As the COVID-19 crisis has evolved, the banking industry has needed to rethink strategies around how to get work done and how to serve consumers. After years of a slow but steady digital banking transformation, the pandemic catapulted the industry into the future of work almost instantaneously.

Banks and credit unions had to adjust to a work-from-home workplace that placed a premium on the ability for employees to be flexible, collaborative and innovative. More importantly, COVID-19 highlighted the importance of new skills that integrated humans with advanced technologies.

In new research conducted from April 10 – May 10, 2020 by the Digital Banking Report and sponsored by OpenText, it was found that the adaptability of the workforce to remote work created new opportunities for knowledge-sharing across departments and functions. It also revealed talent gaps, where existing roles may be threatened and new training will be required. Finally, the research revealed that technology will most likely not replace humans, but will augment their ability to reduce costs, create customer value and improve job satisfaction.

The research that included responses from close to 300 financial services industry executives found that:

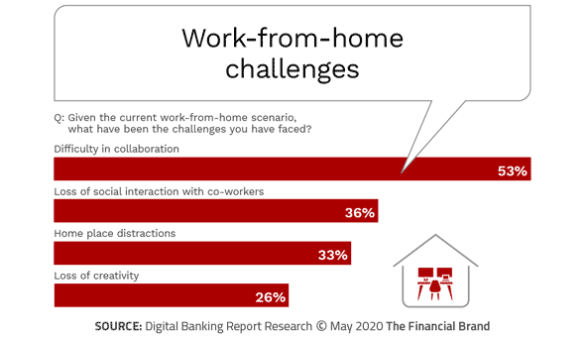

- While there were work-from-home challenges initially, many of these challenges have diminished from April till May.

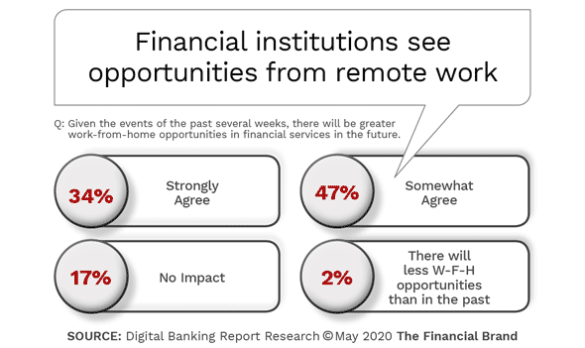

- 81% of financial institution executives believe there will be a greater remote working opportunities in the future.

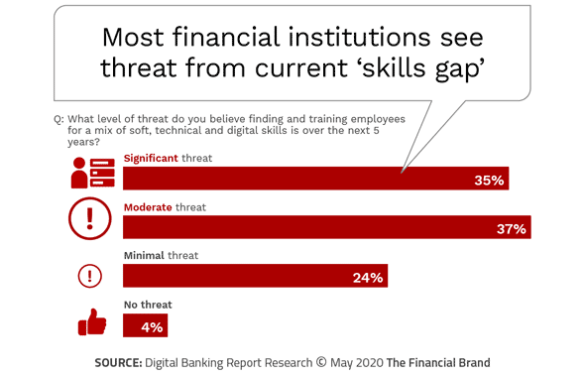

- 72% of banking executives believe there is a moderate or significant skills gap threat.

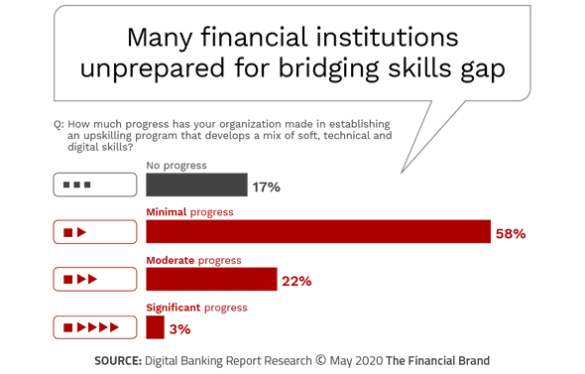

- 75% of respondents feel there has been minimal or no progress in upskilling for digital or technical needs.

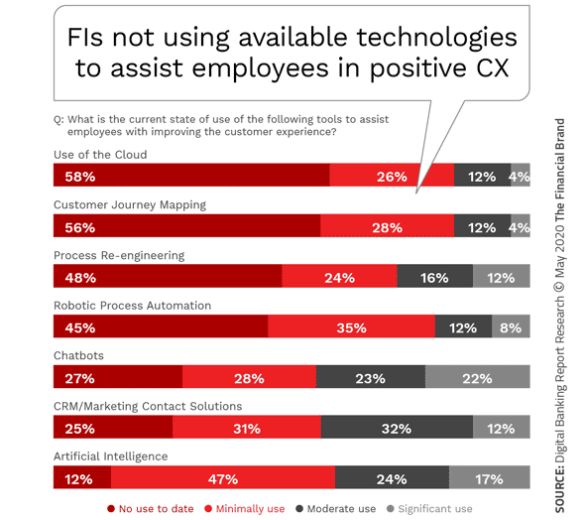

- The vast majority of banking organizations have not leveraged technology to help employees improve the customer experience.

