Two key trends have been seen by banks and credit unions in digital channels during the COVID crisis. One is the rising use of digital banking by consumers, many of whom have adopted digital because they wish to avoid going to branches during the pandemic. The other is the increasing use of digital marketing by financial institutions during the crisis.

While these trends concern different uses of digital channels, there’s a point where they come together. This intersection emphasizes the importance of getting both functions right: You can’t sell to people who are unhappy with your service.

“If you don’t get the seamless and intuitive customer experience down, you won’t maintain the customer relationship long enough to do the marketing that you want to, to solve the customer’s broader portfolio needs,” explains Brianna Elsass, Managing Director and Head of U.S. Digital for BMO Financial Group.

Speaking during a recent pair of related webinars presented by Insider Intelligence, Elsass says giving consumers a clear, clean customer experience in digital channels has become imperative in the wake of COVID-19.

“You have to have an understanding of what it really is that the customer needs and not be guessing,” Elsass explains. “You don’t need a cast of thousands to find that out. If you can get good insights from 50 bankers who talk to 50 customers each, you will know what consumers need.”

So both digital product design considerations and digital marketing functions are coming into play during the continuing COVID-19 period. The first of the webinars covered digital advertising trends and the second covered the acceleration of digital adoption during the coronavirus outbreak.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

COVID Drives Increase in Financial Firms’ Digital Marketing

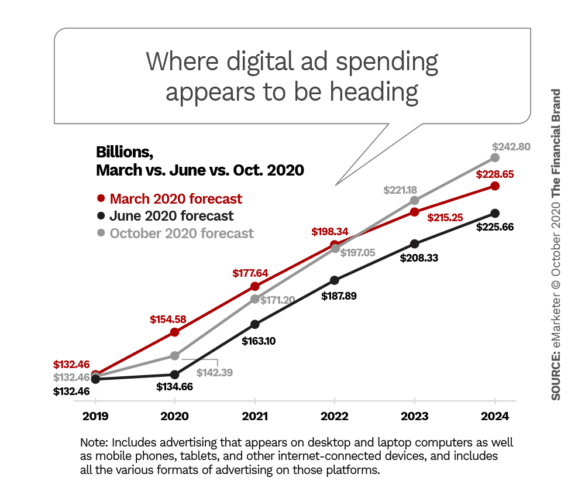

eMarketer, part of the Insider Intelligence family, makes quarterly predictions on the growth of digital marketing in its many forms. In June 2020 eMarketer analysts predicted that digital advertising spending for the year for all industries would fall almost 13% from the March 2020 forecast, made before the coronavirus hit the U.S. in force.

However, eMarketer’s Nicole Perrin, Principal Analyst, says the 2020 forecast was revised in October to reflect a falloff of only about 8%. While many industries reduced their digital presence, “ecommerce sales have significantly outperformed our expectations,” says Perrin. With this pickup, the firm anticipates that spending by 2023 will come in higher than projected in March, thus passing the level of the original pre-pandemic forecast. On the other hand, the firm projects that traditional media marketing will fall by 18% in 2020, including a 16% decline in traditional television advertising and a 22% decline in out-of-home advertising.

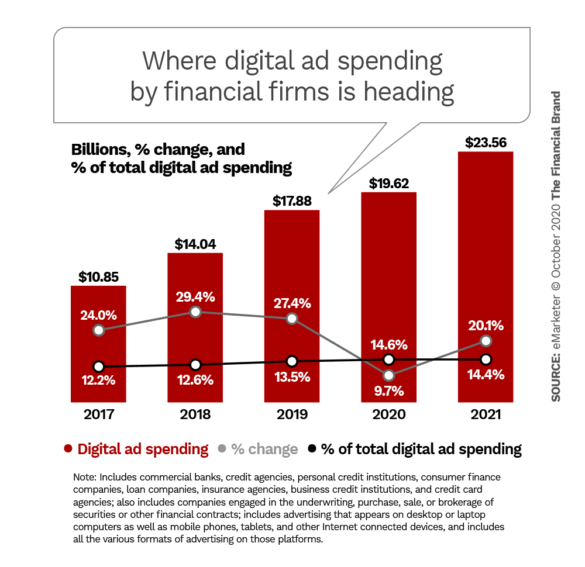

Against this backdrop, consider the trend projected for financial firms’ ad spending. eMarketer expects to see an increase of 9.7% in 2020, to be followed by an increase of just over 20% in 2021. In both years, financial firms’ digital ad spending will be approaching 15% of all industries’ digital ad spending.

“That will make them the second-largest digital advertiser among business verticals” by 2021, eclipsed only by retail, says Perrin.

This trend has occurred while several other challenges have been in play.

• Braving the “cookie-less future.” While the death of the third-party cookie has been coming for some time, Perrin says, “the clock is ticking now and we’ve got just over a year. In addition, we learned over the summer that Apple is making changes to iOS 14 that will make it more challenging to obtain identification [of consumers] for advertisers.”

• Addressing COVID challenges. The pandemic has been a time of twists and turns for all marketers. “Advertising went completely dark for a couple of weeks to allow companies to reset their messaging but they did come back,” says Perrin. “The challenge is to continue to assess what the appropriate message is across time and space.”

Perrin isn’t getting into sci-fi mode with that last remark. “You can’t ‘set it and forget it’,” she explains. “You have to pay attention to what’s going on in the world and understand if your messaging is relevant for your audiences.”

• The rise of CTV. Connected television, TV sets that connect to the internet and provide content — and advertising possibilities — beyond ordinary cable is growing.

Read More: Digital-First Banking Doesn’t Mean Chasing Every Fintech Innovation

Financial Marketers Discuss the Challenges of the COVID Age

An opportunity that COVID presents to financial institutions both in digital banking and digital marketing is the potential to stand out from the crowd. Many still haven’t grabbed it, so far, not in a marketing sense.

