The number of bank branches in the United States will shrink by as much as 20% in the next years, according to a study from commercial real estate firm JLL.

The report says that the mobile channel and innovations in fintech are driving this shift from bricks to clicks. The reductions also come as banking providers look for ways to improve margins by pushing self-service options and lower-cost digital alternatives.

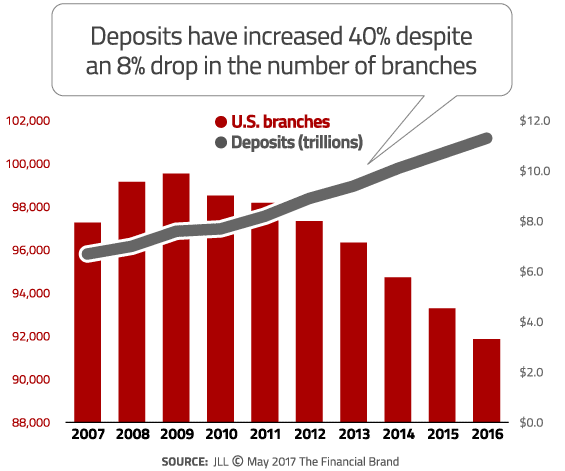

Just before the 2007 global financial downturn, there were roughly 97,000 branch banks in the U.S. The banking industry continued to add more net new branches through 2009 until the severity of the recession finally sunk in. At the same time, adoption of smartphones was skyrocketing enabling mobile banking to take a firmer hold among consumers.

This forced traditional banks and credit unions to reevaluate their retail delivery strategies — consolidating and optimizing their brick-and-mortar networks. As a result, the FDIC estimates that there are almost 7,700 fewer branches in the U.S. today. This represents a decline of close to 8% in the number of locations nationwide.

“The number of branch locations will continue to shrink, and we won’t miss them,” said Geno Coradini, EVP and lead of JLL’s retail group. “While customer access to branches remains important, the necessity of a branch network is being balanced with advances in mobile platforms and fintech.”

“The branch strategy of relying on sheer numbers to win market share is a thing of the past,” Coradini added. “It is no longer about which brand has the most locations — the ‘bricks’ — but how effectively the bank is delivering services to its customers and their need for remote, anytime, anywhere access for transactions — the ‘clicks.'”

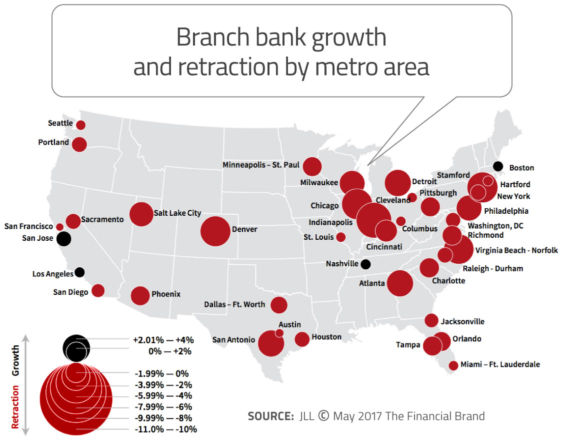

The contraction in the number of branches isn’t distributed equally across the country. Some markets are seeing greater reductions, while others — like Los Angeles, San Jose, Nashville and Boston — are seeing more branches opening than closing.

Read More: Do Banks Need Branches in the Digital Age?

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Walter Bialas, Director of Research with JLL, said he expected their research to reveal growth in the number of branches in the nation’s hottest population centers such as Florida, California and Texas. But it wasn’t so; even those regions saw drops.

“Although a few markets seem to have bucked this trend, net branch additions in these markets are modest and may have more to do with local location optimization, as well as bank holding company expansion and M&A dynamics, than a targeted growth initiative,” the report said.

“Although a few markets seem to have bucked this trend, net branch additions in these markets are modest and may have more to do with local location optimization, as well as bank holding company expansion and M&A dynamics, than a targeted growth initiative,” the report said.

JLL was keen to stress that their findings don’t suggest that the branch bank is disappearing.

“There’s not a complete retrenchment in the industry,” Bialas explained. “It’s more of an optimization.”

Despite branch locations closing across the nation, total U.S. bank deposits have grown more than 40% since 2010. In other words, consumers aren’t ditching banks, they’re just changing the way they use them.

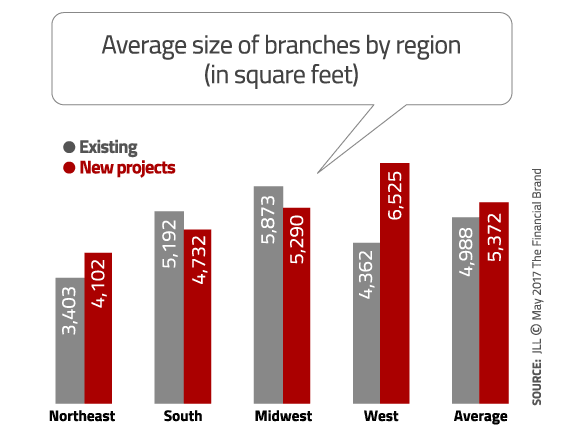

The Financial Brand has not only forecast that the number of branches would contract, but that the size of branches would shrink as well. This prediction isn’t necessarily supported by the data found in JLL’s report. The average square footage for existing branches in the U.S. is 4,988. But in JLL’s research, they identified 100 or so new projects that have either been built or are currently underway, and those branches average 5,372 square feet — an increase of 7.7%.

JLL estimates that U.S. banking industry could save as much as $8.3 billion annually if it trimmed the number of branches and downsized the average bank branch from 5,000 to 3,000 square feet. It is The Financial Brand’s position that — in most locations — there is no reason to build a new branch larger than 2,500 square feet, and that 1,000 to 1,500 square feet will be adequate in many situations.

To meet customer needs and regional demographics, JLL says banking providers will offer both full-scale operations and smaller “convenience” locations for basic transactions. Examples of these “convenience locations” include branches inside a grocery store or other micro/nano branches within a hub-and-spoke delivery model.

JLL also says automated branches are an inevitability. People today are more accepting of banking innovations than in years past, so consumers should expect to see greater use of remote tellers assisting with basic transactions.

“The introduction of automated tellers is pivotal for banks to limit real estate costs, however it will take time for customers to fully embrace a technology that introduces a whole new customer service experience,” said Coradini. “Optimizing market coverage is neither quick nor easy, but the long-term cost savings from this shift can be significant as banks also eliminate and shrink existing locations.”