Anyone who finds the huge range of choice of items available on Amazon intimidating had better avoid contemplating the size of the market for marketing technology, “martech” for short.

Blogger Scott Brinker’s “Martech Technology Landscape Supergraphic,” a visual representation of the types and numbers of martech available, contained about 150 listings in 2011. In early 2019 — just eight years later — the total had grown to 7,040 and the graphic keeps on growing. Even as the martech field consolidates, new players keep emerging and existing players bring out new tools.

Martech can be an equalizer for small and medium-sized players facing large bank competition and can give the large bank or credit union an edge. It’s not just about the technology, of course, any more than buying the best golf clubs, balls, and shoes make you a tournament contender. How well, and how much, a financial institution of any size uses the technology it has makes a big difference. Likewise, how adept marketing leadership and staff are makes a difference.

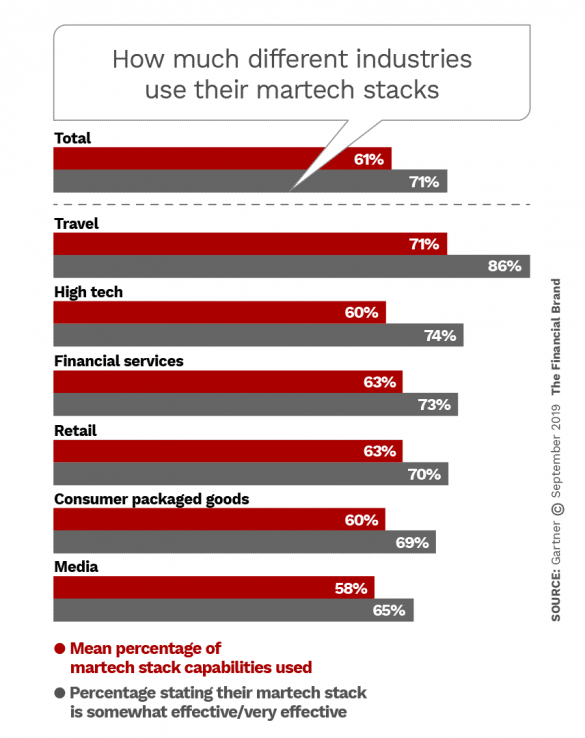

So too does how well the total collection of marketing technology that a bank or credit union has — its “martech stack” — works together. Salesforce research reported in a blog indicates that high-performing marketing organizations use 14 martech tools, on average, while low performers average only seven.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Stacks Alter Classical Roles of Marketing Jobs

All this technology has changed the financial marketer’s job.

“Somewhere along the way, finance industry marketers became stack managers: shadow IT experts who spend more time on technology implementation than messaging, creative development or customer research,” writes Eric Holtzclaw, Chief Strategist of PossibleNOW, in a blog. “Marketing technology budgets now commonly exceed IT budgets … for some, the job is now ‘nothing but the stack’.”

In fact, in a Wipro survey, 47% of CMOs themselves ranked martech expertise as among the three most important skills they need. This outpaced marketing strategy skills (44%) and business strategy skills (37%) — and blew away classic marketing skills such as brand management (21%), advertising (13%), and sales (15%).

While the shift to martech is by no means universal, to some degree the trend will increasingly touch on every institution of any size, going forward, and the tensions will grow.

“Banking departments today face unprecedented pressure to build and leverage stacks,” Holtzclaw states. “Technology and software companies are desperate to control as much of the stack as possible. Internal technology teams are desperate to maintain their seat at the table. And all too often, service to the customer is compromised.”

That last bit is not what is supposed to happen. All of the technology is meant to result in serving as many of the right people with the right products at the right time and in a fashion so personalized that they will think it’s been cooked to order. It’s not meant to be served with a side of angst.

In fact, Salesforce doesn’t favor the term “martech stack.” Instead, it suggests thinking of martech as aids on the customer journey.

“To a customer, there is one company — not separate departments,” according to the blog. “As customer experience leaders, marketers must look beyond their own walls for new opportunities to drive superior engagement across the entire customer journey. Thus, the notion of a ‘marketing stack’ is really a misnomer. High performers integrate their marketing technology across the entire customer journey, from advertising to customer support. Banks and credit unions intent on making the martech trend work for them — instead of getting swept away by it — must proceed deliberately, using some key strategic steppingstones. Without following that path they risk falling into a steady stream of buzzwords, never in short supply.

