Now more than ever, banks and credit unions need to reset their customer experience agenda to meet the needs of consumers who have adjusted their lives as a result of the pandemic. Not only have consumers moved in vast numbers, across all demographic segments, to digital channel use, but they expect organizations to leverage data and insights to provide better solutions that are personalized to their specific needs.

Before COVID, the use of digital products, services and engagement tools in banking was increasing at a modest rate. About half of US banking consumers used mobile apps infrequently or not at all, with satisfaction levels being lower than branch interactions. But as the pandemic shut down branches nationwide, the transition to digital happened almost overnight, with consumers going through the needed learning curve as they quickly adapted to the ‘new normal’.

But the transition to digital is not complete – either for the consumer or the financial institution. Similar to learning to drive using a car with a manual transmission, the ride has not always been smooth, and the experience for most has been sub-optimal. It is the responsibility of banks and credit unions to improve these new digital banking experiences.

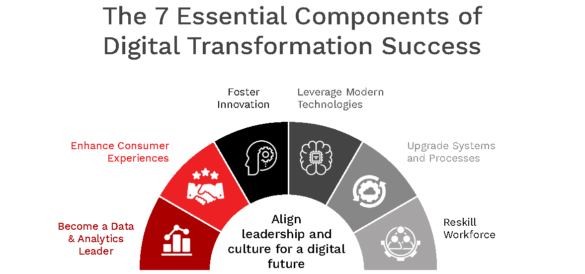

Read More: 7 Essentials of Digital Transformation Success

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Support Shift to Digital Channels

Despite the significant shift to digital transactions and interactions by consumers of all ages, many consumers still struggle with the basics of digital banking. While they most likely have become accustomed to tracking their balances on a mobile device, the comfort level most likely goes down from there. This is why the least satisfied digital banking consumers are those that use mobile banking the least … change is tough, especially when everything else in the world is changing at the same time.

Banks and credit unions must do all that is possible to improve the transition to digital channels. This includes, but is not limited to:

- Educational Tools. Provide ongoing communication to consumers about how to complete all typical digital tasks, from finding a balance, to transferring funds, to paying another person, to depositing a check. Many organizations have done an excellent job of creating easy-to-follow video guides that are segment-specific and supported by chatbots and live human support. Institutions must use all channels to promote the availability of these learning tools (including direct mail, branch personnel, texts with links, online statements and mobile banking apps).

- Simplified Processes. Consumers are already under time pressures unforeseen just a few months ago. In addition to working from home, many also need to play the role of teacher and babysitter as well during the same hours. Time is valuable, so simple and seamless digital functionality is a must. If a consumer wants to open a new account, or apply for a loan remotely, they have no patience for a 5-10 minute (or longer) process that is common. Banks and credit unions must improve the user experience by simplifying all digital processes. The use of quality internal and external data, combined with revamped processes, can position organizations well compared to the biggest banks and smallest fintech firms.

- Increased Value of Digital Engagement. The more times a consumer uses their mobile banking app, the more comfortable they will become. Therefore, the creation of easy-to-find online and mobile functionality is needed. From appointment-setting apps and budgeting tools, to local merchant discount coupons and news flashes, the objective is to have your organization’s digital app valuable for more than just financial transactions. The value proposition for consumers should include simplicity, transparency, real-time insights, and a consumer-centric perspective.

- Personalization. If there is a single revelation consumers have had during the pandemic, it is the ability for organizations across the spectrum of industries, to personalize digital engagements. From Netflix and Spotify providing highly targeted entertainment options based on previous watching or listening patterns, to Amazon, Instacart and most digital retailers providing purchase recommendations, consumers are more aware than ever of the value of their data. Consumers expect you to know them, understand them, and to provide proactive financial recommendations in real-time based on their previous and potential actions.

- Culture Shift. Employee satisfaction drives customer and member satisfaction. While most financial institutions mention ‘improving the customer experience’ at the top of corporate objectives, many fail to realize how much employees need support during this pandemic. If employees are under strain because they fear that digital alternatives will cost them their job, or because they are ‘out of the loop’ on the direction of their employer, they will be ill equipped to provide a positive experience to the consumer. We must use data, insight and ongoing communication (with training) to empower employees to better serve their clients. We also must train them for the future of banking.

Read More: Data and AI Must Play Bigger Role in Financial Marketers’ Growth Strategies

Using Data and Analytics to Drive Engagement

The banking industry has experienced rapid advancement of digital technologies and the use of data and artificial intelligence (AI) to create compelling customer experiences. Across the entire customer journey, the way financial institutions engage with consumers is being transformed.

