The rapid onset of the coronavirus caused banks and credit unions all over the country to close or limit access to their branches. Many institutions implemented banking-by-appointment or drive-thru only options during that period of time.

Although closed lobbies are still the case for some branches, many others have returned to full lobby access, which often includes the use of masks, shields and social distancing practices.

Undoubtedly, these new protocols have changed the way consumers and businesses interact with their primary financial institution (PFI). Many articles have focused on the digitization of the consumer’s banking experience during the pandemic. Some studies have indicated that many of the transactions that moved to digital channels would remain there.

How consumers interact with their financial institutions certainly may have been altered for some. However, we have begun to see normalization in the data in the area of generating new banking relationships — opening new retail and business checking accounts — the gateway to primary financial institution status.

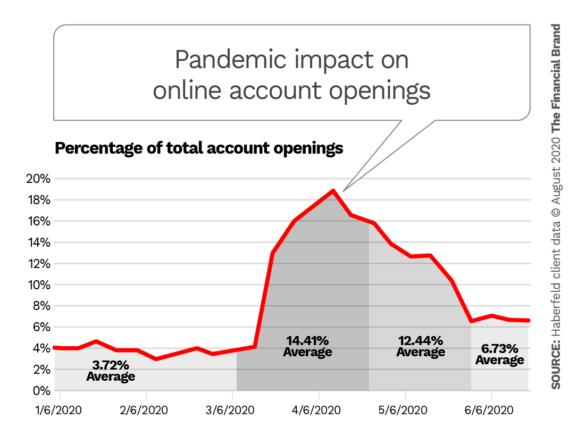

Prior to the pandemic, online checking account openings at community-based financial institutions averaged six per week, based on data from a sample of our national client base as of the end of June 2020. During the early stages of branch closures and sheltering at home in March 2020, online openings peaked at 18 per week. By June, the number had fallen to ten per week. As a percentage of total new checking accounts opened, online openings are up, but have since dropped to less than half of the April peak.

Much of the initial increase in online openings can be attributed to employees directing consumers to the financial institution’s website — often guiding them through the process while on the phone — not necessarily due to consumers actively seeking online channels. The role of employees serving consumers cannot be minimized. In June, 93% of new PFI relationships at community banks and credit unions in our study group were opened through the branch.

Seeing online openings increase, but still representing a relatively small portion of total openings, led us to explore the impact on community financial institutions’ ability to attract and serve new customers throughout the pandemic.

Based on data from up to 150 client financial institutions, we analyzed the pandemic’s impact on new core consumer and business acquisition.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

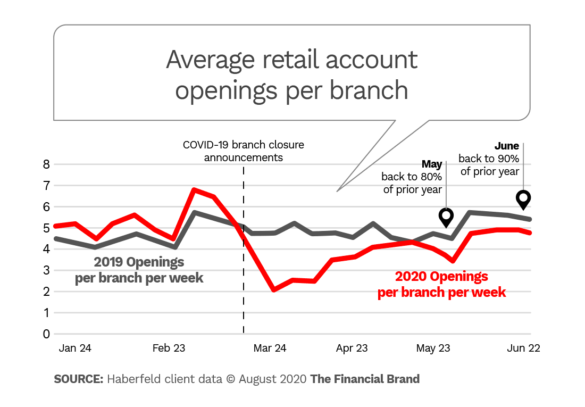

Sharp Impact on New Consumer Accounts

On the consumer side, the pandemic impact was immediate. In mid-March account openings dropped by more than 50% and stayed close to that level for three to four weeks. The recovery from those numbers began in mid-April, driven by a majority of community institutions continuing their print and digital marketing outreach and finding ways to attract and serve new customers and members at their branches.

Based on this continued marketing outreach, in many cases with community-focused messaging, the data showed a significant recovery starting in May and continuing into June. By the end of June new account openings were at 90% of the prior year’s level, even while the majority of institutions still had lobby restrictions in place.

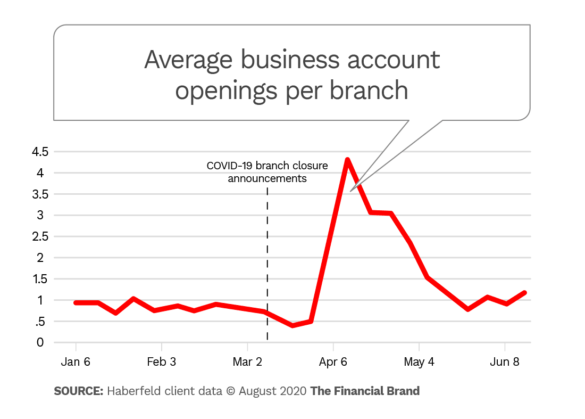

A Different Picture for New Business Accounts

Analyzing data from more than 100 financial institutions painted a significantly different picture for business checking account openings. April and May were dominated by community financial institutions serving both customer and non-customer businesses in their markets with Payroll Protection Program (PPP) loans, which often included associated deposit accounts.

For the majority of community banks and credit unions that meant an all hands-on-deck effort to serve their communities, resulting in opening four times the average number of business checking accounts in April. By the end of May, we found business checking openings had somewhat normalized based on seasonality.

The quick response, and the fact that community-based financial institutions were able to take care of their customers as well as other local businesses much better than their regional or megabank competition, positioned them well with local businesses going forward. Those who have stepped up to this challenge have used this messaging effectively in their print and digital marketing outreach as well as in communication through social media channels.

The Key: Stay Focused on Growth

As community banks and credit unions evaluate plans for moving forward, it is imperative their marketing teams are committed to staying focused on growth. Much has changed, but much has not. Having a strategic focus on growth that aligns your marketing and promotion strategies with your execution efforts (people, product, processes) is crucial.

Lessons from the past always inform the future. What we saw coming out of the Great Recession was that community-based financial institutions that stayed true to their growth strategy — that is, they continued to build recurring non-interest income, grow no- and low-cost deposits and increase relational intensity —ultimately outperformed other institutions in both return on assets and return on equity. Many even accelerated out of that recession more quickly.

The data from 12 years ago and the data from the 2020 pandemic period tell the same story. Banks and credit unions that stay focused on growth reap the greatest rewards. Now is the perfect time to make sure you have the right strategies in place to capitalize on the growth opportunities presented in any economic environment.