“While it is still impossible to know for sure what the ‘new normal’ will be, it is clear that it will be far different than what we remembered just a few months ago,” said Monica Hovsepian, senior global industry strategist for financial services at OpenText. “The most successful organizations will be those where leadership adjusts to the changes we have already experienced, but remains flexible as to the possibilities ahead.”

Read More: How Banks & Credit Unions Can Fortify Stressed-Out Customer Support

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Workday Disrupted

In an instant, the definition of “going to work” and “9 to 5” changed, as the coronavirus outbreak shut down the majority of office towers and bank branches globally. Moving from cubicles to kitchen tables, employees needed to adjust their daily work routine to one that had to balance home and work on the fly.

The ability to work remotely shifted from a luxury offered to a few to a necessity required for many. The outcome has been much more positive than many leaders had expected. In fact, our research found that, while there were challenges initially, these challenges decreased with each stage of our research from April 10 – May 10.

During the same research period, the positives of remote work began to emerge, with 81% believing the remote work changes we have experienced provide an opportunity in the future. Not only did new collaboration and creativity opportunities increase, but distractions became more manageable resulting in increased productivity. Interestingly, many respondents noted longer working hours in an at-home workplace.

COVID-19 Puts Spotlight on Digital Skills Gap

Over a period of only a couple months, entire workforces were required to familiarize themselves with digital tools which never were needed in a traditional work environment. At the same time, financial institutions were required to connect with customers using mobile apps, online tools and digital engagement capabilities that were foreign to many.

The impact of these changes was felt most by the employees who had been with their financial institution the longest or were in areas of an organization that had not adjusted to recent marketplace realities. Many financial institutions responded to internal and external digital needs with mid-term solutions, understanding that significantly more is needed.

The impact of COVID-19 has forced banks and credit unions to quickly assess the digital competency of their teams, while looking to internal training and the marketplace to provide longer term solutions. This comes at a time when every industry is looking to address a massive digital and technology skills gap.

The research from the Digital Banking Report found that 72% of financial services executives believed there was either a moderate (37%) or significant (35%) skills gap. Less than three in ten thought there was only a minor or no threat.

As found in research conducted before COVID-19, despite a recognized threat around digital and technical skills, only 3% believed significant progress was made by their organization in addressing the skills gap, with 75% believing minimal or no progress has been made.

The biggest risks to not having employees adequately trained were thought to be a lack of innovation or digital transformation 58%, with 53% believing the customer experience would be negatively impacted and 44% stating that growth targets would be missed. Not surprisingly, between April and May, each of these negative impacts grew in importance.

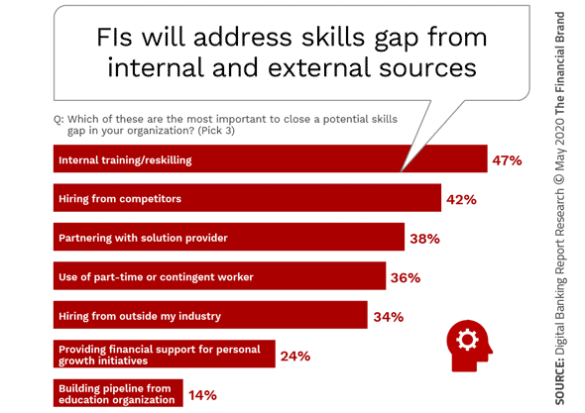

Finally, when asked what strategies would be used to close the digital and technological skills gap, financial institutions were expecting to rely on internal training and re-skilling (47%), hiring from competitors (42%), or partnering with a solution provider (38%).

Read More: Gallery: Pandemic Marketing Campaigns from Financial Institutions

Banking Not Prepared For Technology To Augment Humans

For anyone who was forced to purchase products online, have groceries delivered, receive telemedical consultation, or have their children educated remotely, it became clear that technology is the most powerful when combined with humans … as opposed to simply replacing them. The COVID-19 crisis only scratched the surface on the potential for modern technologies to enhance all components of banking.

Obviously, the collaboration and augmentation of humans by machines requires that the human component of the equation be prepared for this transformation. This will highlight the need for the re-skilling and up-skilling described above. This collaboration will also need to focus on the reduction of costs while putting the customer experience at the center of the process.

Unfortunately for almost every organization surveyed by the Digital Banking Report, the current ability to leverage new technologies for the benefit of the consumer falls way short of what is required. It is clear the banking industry is still at the embryonic stage of knowledge creation and operational improvement.

It’s About the People

If anything is clear after this crisis, it is that the people in the organization are more important to the future of work than ever before. In a digital world, leaders and employees who are not prepared to embrace change and take ownership of the skillsets required to compete in the future will become less valuable and will be replaced.

Leaders must guide organizations and employees to be prepared for changing business requirements. Self development will become more important for personal and professional growth, since organizations are not prepared to provide all of the skills training required. There is no looking back to a pre-COVID world or to believe that a post-COVID world will only be an evolution of what we had before.

Being a ‘fast follower’ is no longer a viable strategy for people or organizations.