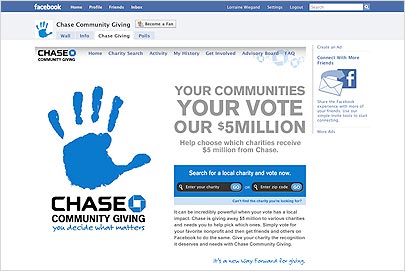

The announcement from JP Morgan Chase that its retail banking arm is giving away $5 million to charities via a Facebook promotion signals an emerging trend in how financial institutions allocate their corporate donations.

‘Chase Community Giving: You Decide What Matters’

In the first round of the Chase Community Giving program, Facebook users will nominate non-profits, then vote to determine which organizations will receive Chase’s philanthropy funds. The top 100 getting the most votes will receive $25,000 each, and will move on to the next round.

Chase Community Giving: You Decide What Matters

In round two, these organizations can submit a proposal for a $1 million grant. Facebook users will vote to pick the winner. The five runners-up will receive $100,000 each. Additionally, Chase will donate another $1 million to the charity of its choice.

“This innovative program unleashes the charitable passions of our neighbors, friends and colleagues to rally around the issues and organizations that are most meaningful to them,” said Kimberly Davis, President of the JPMorgan Chase Foundation.

This type of promotion taps the same kind of networking power mastered by grassroots organizations. Non-profits excel at mobilizing their troops. With a bucket of money at stake, expect these organizations to do a lot of the marketing legwork for you.

Between the Lines:

People who support causes and work for charities tend to be better educated, and anyone getting involved in this type of promotion will be online. They have to be. That’s where the voting takes place.

“Even though this is a Facebook-based program, we’ve already had over 100,000 visitors from Twitter alone,” the spokesperson told Marketing Daily. Keep in mind: This was accomplished without Chase ever sending one tweet. In fact, Chase is one of the few big banks that doesn’t even have an active presence on Twitter. The passionistas are tweeting for them.

Fractional Marketing for Financial Brands

Services that scale with you.

CFPB 1033 and Open Banking: Opportunities and Challenges

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

Chase joins other banks and credit unions who are opting to give consumers a say regarding what kind of charitable activities should receive monetary support. This year, Umpqua Bank included Click 4A Cause as part of its Save Hard, Spend Smart campaign, where every vote equaled a $1 donation to one of three charities, each competing for a $15,000 grand prize. Last year Wells Fargo held its Someday Stories promo with two parts: a competition among charities, and a $150,000 “dream fulfillment” contest for do-gooders to make their lifelong aspirations a reality.

Umpqua’s ‘Click4aCause’ (left) and Wells Fargo’s ‘Someday Stories’ (right).

Key Insights:

This is money you are already giving away. Milk it for all its worth. And for financial cooperatives like credit unions, this type of democratic approach should come as second nature.

“Every year, our company donates more than $100 million to non-profit organizations in local communities, nationally and abroad, and our employees dedicate countless hours of their own time to helping those in need,” said Jamie Dimon, Chairman and CEO of JPMorgan Chase. “The grassroots nature of Facebook will allow us to hear directly which local charities matter most to our communities, hopefully creating an even bigger impact.”

The $5 million Facebook effort from Chase is in addition to the bank’s traditional philanthropic giving. If successful, the bank hopes to allocate more of its annual philanthropy budget using these methods.

“We look forward to applying the learning from this program to future philanthropic endeavors,” said Chase’s Davis.

Bottom Line:

Some people may dispute the strategic brand value of charitable contributions, but if your financial institution is committed to giving money away, why not get the most out of it?

Tip: Let people vote as often as they like in these promotions. Do not cap votes at one per day or one per person. If someone wants to sit around hitting the refresh button on their browser all day, why stop them? Remember, you’re tapping a passionate audience.