Read More:

- 6 Financial Marketing Technology Trends You Must Watch

- Retail Banking Lagging in Process Automation, Despite Benefits

- 10 Technologies That Will Disrupt Financial Services In The Next 5 Years

How to Choose What’s Going into Your Stack

The martech stack that a bank or credit union assembles must reflect the capabilities and scope of the institution, the markets it serves, and how it serves them.

“Anyone who has ever shopped at a warehouse club knows how much can be bought in large quantities without thinking, and that’s a good thing to keep in mind before buying marketing tech.”

“The first step is to adopt the right customer-centric mindset,” states a white paper by Marketo. “After all, technology for technology’s sake is just an expense. You need to ensure that your strategy is helping your team fully engage buyers in order to meet organizational objectives.”

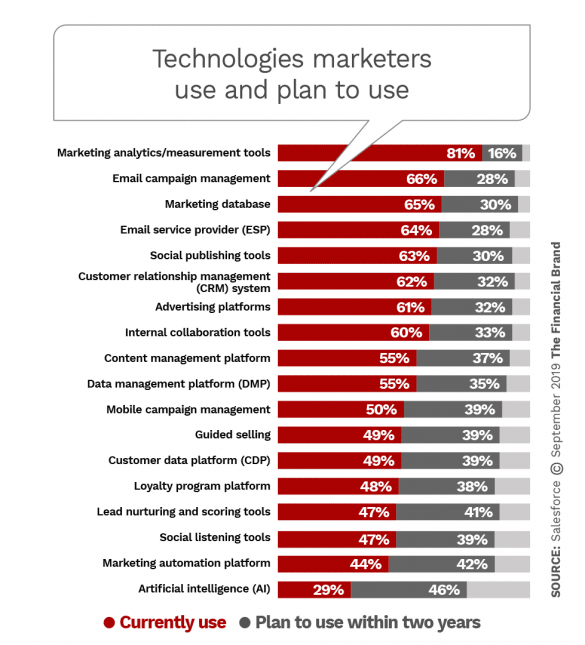

The top five technologies that are currently deployed in U.S. marketing organizations are email marketing platforms (71%); web content management (68%); surveys and customer insights (64%); content marketing platforms (64%); and digital marketing analytics (62%), according to a survey by Gartner. Among those reported as in the process of deploying are social analytics platform; advanced analytics/data science tools; lead management platform; data management platform; and ad verification service.

Anyone who has ever shopped at a warehouse club knows how much can be bought in large quantities without thinking, and that’s a good thing to keep in mind before buying marketing tech.

“Until recently, most organizations have built their martech stacks piece by piece — adding technologies to meet new needs or test new delivery methods. But with so many applications available and so many competitive gains to be made by using the right combination of technologies, it is increasingly important to have a strategy to connect your stack across marketing and other revenue-driving functions,” states the Marketo white paper. The paper lays out the skeleton of a process for moving forward:

- Document your institution’s strategy.

- Take inventory — what have you already got inhouse?

- Get your data in order — it’s the foundation of much that will follow.

- Assess the institution’s real needs — the process isn’t just about buying, but ditching things already on board that aren’t necessary or aren’t working out.

- Conduct a content audit.

- Begin to build the institution’s stack.

“Your martech stack is a means to an end,” the paper advises, “so commit to the technology you need to help you achieve your goals.”

How to Source What’s Going into Your Stack

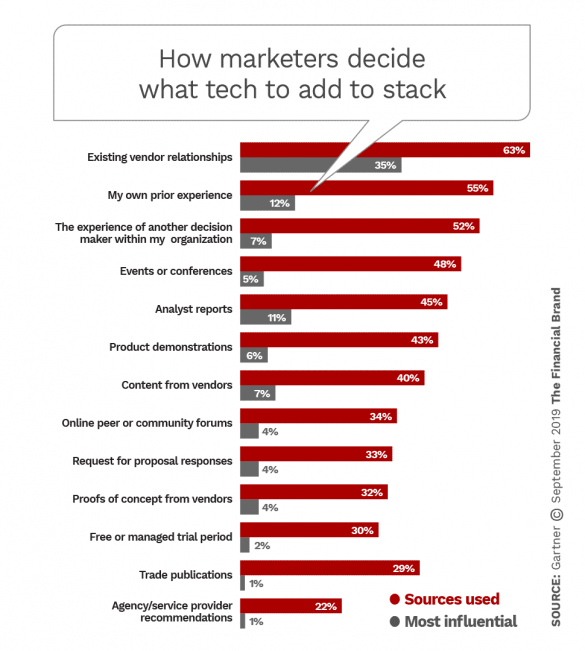

Wrapped up in the “what” of building the martech stack is the “where,” as in which vendor or vendors it is going to come from.

