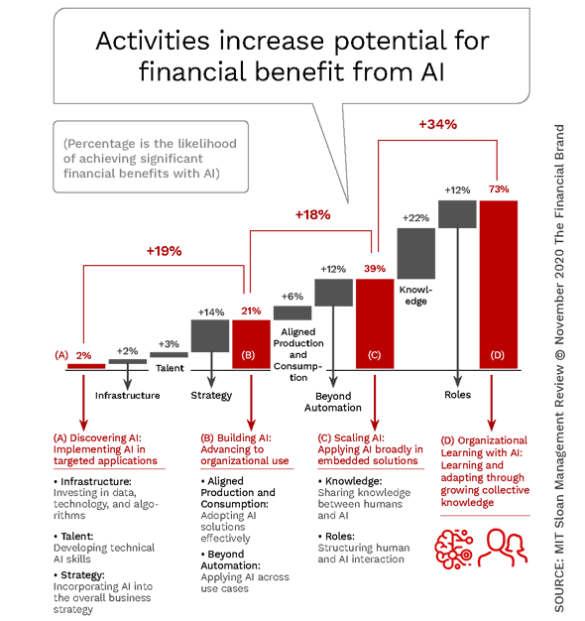

The research from MIT Sloan Management Review and BCG found that as organizations moved along the AI maturity continuum, the potential for financial benefits increased. They found that there were four primary stages of activities for achieving significant financial benefits with AI:

- Discovery. The use of AI for a specific, narrow purpose where realizing more than incremental value is limited.

- Building. Expansion of AI deployment across multiple areas of the organization, leveraging data, technology and an expanded talent pool for increased benefits.

- Scaling. This stage usually includes the embedding of AI into process and solutions, with greater training of managers on the use of AI outputs for external parties (customers).

- Learning. This stage results in doubling of financial benefits over the scaling stage because of the integration of both technology and humans to enable the near immediate response to changing circumstances.

The Learning stage of AI maturity is the most difficult to achieve because it requires top-down commitment, a culture that supports the use of data and analytics organization-wide, massive changes to internal processes and procedures that do beyond creating great internal reports and the belief that the education of legacy managers is fundamentally based on the integration of both machines and humans.

Read More:

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- 5 Cultural Shifts Needed to Achieve a True Customer Experience Mindset

- Rethinking Financial Services with Artificial Intelligence Tools

The Integration of Human and Machine Learning

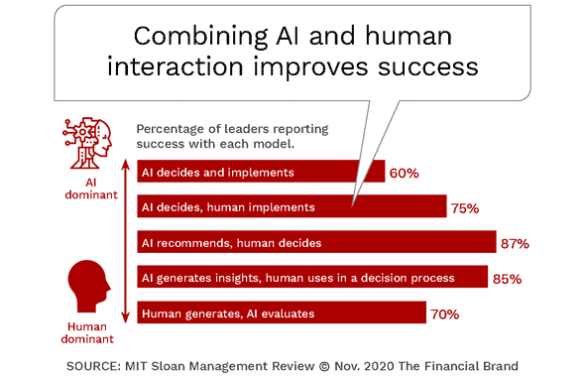

“Organizational learning with AI isn’t just machines learning autonomously. Or just humans teaching machines. Or just machines teaching humans,” states the MIT Sloan Management Review research. “Successful organizations combine multiple teaching and learning methods to take advantage of humans’ and machines’ distinctive strengths and weaknesses.”

It has been proven that enabling humans and machines to learn independently and from each other produces better results than either can achieve autonomously. This is not just a function of enhanced solution deployment, but the ability to understand the logic used by both humans and machines.

It has been found that organizations that use all five modes are six times more likely to attain measurable financial benefits than those able to use just one or two. It was also found that companies gain the most when they increase their expertise from four to five modes. But the use of one model vs. another isn’t static. Organizations need to be able to switch between the modes based on how the technologies will be used.

According to the MIT Sloan Management Review research, “Mutual learning is not just about providing specific corrective feedback in a specific situation. Rather, it is an ongoing process that improves both human and machine decision-making. Implementing this process requires multiple modes of interaction between AI and humans.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Data and AI Success Goes Beyond Simple Tasks

The use of data, advanced analytics and modern technologies is not as simple as checking off a task on a priorities list. Building an organization that can leverage AI and machine learning to achieve the greatest financial and customer experience benefits requires significant changes in processes, behaviors and organizational thinking.

It also requires increasing the level of digital talent within an organization to develop AI capabilities and to deploy the results to internal and external audiences for greater results. Change at any time is difficult, but it may actually be easier during a time of crisis like we are experiencing now with the ongoing pandemic. This is because processes in motion tend to be easier to adjust than those that are static.

A long-term perspective to change is needed that goes beyond quarterly reports but can impact the business model of the organization now and in the future. Instead of feeling threatened by the potential of being replaced, employees should view the needed change as an opportunity for future growth and survival.