“There’s a lack of distinctiveness across many of the banks in the U.S.,” says webinar panelist Paul Kadin, Managing Partner at Resonance LLC and a former senior marketer at Citi and Chase. “During the early days, how many campaigns did we see that said, ‘We’re here for you’? That exacerbated the lack of differentiation.”

Bankers on the panel spoke to the challenge of treading carefully in the early days of COVID. Alissa Van Volkom, SVP and Head of Customer and Product Marketing at TD Bank, says it was felt appropriate to halt all prospecting messaging, shifting to messages expressing concern and support for customers, and explaining how they could bank digitally during shutdowns.

Brand messaging was brought back into the mix later on, and gradually “full-funnel” marketing was restored.

On the other hand, at Regions Bank, Alyssa Blair, SVP and Manager of Media Strategy, says no form of marketing was completely paused but the messaging early on shifted to talking about the bank’s digital capabilities.

A big part of financial marketers’ challenge is that little of the old do-list went away. Some elements have become even more important as COVID changes the landscape and the way marketing is accomplished. Regions’ Blair says that measurement of marketing effectiveness is becoming more complex as the demise of cookies is weighed. Both she and TD’s Van Volkom spoke of investing in additional outside expertise to make sense of new marketing strategies and advertising channels.

Brands and Trust Comes in for a Rethink

Content marketing often came to the front of institutions’ efforts, as consumers’ thirst grew for guidance on everything from banking digitally to handling bills when you’ve suddenly become jobless, according to Chris Gee, Head of Digital, U.S. Corporate Affairs and Advisory Services at Edelman. Borrowers, particularly, wanted to hear from lenders and in an “authentic way.”

Gee says it was significant that the CEO wasn’t always the face of the institutions. Sometimes lower-level managers presented institutions’ messages. “It was important to get their faces out there,” says Gee, to establish trust.

“Digital marketing became a substitute for face-to-face conversation in many cases.”

Van Volkom says an important distinction arose during the early days. While many consumers told researchers that they wanted “advice,” that had different meanings for different customer segments. Some people craved face-to-face consultation with a trusted banker, albeit under COVID restrictions; for others the need could be solved simply with spot-on, specific content addressing a financial challenge of the moment.

Digital marketing became a substitute for face-to-face conversation in many cases, she explains. The company has had some help from Google in crafting YouTube segments providing educational content.

The evolution of financial marketing got a big push from COVID — Gee went so far as to call it a “quantum leap.” Marketers stepped up or were drafted for many tasks beyond their usual ones — even communicating about testing and personal protective equipment, for example.

“They are finding that defining the company’s brand is no longer simply about its products and services,” says Gee. He says brand has become more central to companies than ever before. Edelman works extensively on measuring importance of trust in a longstanding series of surveys and a special pandemic edition found that six out of ten Americans believe brands will play a major role in the recovery — or failure to recover — of the country.

Read More: 5 Reasons Millennials Hate Your Bank’s Content Marketing

Digital Adoption Knocks It Out of the Park

In 2015, 56% of Americans banked on all digital channels and 35% banked specifically on smartphones, according to Insider Intelligence research. In 2020, those figures have risen to 73% and 55%, respectively. That means in five years digital banking usage has risen by 30% and mobile banking usage by 57%.

“Our customers need this — now.”

Clearly the shift to digital had been under way already but panelists at the second webinar agreed that the pandemic’s requirements have been an accelerant in two ways. One was the means financial institutions used to provide services remotely. The other was the way they allowed, or even encouraged, front-line staff to reach out to customers to communicate the latest developments.

Particularly interesting were the comments from panelists concerning how COVID’s exigencies caused changes at the banks themselves.

At M&T Bank, once most staffers were working remotely a major change in risk tolerance occurred, according to Mary Kate Loftus, SVP and Director of Digital. She explains that the typical bank requirements for nailing down every detail had to give way to flexibility. She says the bank’s mantra became: “Our customers need this — now.”

“The services customers needed bubbled to the top,” says Loftus.

BMO’s Elsass says management decided early on that downtime could not be tolerated under the pandemic’s circumstances and a “0% outage” rule went into place. She says that policy necessitated a constant weighing of what had to give to make that deliverable. For example, back in April the bank paused two major upgrades originally planned for 2020 because the risk of system downtime was unacceptable.

A substantial rethinking of how front-line employees communicate with customers took place at First Horizon Bank, according to Ben Hopper, SVP and Head of Retail Strategy, ATM and CRM Delivery. For example, to relieve pressure on the bank’s call center, management decided to get the word out that customers could call their own branches for information and other assistance. Bankers were encouraged to reach out to consumers to see what they needed and to provide updates. Part of the message was “Tell us what you need.”

The outreach didn’t have to only be by phone. “We empowered the bankers to communicate the way they wanted to.” While some institutions have historically kept a tight rein on social media and other nontraditional channels, Hopper advised that institutions “let them have some creative range and then let them go forth.”

“Customers trust the banker they work with regularly,” says Loftus. Enabling such contact went a long way toward making rapid digital adoption work.

Elsass says it’s important that customers not feel forced into channels, and for those who didn’t feel comfortable with the digital shift, workarounds were engineered. One such accommodation was providing emailed PDFs of applications that digital-shy consumers could print out and deliver to the bank in some other way.

“We have been allowing customers to work with us in the fashion we feel they are comfortable with,” says Elsass.

And there is a specter overshadowing all, according to Elsass. Should a major second wave of COVID come about, the industry may have to figure out even more solutions, even, conceivably, banking with no physical facilities at all.

That’s unpleasant — but not entirely unanticipated.