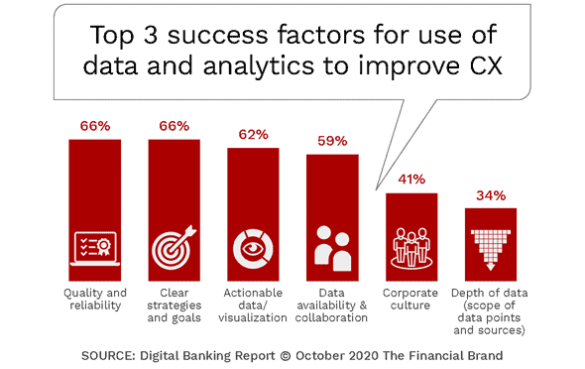

By adopting an innovative culture, supported by the use of quality and consistent data across the organization, banks and credit unions can design and deliver personalized products and services, in real-time, that can create revenues and loyalty far beyond what was possible in the past.

This stage of the digital banking transformation process is not simple, since it requires full leadership commitment, enhanced skills, total organizational buy-in, significant revisions to legacy technology and processes and an openness to partnering with external providers that can enable both flexibility and agility.

Despite an understanding by virtually all financial institutions of the importance of data and AI to drive the future of customer experiences, most banks continue to struggle to build a clear strategy for the use of data and advanced analytics. Most organizations have deployed AI technologies for the support of risk and fraud detection, but almost none have invested in using the same tools to deliver improved customer engagement at scale.

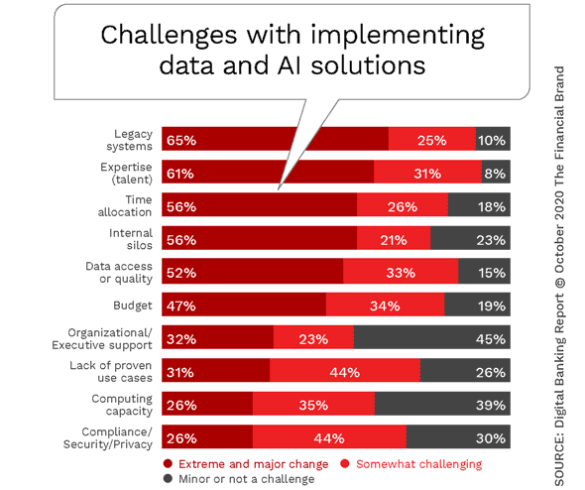

The top challenges mentioned by financial institutions globally include the presence of legacy systems, the lack of existing talent, internal silos, consistent data quality and adequate resource allocation (time and money).

With fintech firms already using advanced analytic tools and modern technologies to drive segment-based digital solutions, and big-tech firms looking to enter financial services focused on highly personalized engagement, legacy banking organizations must respond with new business models, enhanced value propositions, and differentiated customer experiences.

From Efficiency to Effectiveness

Traditionally, financial institutions have talked about improving customer experiences, but focused on using technology to reduce costs and increase efficiency. From ATMs to card-based payments to mobile banking, the rationale was made that these innovations were great for the consumer, while the reality was that each was a way to deliver the same services in a lower cost manner. In fact, the rationale for each ‘advancement’ was made on the cost savings potential to the bank or credit union.

The good news is that digital transformation can reduce the cost of supporting technologies, data storage and processing, underlying back office processes and procedures, human resources and even the loss from inefficiency and fraud loss. And, unlike many of the other technology advancements of the past, the use of data and AI can create value beyond cost cutting.

Correctly deployed, data and AI can generate revenues by personalizing products and services at-scale, and improve the ability to sell and market solutions with proactive and contextualized recommendations across multiple channels. There is also the ability to leverage the insights to support open banking solutions that extend beyond traditional financial services.

Data and advanced analytics also provides the opportunity to innovate at a pace never before imagined at traditional banking organizations. As opposed to quarterly, annual or longer updates to products and/or apps, innovation can be done at close to a real-time pace, because the underlying insights will be centralized, uniform, accurate and universally available.

The Empowered Digital Consumer

The future of digital engagement will share the insights uncovered by the financial institution with the consumer on a real-time basis. In much the same way that a concierge at a hotel, or a digital hospitality or entertainment app provides insights to consumers to allow them to make informed decisions, banks and credit unions will share the results of analytic models with consumers to empower them to manage their finances better.

This sharing of insights will be possible with every activity the consumer does on a daily basis, from traveling across the city, to making purchases, to engaging on social channels. By sharing insights and generating increased customer engagement, more accurate and timely recommendations can be made in the future … increasing the value of the overall relationship. This also increases the amount of engagement the consumer wants going forward – a win-win for the customer and the financial institution.

