While the pandemic poses a financial and organizational challenge to many financial institutions and their marketing efforts, it has also created a unique backdrop for opportunity unlike any in our memory. More than ever, marketing has become essential to the recovery of the banking industry, with the power to connect consumers and businesses to solutions in ways previously only imagined.

Many studies suggest that companies that maintain or increase their marketing activities during challenging periods tend to grow faster – not only during the downturn, but beyond it – while organizations that reduce their marketing efforts tend to see revenue declines both during the crisis itself and for years thereafter.

It is clear that understanding the consumer is essential to navigating the changing landscape and to succeeding going forward. The insights will allow for improved product development, targeting, message development, channel selection and the deployment of marketing technologies.

The question is … what has changed in the way we market financial services in a post-COVID world? That was the objective of research completed by the Digital Banking Report and Deluxe entitled, The State of Financial Marketing. It will also be important to balance the short and long term, continuing to show empathy for the financial challenges faced by consumers and small businesses in the short term, while building a strong long-term vision and brand focus. Much of what financial marketers have learned in the past will serve them well, but will not be enough for what is needed going forward.

The question is … what has changed in the way we market financial services going forward? That was the objective of research completed by the Digital Banking Report and Deluxe entitled, The State of Financial Marketing.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

1. Revamped Focus on the Customer

Focusing on improving the customer experience and placing the consumer at the center of business strategies is not a new concept in banking or any industry. What is new is the ability to go far beyond simple personalization to leveraging big data, real-time behavior, ethnography, social media activity, interviews and surveys to discover actionable insights and deploy instant solutions.

Done well, internal and external data and advanced analytics can assist in product development and pricing as well as determine distribution and marketing communication mix across the customer journey. The use of artificial intelligence (AI) to augment the understanding of the customer is not required, but the collection and application of quality data from multiple customer touchpoints is.

As consumers have become more aware of what is possible in the support of strong relationships, they no longer view the delivery of a great experience as the sole responsibility of marketing. Instead, they want their data to be used to understand their needs, simplify their journey, contextualize the solutions recommended and simplify their lives.

2. Deployment of Advanced Technology

As consumers shift to digital channels for transactions and media consumption, and expect increased personalization, financial institutions will need to invest in the technologies that can deliver on the personalization promise. From improved use of mobile wallet marketing tools to use of customer journey analytics to understand changes in individual behavior over time, financial marketers must start building the infrastructure today that will deliver results tomorrow.

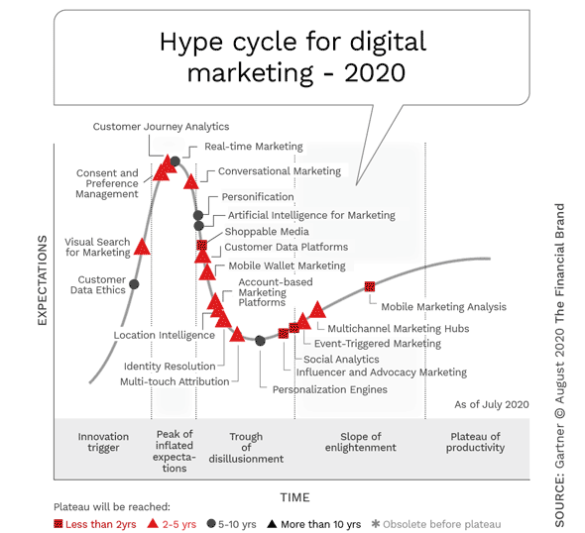

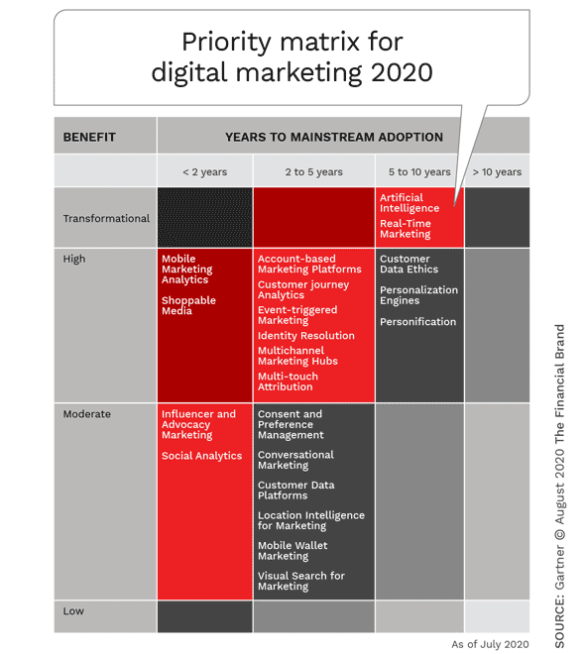

The annual Gartner Hype Cycle for Digital Marketing provides a graphic representation of the maturity and adoption of marketing technologies and applications, and how they are potentially relevant to solving business challenges. The methodology also shows how a marketing technology or application will evolve over time.

