Much discussion has gone on in the industry about how changing customer behaviors should be driving increased branch closures.

Digital banking supporters have been beating the drums for the demise of branches ever more strongly since COVID-19 arrived. Yet in an interview with The Financial Brand, Mary Mack, the Senior Executive Vice President/CEO of Consumer & Small Business Banking at Wells Fargo and head of its branch network, said “Even in the midst of a pandemic, we have over a million customers a day coming into our branches across America.”

Can you close branches? If you have a branch network serving a market, the answer is likely yes, but you have to proceed carefully.

I’m a geographer so I studied retail distribution theory in college. I’ve also been blessed in my 40-year career to be able to continue those studies with both regional and national banks — both great laboratories for experimentation. My colleagues know I like to understand not only how things work but why they work the way they do.

In this article, I’m going to explain why certain moves make sense from a retail theory perspective — and why some could be damaging without thinking them through and potentially taking additional actions.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Branches and Groceries Are Often Right Nearby

One of the basics of retail distribution theory is that the more frequent the “purchase” (i.e. interaction), the shorter the distance your customers are willing to travel to get to the purchase site.

In other words, the closer they want the source to be. So milk and eggs can often be found at the corner convenience store as well as neighborhood grocers, relatively short distances. To buy a new refrigerator or oven, you’ll likely need to drive further. The reason car dealers tend to cluster on auto rows is that these purchases are very infrequent, so car sellers are willing to locate near competitors to get maximum exposure to potential buyers. They know that consumers are willing to drive 30+ minutes to shop in most markets.

Historically, because weekly visits to the branch were the rule, bank and credit union branches historically aligned with the grocery model. Not anymore.

The Vanishing — But Not Vanished — Branch Visit

Branch visits have been declining for many years. FMSI tracks teller traffic and shows volume has fallen 41% in the last 30 years, despite a growing population. That’s because the industry has introduced many new self-service channels to drive routine teller transactions to lower-cost channels.

Deposit-taking ATMs made it easier for customers to deposit paychecks and cash into their accounts at all hours of the day, for example. Most of these ATMs were still located “at the branch” but were either drive-up or walk-ups with 24-hour access. So, customers still made branch visits — they just didn’t go inside. The increased use of direct deposit of payroll checks, often associated with getting account fees reduced or waived, further reduced the need to visit a branch.

The introduction of online banking migrated additional routine transactions like balance inquiries, transfers and loan payments. Finally, with smartphones came mobile banking with remote check deposit capability, removing millions more transactions annually from branches.

All of these changes made banking more convenient without introducing more branches.

Research by Adobe Analytics indicates about 50%+ of consumers, including Millenials and Gen Z, still visit branches at least monthly. In fact, those two younger segments are more inclined to visit monthly than older segments. 72% of Gen Z consumers visit a branch at least once a month. That’s more than any other age group, according to this 2019 study of 1,000 consumers. And 60% of Millennials say the same.

Surprisingly, older Americans were less likely to visit physical banks monthly, with only 50% of Gen X, 55% of Boomers and 58% of Traditionalists saying they did so.

This doesn’t mean the older generations don’t go to the branch, but with direct deposit, well-established accounts and generally more comfortable financial situations, they don’t need to visit as often. Gen Z visits more often because they are the least informed about how the industry works and have the most limited resources.

The reason for these branch visits is well known. Branches are still the place where most new accounts are opened and the place customers go for face-to-face advice, especially for complex questions.

Read More: Why Universal Bankers are Now the Only Logical Option for Branches

Branch Networks Can Be Thinned … Sometimes

The less frequent the store interaction and the more valuable that interaction, the longer the distance consumers are willing to drive to conduct it. Bank and credit union customers are visiting branches less frequently because their financial institutions have reduced the need to do so by offering convenient self-service options for routine transactions. Branches, therefore, can be spaced further apart in a market, and trade areas become larger.

Retail distribution theory has proven this idea for a hundred years, and it seems to be playing out in front of our eyes in the delivery of retail financial services today. If you have had 20 branches serving a market, you are able to fully cover that market with 15-16 instead. If you have five branches you might only need four.

However, trimming networks isn’t always as easy as pruning a bush. Shrinking the network becomes more difficult when you have only one or two branches serving a town of, say, 25,000 households. If you have two — the correct level in pre-pandemic days — and want to cut back to one, the remaining single branch must be easily accessible to all of your customers in the town.

The remaining branch may not be situated in the right place for that to happen. You may need to consider building one new branch to consolidate the service areas of the two old branches. Alternatively you may need to fulfill customers’ needs in another way, by adding a new remote ATM site, with a deposit-taking machine, to serve a section of town.

Take a Hard Look at Your Market Before You Shutter an Office

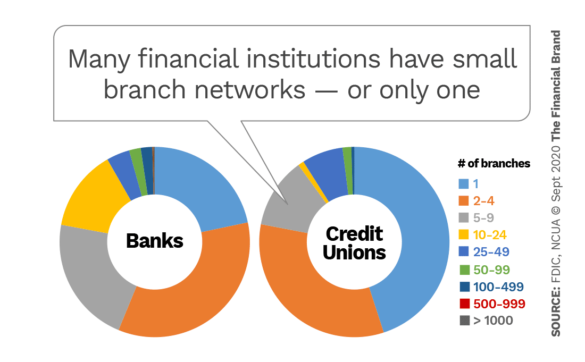

There are multiple challenges in achieving growth with a smaller branch network. First, only a small portion of the roughly 10,000 retail banks and credit unions firms today operate five or more branches.

If you operate one or two branches in a large city, it will be difficult to maintain your customer base if you close one, unless certain conditions are present.

Closing branches takes careful thought and analysis, or you risk running off customers to competitors. Here are five questions to ask:

1. Do your customers use online and mobile banking at high rates? The more comfortable they are with these options, the less likely they are to leave you as you close a branch.

2. Is the one remaining branch easily reached by all your customers in 10-15 minutes? The remaining branch still needs to be somewhat conveniently located (perhaps near a big box retail center that has a larger draw area).

3. Is the remaining branch large enough to handle the combined volume of the original two branches? You don’t want to overwhelm the remaining branch and create a bad customer experience.

4. Do your customers have access to non-branch ATMs in the market to get cash or make deposits without surcharge fees? Customers will travel greater distances to avoid fees.

5. What’s the bigger picture? Is your brand and customer loyalty strong? If your customers already have issues with your institution, your products, your pricing, or your service levels, they won’t like your closing branches. Beware of creating a “last straw” situation.

Be Honest About the Quality of Your Network

The more valuable and important the interaction is to your customers and the less frequently they need to do it, the greater the distance they are willing to travel to conduct it.

That’s the case if you have a true “branch network” in a market, and not simply a random smattering of branch sites. A real network will allow the institution to safely gain some expense savings while retaining your customers. Not only does retail distribution theory support this opportunity, so do my 40 years of doing just that.