This leads to a key decision point. Marketers typically decide on one of two main paths when building a martech stack.

The first is “best of breed” thinking. That means for potentially every category and sub-category of martech, the bank or credit union chooses to go à la carte, preferring what’s supposed to be the superior selection for each need.

The second main path is using a suite of martech products offered by a single vendor. One advantage of this is the assumption that everything in the stack communicates with everything else, without tweaking.

Research among marketers from many types of companies by both Gartner and Walker Sands gives the edge to the best-of-breed approach. As tabulated in its latest State of Martech report, Walker Sands noted this split:

- Integrated best-of-breed architecture 34%

- Single-vendor suite 27%

- Limited piecemeal solutions 9%

- Fragmented best-of-breed architecture 8%

- Proprietary technology, developed internally 5%

- Nonexistent 17%

A gray area: Some software begins as an independent, à la carte choice but its creator is acquired. Marketo is an example. It’s now owned by Adobe.

“As the single-vendor suite players like Adobe and Oracle have moved to acquire some of the top best-of-breed providers, we may see them strike back against best-of-breed stacks, especially since most marketers note that consolidation hasn’t affected or has positively affected their access to market,” writes Walker Sands.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How High Should Your Stack Be?

More and more financial institutions are adopting martech, but, as London Research states in its annual marketing automation report, “despite this widespread adoption, the use of marketing automation is still in its infancy.”

Clearly, building a marketing technology stack isn’t like piling up Jenga blocks, nor like compiling a stamp collection.

“Utilization can be a misleading metric. Value is what really matters.”

— Scott Brinker, martech blogger

In fact, as you assemble your institution’s stack, bear in mind Brinker’s own thoughts on this matter. In a blog he wrote that many marketers weigh how well their stacks serve their companies by the degree of utilization of the individual elements of the stacks, but this by itself isn’t the whole picture.

“Utilization can be a misleading metric,” says Brinker. Instead, he suggests that marketers consider the value produced by the stack. Even if just a small portion of a given program is actually being used, if it’s generating results that are off the scale, that’s huge.

“Value is what really matters,” says Brinker.

Who Should Be in Charge of Building the Stack?

All craftsmen like to choose their own tools. But a martech stack isn’t like picking out hammers and screwdrivers for a homeowner’s toolbox.

In a blog by BAI, Holly Hughes makes the point that Marketing and IT ought to be working together on such tasks.

“Banking’s continued march to digitization and personalization makes it imperative that the ‘right brain’ of a financial services organization’s marketing operation is in sync with its ‘left brain’ in IT,” Hughes writes. “Real-time customer data — and all the insights it can generate — is too precious to waste, as can happen in a dysfunctional marketing-IT relationship.”

Salesforce puts it more bluntly: “Marketers are not IT people. They use technology to do their jobs better, but that does not mean they should be the managers of the software. As brands add more technology, they need to begin to employ a new layer of staff — systems administrator (also known as a marketing operations team).”

Gartner’s study finds a fairly even split on how martech is managed in many types of firms:

- Primarily by Marketing, with dedicated martech leader and team 26%

- Primarily by Marketing, no formal leader or team 24%

- Primarily by marketing, cross-functional committee 24%

- Shared between marketing and IT/Technology 23%

- Entirely outside of Marketing 3%

Related to the question of who should lead the effort is the matter of how prepared marketers are to use the technology.

“There’s an issue with many marketing departments’ competence in this area,” the London Research report says. The study involved both marketing staff and outside marketing agencies. Among the marketers, only 36% indicated that there was a lack of expertise in Marketing, but marketing agencies surveyed cited this as a major barrier to getting the best out of stacks.

Wipro’s research discovered that over one third of marketing executives believe less than half of their teams have the skills to deploy marketing stacks’ technologies.

The solution lies in training, pure and simple.

“Many marketers are focusing on this issue,” the report says. “They have made reskilling current marketers with the skills they’ll need for martech success a huge priority.”