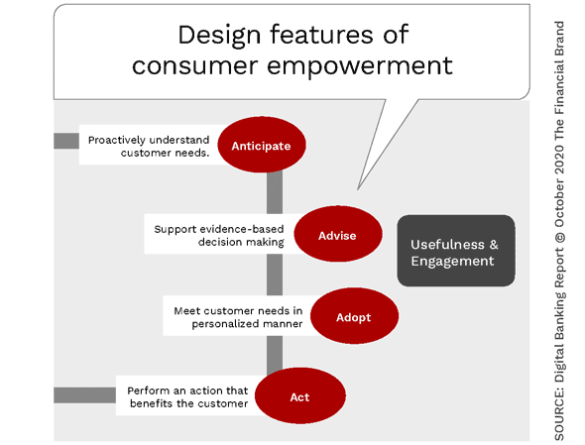

There are four key characteristics that make customer empowerment distinctive according to insights from the MIT Sloan Management Review:

- The data analytics “users” are a company’s customers, not employees.

- Product owners, as opposed to IT lead the product road map because analytics must be developed as a part of the product’s overall feature and experience portfolio.

- Economic returns result from a lift in sales, not from an internal business process improvement.

- It’s risky; unless companies deliver accurate, valued data wrapping, they could confuse, irritate, offend, or drive away the customers they serve.

Building an empowered customer capability also requires an empowerment of all customer facing employees in an organization, since the consumer wants a consistent experience across all touchpoints. Finally, there must be the ability to process large reserves of internal and external data in close to real-time.

The beauty of an empowered digital consumer in banking is that they willingly partner to make the experience better. This improvement, in turn, results in greater loyalty since the consumer would have no desire to ‘educate’ another financial institution on how to serve them better.

Success Factors for Delivering an Intelligent Experience

To deliver an intelligent digital banking experiences to customers and members, financial institutions must commit to becoming a ‘digital bank’. Far beyond being a bank or credit union with digital capabilities, financial institutions must commit to changing the back-office that is steeped in legacy technologies, processes, people and culture.

Leadership must support the changing of operating models, core technologies, the way decisions are made and how customers are served. Most importantly, organizations must take a long-term view of their business, investing in all seven components of digital transformation. This investment must include the development of quality and uniform data that is available across the organization.

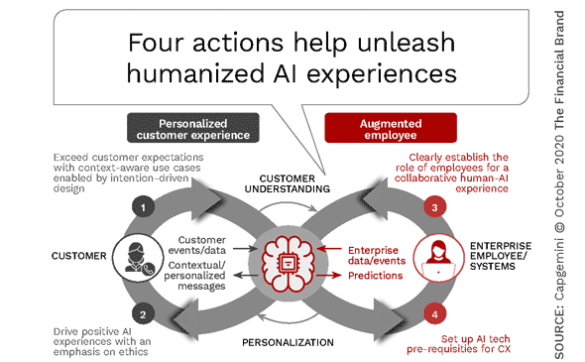

Often overlooked is the importance of humans in a digital experience. This includes more than just customer support personnel and employees in a branch. The humanizing of an intelligent digital banking experience extends to the analysis of data and the deployment of the insights to drive engagement. In most cases, technology and automation should be used to augment human judgement as opposed to fully replace it. This will create better outcomes and a more personalized experience.

Begin With the End in Mind

The second of the ‘7 Habits of Highly Effective People‘ as presented by Dr. Stephen R. Covey was to begin with the end in mind. If an organization genuinely wants to improve the customer experience, it must understand what leads to a superior experience in banking. This is not the same for all organizations, because some of what your customers want is based on what you provided to them in the past.

Is your organization defined bu the personalized service it provides, the products it offers, the trust it invokes or the way it supports the community. Do consumers want you to be an innovator or do they just want the basics. Be careful here though – because aspirational assumptions can generate a false narrative and looking only at existing customers can limit your growth potential. Don’t ignore finding out what is wanted by consumers you covet.

And, the determinations made around the desired customer experience is not a constant over time. It changes based on both internal and external factors. The COVID crisis obviously had a major impact on what consumers wanted.

To get an ongoing read on what consumers want, and how your organization is performing, requires ongoing measurement. Too often financial institutions measure satisfaction from non-digital interactions that are transaction-based as opposed to measuring satisfaction across multichannel journeys.

Without knowing your destination and measuring your progress, you’ll never know if you have reached your destination or are even traveling in the right direction.