In 2016, I predicted that:

“The most significant trend of 2016 will be the ‘platformification’ of banking, where both existing banks and startups begin a strategic shift towards becoming banking platforms, much like how Amazon is a platform in retail.”

According to Platform Strategy, a platform is:

“A plug-and-play business model that allows multiple participants (producers and consumers) to connect to it, interact with each other, and create and exchange value.”

There are three important components of that definition:

- Business model. First and foremost, a platform is a type of business model.

- Plug-and-play. A platform must enable participants to easily engage — and disengage (which partnerships typically don’t).

- Create/exchange value. One plus one has to equal more than two, or there’s no need for the platform.

The Elements of a Successful Platform Strategy

There are three elements to a successful platform strategy:

- Magnet. Without the ability to attract a meaningful number of the “right” participants, a platform cannot succeed. Simply having a lot of producers and consumers is no guarantee of success. The platform must attract the right producers (those with the most desirable products and services) and the right consumers (those who the producers in the platform want to do business with).

- Matchmaker. A platform requires a mechanism for matching consumers to the right producers, and for enabling producers to reach the right consumers who come to the platform. At its most basic level, a search engine can be matchmaking mechanism.

- Toolkit. The toolkit is what enables producers (and consumers) to easily plug-and-play. This is why APIs are so critical to firms pursuing platform strategies.

A number of big banks have taken steps towards building the toolkit — BBVA, Capital One, and Citibank have all launched API markets, exchanges, or developer hubs.

New Vendors are Needed

The vast majority of banks and credit unions in the US don’t have the resources to launch API markets. But that doesn’t mean they won’t be able to pursue a platform strategy or participate in them.

If 25 years ago I told you that the bank you work for would have a website where your customers would access their accounts, get customer service, and open accounts, you might have believed me, but you probably would not have believed that your institution could do it because you didn’t have the skills or resources.

But today you have that website — because a vendor market emerged to fill the need.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The New Fintech Vendors: Platform Service Providers

The vendor market for platform services — let’s call the vendors in this space Platform Service Providers — will emerge, as well (in fact, it’s already emerging).

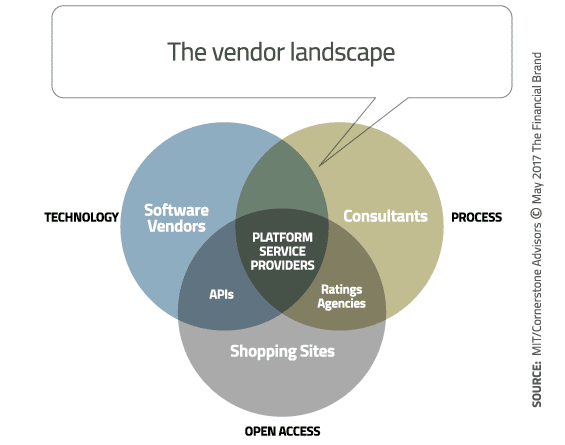

There are three capabilities required to being categorized as a Platform Service Provider: 1) technology; 2) process support; and 3) open access.

The big three core banking vendors offer great technology and process support, but provide limited open access (they’ll claim they offer APIs, but these offerings enable technology integration — not financial product and service integration.

Emerging API vendors like Xignite provide strong capabilities for open access, but not end-to-end process support. A number of firms are emerging, however, as platform service providers, meeting all three criteria.

As lending marketplaces hit speed bumps in their evolution, a few have aggressively turned to a platform services provider strategy, including:

- Kabbage. Re-branding itself as Kabbage Platform, the small business lending marketplace is opening its platform to financial institutions, offering processing capabilities, and promising access to non-traditional data sources for underwriting.

- LendKey. The company provides demand generation, decisioning, origination, servicing and liquidity management services to banks and credit unions. At the ABA National Conference for Community Bankers this February, LendKey CEO Vince Passione said in a breakout session, “We’re not a fintech company.” I interpreted this as underscoring the firm’s commitment to providing services to financial institutions versus competing with them for lending opportunities.

- Akouba. On Akbouba’s platform, banks retain control over lending decisions, the pricing, the credit policy, the loan dollars, and the customer experience. Akouba configures the underwriting for each institution based on its credit policy and guidelines. Akouba integrates with the big three core systems, and integrates data from Experian, Transunion, Paynet, and LexisNexis.

Platform service providers aren’t limited to lending marketplaces. Other examples include platforms for:

- Account opening and onboarding. Avoka’s Exchange™ is a catalog of pre-integrated applications that integrates pre-built connectors for more than 30 services, including fraud detection, identity verification, and digital signatures from companies like FIS, Mitek, Yodlee, Salesforce, and eSignLive, to enable account opening and onboarding.

- Digital banking. Constellation’s Digital Services Platform gives credit unions the ability to create, provision and integrate digital banking services from various providers. Constellation recently received a patent for the provisioning of secure services via an application container model. For more info on Constellation, see Kris Kovacs’ presentation at the recent NACUSO conference.

The Platformification of Banking

The platformification of banking will evolve over the next 20 years. Platform services providers will emerge –and are emerging — to provide new distribution channels, new processing capabilities, and new sources of data to help create platforms in banking.

Similar to how the big three core vendors have grown through acquisition over the past 10 years to provide a full suite of banking applications across functions and channels, platform services providers will grow through acquisition, acquiring API providers and specialized fintech firms to fulfill a platform services vision.

One way or another, nearly every institution will be impacted by this platformification trend.