The combination of advanced analytics and AI with new marketing technologies will enable proactive solution recommendations, identity resolution, conversational marketing and the ability to deploy messaging based on location intelligence. This will make marketing both more effective and more efficient.

3. Expansion of Digital Marketing Arsenal

There is no doubt that digital marketing continues to increase in importance as a percentage of overall marketing expenditures. The effectiveness of digital channels and social media continue to overtake traditional media as does SMS and mobile channels.

New forms of digital marketing have also emerged quickly with the impact of COVID-19. The process of creating and distributing relevant content to attract and engage customers and prospects has never been more important to marketing than it is now. In addition, the trend shows no sign of abating.

Content marketing is a constantly evolving practice, impacted by technology, new distribution channels, changes in consumer behavior and an organization’s business objectives. With branches closing and consumers forced to perform banking in new ways, digital content has been essential to maintaining relationships with consumers.

With the importance of strong brand values and purpose needing to be front and center, content can play a vital role in how organizations communicate a brand. In the future, more sophisticated use of AI and machine learning will increasingly be used for content targeting, delivery and dynamic content generation, improving personalization.

Read More: CRM Adoption Takes on New Urgency at Community Institutions

4. Increased Importance of Trust

One of the most dramatic, yet somewhat less discussed, impacts of COVID-19 is the increased focus on brand values and trust. Developing a strategy that focuses on elements of trust will require an ongoing demonstration through actions rather than words.

While regulations are in place to protect consumer data and privacy, high-profile data breaches, as well as the misuse of data by brands, continue to create concerns. Transparency around the use of data continues to be a big area where trust can be broken down between a brand and consumers.

In addition, over the past several months, consumers have become increasingly wary of organizations that put profits first, are less transparent, or lack a strong social consciousness. More than ever, consumers want to work with organizations that contribute to the communities they are in.

According to eConsultancy, “To build trust, brands must demonstrate consistency and deliver on the customer experience. Brands also must be careful not to rely too much on machines, data and automation, and should instead seek to (re)connect on a more human level.”

5. Recruitment of Talent and Partners is Critical

It is becoming increasingly challenging to deploy modern marketing with legacy talent, skills and mindset. Many financial marketing organizations are still managed by individuals from the ‘Mad Men’ era, when broadcast media ruled. If organizations want to successfully deliver on the promise of the future of marketing, they will need to embrace digital channels and tools, and understand the technology that can make modern marketing effective.

While some of the people in existing marketing organizations may be ready to embrace the skills needed to succeed, most organizations will be better equipped to partner with specialty organizations that can provide the skills needed. When respondents to the State of Financial Marketing 2020 research were asked to rank their own competency with data management, over 75% considered themselves inept.

“Data and digital marketing skills are predicted to become more important over the next two years, as they relate to a brand’s survival in the increasingly competitive digital environment,” states eConsultancy. A modern marketing mindset is also required, including empathy, curiosity and adaptability.

Competition for skilled individuals is likely to remain high, particularly around the areas of data, analytics, AI, content and advanced marketing technologies. The good news is that the current period of disruption is an opportunity to snap up digital talent from the displaced recruitment pool.

Predicting the future, especially as the world continues to respond to the COVID crisis, is almost impossible. That said, research has made it clear that most financial institutions are not prepared for the marketing environment that exists today.

As a result, financial marketers should be focused on putting the foundation together to understand the customer, embrace the changes in technology that are already defined, focus on brand development and quickly build a response team that can take advantage of the opportunities ahead. Because the importance of effective marketing will only increase in the future.

Purchase The Report

The State of Financial Marketing report, sponsored by Deluxe, provides insight into the marketing strategies, priorities, channel allocation and budget shifts financial institutions are making in a post pandemic world.

The State of Financial Marketing report, sponsored by Deluxe, provides insight into the marketing strategies, priorities, channel allocation and budget shifts financial institutions are making in a post pandemic world.

The report includes the results of a survey of more than 300 financial services organizations worldwide. The report includes 112 pages of analysis and 51 charts.

Subscribers to The Digital Banking Report and those wishing to purchase the complete report can access it immediately by clicking here.