About three years ago, calls for banks to become “mobile-first” started coming in. In July 2014, Bank Systems & Technology ran an article titled 5 Keys to Success for a Mobile-First Strategy, in which it wrote:

“Digital banking is undergoing a dramatic shift as banks’ strategies go from “cram online banking into the mobile device” to a true mobile-first …”

Then, in March of 2016, another article said the following:

“As more people research, shop and buy financial services with their mobile device, a ‘mobile-first’ design strategy may not be enough. To be successful, brands and agencies must think beyond mobile campaigns and start to think about mobile-only as a complete foundation for the next generation customer journey.”

Apparently, to be successful, you don’t actually have to do anything, you just have to “start to think” about it.

Three months after that, another article warned us to Get Ready for the Voice Revolution in Financial Services. Damn, I wasn’t even ready for mobile-only at that point.

Just 11 months later, in May 2017, an Accenture white paper which proclaimed that:

“AI is creating a new era of computing, rapidly moving from mobile-first to AI-first in the customer experience and moving staff to more judgment-based and higher value added roles.”

Judgment-based roles? What does that mean? I thought one of the big promises of AI was that it would produce “judgments” that are superior to what humans are capable of.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

What Banks Must Do Is Stop Being ‘Technology-First’

The calls for banks to be mobile-first, mobile-only, voice-first, AI-first — or any ‘technology-first’ — are misguided. They represent a channel-, technology-, or device-centric view that is at the root of banks’ strategic problems.

This [fill-in-the-blank]-first thinking is misguided for a number of reasons:

1) Convenience drives consumers’ choices of channels and devices. I don’t care how many market research stats you can find about consumers’ use of branches, mobile devices, or voice-enabled technology, you will never sway my belief that consumers will use whatever channel or device is most convenient for them at the moment they want or need to interact.

One chatbot provider advertises the following:

Seriously? In the time it takes this customer to type out or even say “I would” he could have hit a button and found out his balance.

Granted, if he was underneath his car doing repairs, with greasy hands, and realized he had to buy a $300 part to fix the car, yelling out “Alexa, what’s my account balance?” would be helpful. But it is simply not a capability that will give any financial institution a competitive edge in the market.

2) It’s the process — not the device — that matters. Having AI-enabled, voice recognition capabilities that understand customers’ questions — and improves the understanding of those questions over time — is great, but is useless unless questions, issues, and opportunities are resolved to the liking of both the customer and the bank.

In other words, technology isn’t a paaacea for ineffective business processes, practices, or policies.

It’s way too early in the evolution and use of AI technologies in banking to know how effective these tools will be for dealing with the wide range of interactions, problems, issues, and opportunities that are out there for anybody to claim that banks must be AI-first today.

Another way to think about this: the “User Interface” is not the same thing as the “User Experience.”

Alexa is a user interface. Without process support behind the interface, the overall user experience falls short.

3) The product still matters. You may be sick of hearing the phrase “putting lipstick on a pig,” but if your core products and services suck, then slapping a “voice-first” or “AI-first” capability on top of them is doing nothing more than….well, putting lipstick on a pig.

If, however, your AI-powered capabilities provide better advice and guidance to consumers looking to make smarter decisions, than that is sellable. In other words, the technology capability can become the product or service if there are consumers willing to pay for — or value — that capability.

Unfortunately, in all of these [fill-in-the-blank]-first proclamations, no one ever seems to mention the underlying products and services.

What Banking Providers Need to Be is Customer-First

When I think of successful financial firms, USAA is right there at the top of the list. Is USAA mobile-first? Mobile-only? AI-first?

I don’t think so, and I doubt that USAA would use any of those descriptions. I think they would describe themselves as member-first. Military member, to be exact.

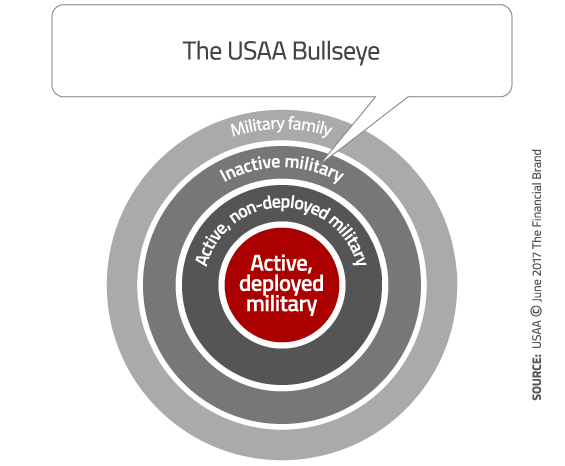

USAA’s focus can be depicted by a bulls-eye. At the center are active, deployed military personnel. Although this is not the only segment the firm serves, it’s the segment with the most unique needs. They have limited access to physical branches, are away from home for potentially long periods of time, and therefore, have a lifestyle that can put strains on their households when financial issues arise.

As a result of these unique needs, USAA naturally relies on digital technologies to meet these needs. But the firm isn’t mobile-first because some survey said consumers are relying more heavily on their smartphones to do things. USAA is mobile-first because the consumer segment(s) it serves requires the firm to be mobile-first.